What is Blockchain 3.0?

Blockchain might be the old wine in a new bottle, but the technology, as we know it today, appeared only in 2008 in Satoshi’s groundbreaking white paper. Bitcoin became the world’s first decentralized cryptocurrency that is powered by the now-ubiquitous Blockchain technology.

In 2015, programmer Vitalik Buterin introduced a brand-new Ethereum Blockchain (Blockchain 2.0) that gave the world smart contracts and promised faster transactions.

However, as these Blockchains were becoming more popular, the scalability trilemma came to a head with more than 140,000 transactions remaining unconfirmed during the peak of the cryptocurrency craze in December.

|

Blockchain 1.0 Advertisement

|

Bitcoin, the flagship currency was created. |

|

Blockchain 2.0 |

Ethereum, an upgraded version of Ethereum was introduced. Additional features include interoperability and scalability. Advertisement

|

|

Blockchain 3.0 |

An armada of new projects based on the DAG technology that are poised to be an upgrade of Bitcoin and Ethereum. |

All the problems that were associated with the two original Blockchains prompted the appearance of the next-generation Blockchains. Of course, Bitcoin and Ethereum remain the top currencies on the market because they enjoy the first-mover competitive advantage, but there are many newcomers that threaten to disrupt this hegemony with their state-of-the-art technologies. They collectively represent a new step in the evolution of the decentralized technology dubbed Blockchain 3.0.

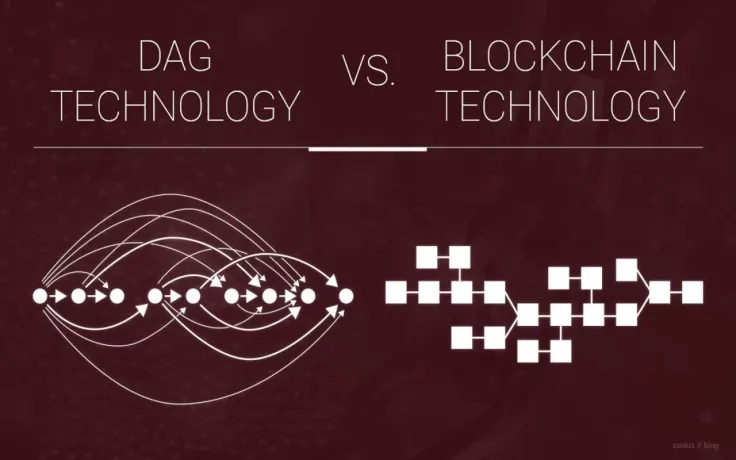

However, keep in mind that the modus operandi of these new projects is different when compared to traditional Blockchains. Actually, these networks may not be called Blockchains at all. A directed acyclic graph (DAG), the third generation of Blockchains, doesn’t rely on miners to maintain blocks, and it strives to improve scalability and interoperability.

These are the common features of the two technologies:

-

decentralization;

-

distributed digital ledger;

-

token economy model.

However, Blockchain is linear while the DAG technology functions in the form of an ‘interlinear’ sequence (it looks like a braid). Such technology makes it cheaper, more scalable and, to sum it up — better (at least in its white paper).

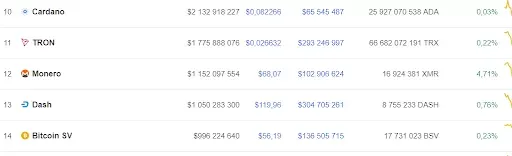

Cardano

Speaking of 3rd generation cryptocurrencies you should definitely watch in 2019, Cardano (ADA) is a top-of-mind option. In fact, Cardano is considered to be the world’s first new-generation cryptocurrency with the sole purpose of solving Ethereum’s scalability issues. Notably, the ambitious project is spearheaded by Charles Hoskinson, one of the original Ethereum creators who left the project due to the split on the vision. Hoskinson, who is the brains behind Cardano, is one of the reasons why the project is so respected and credible.

Not surprisingly, there is a big rivalry between Hoskinson and Vitalik Buterin, and back in August they sparred over the protocols of their respective projects (Ouroboros and Casper).

Sorry, Charles, this is pathetic.

— Vitalik Non-giver of Ether (@VitalikButerin) August 9, 2018

> Regarding Casper, we are not aware of any currently published source that sufficiently describes the protocol’s mode of operation nor any provable guarantees about ithttps://t.co/SHKWyUOLqV?from=article-linkshttps://t.co/LRujTx4hCf?from=article-links

As of now, ADA remains one of the top 10 cryptocurrencies with a market cap of $1.1 bln. That stability is rather impressive, considering that Cardano has been around for just over a year (its mainnet was launched on Sept. 29, 2017). In only three months, Cardano was already valued at $10 bln (Charlee Lee, the creator of Litecoin, even did a tongue-in-cheek remark that it could end world hunger).

So far, the project is in the early stage of development (about 70,000 transactions have been recorded during its first year since the mainnet launch, but it is rather exciting to see what comes next).

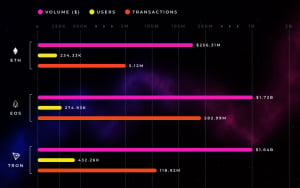

EOS

EOS places an emphasis on usability, using the delegated Proof-of-Stake (DPoS). That particular consensus algorithm strives to solve the main problems of Ethereum-based dApps (such as the transaction fees that are blown out of proportion and slow transactions). In this system, every wallet is able to vote for a representative. However, there are concerns that the EOS network is too centralized.

Just like other Blockchain 3.0 projects, EOS is marketed as scalable (it can potentially process millions of transactions per second with the help of correct optimization). Top-notch flexibility is yet another salient feature of the EOS network — any failed app can be frozen by block producers until the bug is dealt with (hence, there is no need for a hard fork).

Every three seconds a new block on the EOS network is being produced. The complete absence of forks is yet another peculiarity of the EOS Blockchain — there is no competition since miners are supposed to join forces in order to produce a block.

ICON

Icon (ICX) is a highly ambitious Blockchain 3.0 project that wants to connect different Blockchains to create one global ecosystem. It is powered by the so-called ‘Loop’ technology that allows achieving transactions much faster. Loopchain allows processing more transactions per second than previous generation Blockchains.

The list of big-name investors who embraced this project includes:

-

Pantera Capital;

-

Coinsilium;

-

Kenetic Capital.

It is presupposed that there are plenty of private Blockchains that are able to communicate with each other with the help of this ICON project. For insurance, different insurance companies can utilize numerous Blockchains, and there is a single technology that underpins them.

One notable advantage of ICON consists of its scalability — you are able to connect to traditional previous-generation Blockchains (Bitcoin and Ethereum), creating a full-fledged smart economy.

ICON functions with the help of the LFT consensus algorithm. This third-generation cryptocurrency is expected to disrupt e-commerce, hospitals, universities and so on.

Zilliqa

Zilliqa strives to come up with a highly-throughput public Blockchain. The platform is powered by a brand-new programming language called Scilla that is supposed to rival Ethereum’s Solidity. This language addresses some security issues of Solidity (for instance, a bug in Parity's multi-sig wallet would result in $150 mln worth of Ether being locked in a wallet). With the help of the Scilla programming language, such ‘black swan’ programming events are simply not happening.

They want to tackle the current scalability issues faced by the Bitcoin and Ethereum Blockchains by increasing the amount of nodes. Basically, the bigger amount of nodes connected to the network results in a higher transaction speed.

Remarkably, it operates with the help of the Proof-of-Work (PoW) algorithm that is used in order to prevent a potential Sybil attack — everyone is required to do a PoW in order to join the Zilliqa network. Notably, the PoW algorithm is not used to provide consensus on the network. On top of that, not every miner will mine each block.

Aion

Aion is yet another project on the list of Blockchain platforms that solves the great scalability problem. In plain English, the network creates a bridge between two separate Blockchains, allowing them to cooperate with each other.

The network supports both public and private Blockchains. While the Ethereum Blockchain keeps making waves around the globe with its smart contracts, there are numerous other Blockchains that offer a better level of scalability.

Aion and ICON are both interoperability-focused platforms that strive to unite different Blockchains. Hence, it is important to make a comparison of these Blockchain platforms. First of all, ICON is a South Korean project while AION is headquartered in Canada, and that gives it an edge. Both projects can be successful in the long run, but ICON already has a working product and a multi-billion dollar tech behemoth behind its back. AION’s main advantage is the ability to create interoperable dApps and smart contracts on their platform (its success shouldn’t be underestimated).

The bottom line

It is clear that the Blockchain 3.0 revolution has already arrived, and there are new technologies that trump VISA and other popular financial services by the level of scalability, interoperability, and security. Still, these best Blockchain coins haven’t reached the level of adoption that is required for revealing their full potential. So far, the aforementioned revolution only exists within their white papers. In theory, such Blockchains could handle millions of daily users.

There is a very high possibility that Blockchain in its current version will be something completely different in 15 years given how fast the technology is developing, and the different Blockchain platforms on the list could be only a stepping stone.

However, there is also an alternative opinion that the Tangle won’t replace traditional Blockchains since it is now capable of moving certain types of data. If there’s a hefty transaction involved (for instance, a $1.5 mln house), it would be logical to choose the hacker-proof Bitcoin Blockchain even if it would take hours to process the transaction. There will be a mutually symbiotic system where Blockchain and DAG coexist, but Blockchain is already ingrained in the minds of many, and it would be very difficult for DAG proponents to persuade them to ditch Blockchain.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin