Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

XRP did well in August, increasing by over 8% in the first few days and reaching a high of around $3.23 on Aug. 8. The follow-through never came. In the last 10 days, the coin dropped almost 6%, moving into a small range around the round number of $3. This changed the month from "extend the rally" to "protect the floor."

There were attempts to clear $3.14, lower highs stacked up and the price has been chopping between about $2.95 and $3.05. That keeps the $3 focal point: hold that band and August remains contained; lose it on a daily close and the early-summer base around $2.80 comes back into view, with $2.90 the first checkpoint if pressure builds.

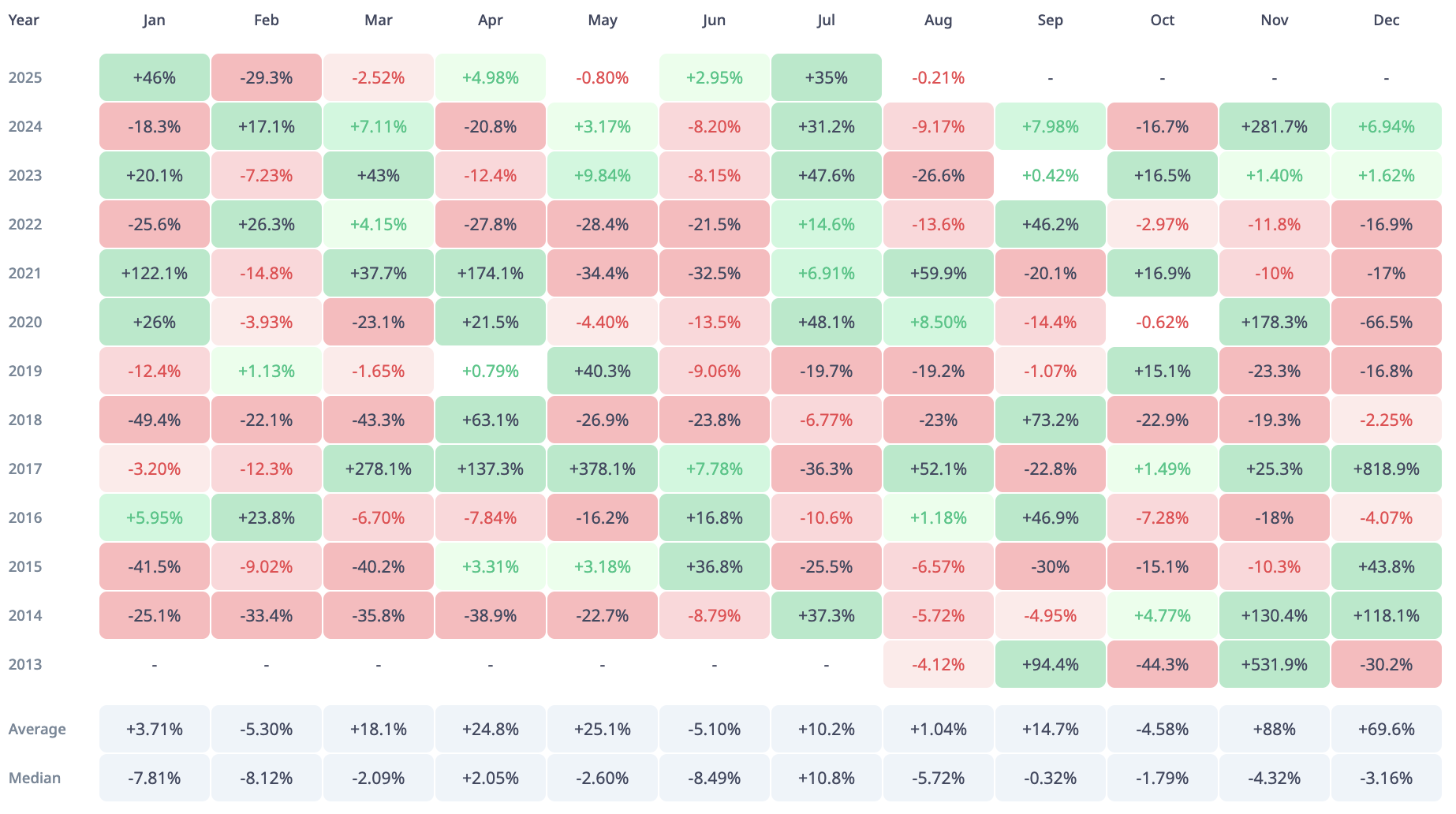

If that sounds familiar, it is because August has a history with the XRP price. In 2018, the month finished at -23%, in 2019, it was -19.2% and in 2022, it was -13.6%. There are some exceptions — 2020 printed +8.5% — but the distribution is mostly red.

On average, you will see about a 1.03% return in August, but the median is actually -5.72%. That is why you often see these modest drawdowns, even in years where everything else is going well.

What's next?

From here, the map is clear. Getting back $3.10-$3.15 and closing above that shelf would balance out the midmonth dip and reopen the door to the August high. Spend more time under $3, and the market risks a grind to $2.90 first, and if that gives way, it will test the $2.80 cluster that caught dips in June.

One step ahead does not settle the debate either. September's average for XRP was +14.7%, but the median was slightly negative at -0.32%.

So, the month had some big rebounds and some big setbacks. Here's the deal: for August to be salvaged, $3 needs to hold, and for the early pop to be more than a mirage, $3.14 needs to finally break.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov