Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

TradeFlow is a novel newbie-friendly liquidity ecosystem on Binance Smart Chain (BSC). Its design boasts an eccentric “Wealth Generator,” a passive income module for TFLOW holders.

Liquidity module, trading algorithm, native token: What is TradeFlow?

Unveiled in Q4, 2021, Tradeflow promotes itself as an ecosystem of instruments for seamless value generation. The profit comes from investing in various assets driven by a patented AI-powered algorithm.

So, what is special about TradeFlow’s toolkit of passive income features?

- 100% automated wealth generating system: traders’ mistakes will not ruin the strategy;

- Diversified portfolio of investing instruments: from NFTs and Metaverse projects to indexes and stocks;

- High APY rates of up to 22%, which is far more profitable than with traditional centralized platforms;

- Tokenomic design boasts built-in “rug pull” protection;

- Native BSC-based token TFLOW is an endpoint to TradeFlow’s income strategies.

With these features activated, TradeFlow is suitable for traders and investors with various levels of expertise in crypto, trading, blockchain and so on.

What is an automated trading algorithm?

An automated trading algorithm (trading bot, trading AI, algo trading tool, etc.) is a specific type of software that automates order placement on centralized and decentralized exchanges. Automated trading is popular across all types of assets - FX, indexes, commodities, ETFs - but it is the crypto segment where AI-powered trading is of paramount importance.

Automated trading went mainstream in crypto due to its unmatched volatility: when perfectly customized, the trading bot can easily generate revenue for its owner.

At its core, automated trading algorithms attempt to track the indicators in order to open and close long/short positions to generate maximum profit.

Sometimes, people buy licenses to utilize trading algorithms and adjust their settings according to their style of trading (high frequency/low frequency, aggressive/conservative and so on).

But the majority of high-end trading algorithms are controlled by large entities that leverage investors’ deposits to profit as much as possible from the market’s fluctuations.

Introducing TradeFlow, an algorithm-based investing system with native token

TradeFlow is a protocol for passive income focused on retail investors: it aggregates liquidity from community-driven pools and distributes it between multiple strategies with different horizons and risk grades.

Investing pools

First of all, TradeFlow introduced a flexible ecosystem of liquidity pools. Users can inject liquidity into various tokens, starting from Binance USD (BUSD) and U.S. Dollar Tether (USDT). Once liquidity is locked in TradeFlow, the platform starts leveraging it with an automated trading algorithm.

To motivate existing and new users to support TradeFlow with their liquidity, the protocol distributes rewards between all LPs proportionally to their contributions: the amount of money deposited and the period for which they are locked. Compared to the top-tier centralized passive income modules of crypto exchanges and lending systems, it offers higher APYs. Even newbies can lock their crypto with 5-22% in annualized yield.

Though still in its nascent stage of progress, TradeFlow’s ecosystem has already yielded $800,000 from 400 investors from 26 nation-states.

Background: Partners and investors

Addressing its goals in the Web3 space, TradeFlow scored an outstanding array of partnerships. It has entered into a long-term strategic collaboration with STOBOX, pioneers of real-world asset tokenization in the DeFi era. With STOBOX’s assistance, TradeFlow is going to offer its customers an unmatched range of assets.

TradeFlow also partnered with North Star Yachting, a global heavyweight of the yachting segment. With this partnership, TradeFlow’s investors get exposure to the luxury and high-tech industry of yachting.

In its blockchain business development and marketing, TradeFlow receives expert and advisory support from Iinuma Consulting, a veteran marketing agency. Iinuma Consulting is well known for its unparalleled experience in whitepaper writing and business model creation.

Last but not least, TradeFlow partnered with X1, a cutting-edge cryptocurrency exchange ecosystem for 20+ assets. EU-regulated X1 offers seamless crypto conversion services for all mainstream coins, including Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE), Shiba Inu Coin (SHIB), Cardano (ADA) and XRP. X1 is a rare early-stage centralized crypto exchange that accepts deposits in fiat from Visa and Mastercard, as well as from SEPA’s bank accounts.

TFLOW: Purpose and design

To ensure inclusive participation for all contributors to its ecosystem, TradeFlow introduced a native token, TFLOW. First of all, TFLOW is a kind of “entry ticket” into the TradeFlow ecosystem: in order to receive rewards, liquidity providers should hold at least 20% of their portfolio in TFLOW tokens.

TFLOW also cements TradeFlow’s tokenomic design: every investor should lock a minimum of TFLOW tokens, so there is no way for malefactors to organize a rug pull. Per the estimations of TradeFlow’s team, more than 63% of the aggregated TFLOW supply is locked in TradeFlow’s liquidity pools.

As such, TFLOW is not vulnerable to a “rug pull” attack: the team is not able to gain control over a critical token supply share. Whale-manipulators also cannot buy a significant share of TFLOW to manipulate its price and TradeFlow’s profitability.

TFLOW: Token sale

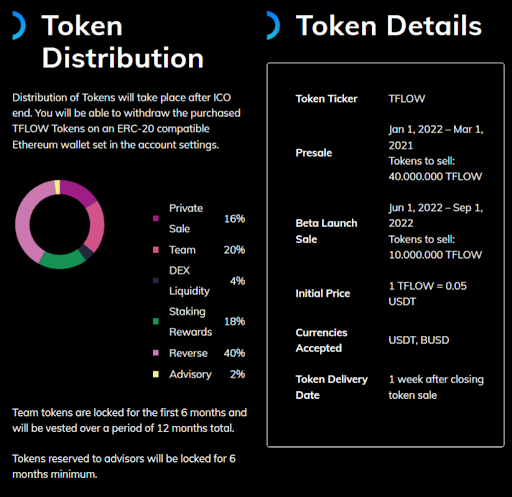

TradeFlow will organize its token sale in two phases. During the presale (Jan. 1, 2022–March 1, 2022), the protocol is going to release 40 million TFLOW, while during the beta sale (June 1, 2022–Sept. 1, 2022), another batch of 10 million TFLOW will be up for grabs.

The token sale price for 1 TFLOW is set at $0.05. BUSD and USDT, two mainstream stablecoins, are accepted by TradeFlow’s team.

TFLOW tokens will be transferred to investors one week after the close of the first and second token sale stages.

In order to purchase TFLOW, crypto holders should fill out the KYC form available on the main website page. The minimum amount of funds accepted in the TFLOW presale is $100.

Read our latest project news about our Launchpad Listing, Token Lock and Staking Platform Launch. #cryptocurrencies #DeFi #PinkSale https://t.co/p2ogp6KzlZ?from=article-links

— TradeFlow Cryptocurrency (@TradeFlowCrypto) February 15, 2022

Then, TFLOW is available on Pinksale, a popular BSC-based launchpad for early-stage products, under the name “TradeFlow Presale.”

Bottom line

TradeFlow is a cutting-edge ecosystem of liquidity pools that leverages a patented Automated Trading algorithm. TradeFlow generates wealth for its investors in an automated and seamless manner.

In order to access all functions of TradeFlow, crypto users need to purchase and hold TFLOW tokens.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin