Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

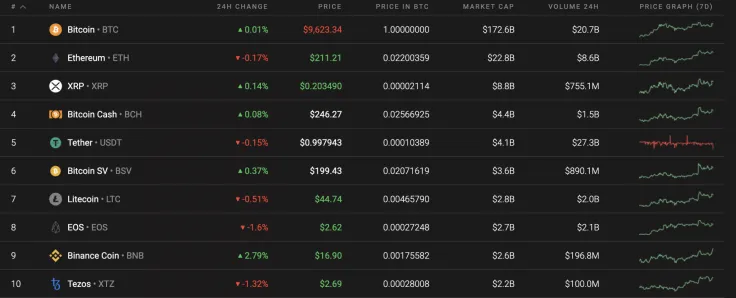

Uncertainty remains on the cryptocurrency market despite the recent bullish mood. Neither bears nor bulls are dominating at the moment. Currently, the top gainer is Binance Coin (BNB), whose rate has risen by 2.79% over the past day.

The important data for Bitcoin (BTC), Ethereum ETH), and XRP are as follows.

|

Name |

Ticker Advertisement

|

Market Cap |

Price |

Volume (24h) Advertisement

|

Change (24h) |

|

Bitcoin |

BTC |

$177 844 301 318 |

$9 675.49 |

$40 154 591 162 |

-0.48% |

|

Ethereum |

ETH |

$23 589 187 229 |

$212.53 |

$14 949 868 049 |

-0.58% |

|

XRP |

XRP |

$9 013 883 361 |

$0.204337 |

$1 999 874 790 |

0.09% |

BTC/USD

Bitcoin (BTC) has lost 0.3% over the past day. However, the potential to retest $10,000 remains. There are both bullish and bearish moods on the market at the same time.

On the hourly chart, the chief coin has remained within the Wedge pattern, which is a bullish signal. The high level of liquidity at the current zone is another reason for possible continued growth.

In this case, there is a high probability of seeing Bitcoin (BTC) trading above $10,000 within the next few days.

Bitcoin is trading at $9,646 at press time.

ETH/USD

Ethereum (ETH) is trading almost the same way as Bitcoin (BTC). The decline over the past 24 hours has amounted to 0.17%.

On the hourly chart, Ethereum (ETH) is showing bearish tendencies that are outlined by decreasing trading volume and a falling MACD indicator. What is more, there is no focused low liquidity right now, suggesting a short decline to $209 soon. If the rate drops below $200, the bearish scenario will become relevant again.

Ethereum is trading at $211.63 at press time.

XRP/USD

XRP is the only coin out of the top 3 located in the green zone. The price of the third most popular coin has risen by 0.14% since yesterday.

Even though the rate of XRP has slightly risen, its short-term perspective is bearish. The Relative Strength Index indicator keeps falling. In addition, we might see a huge amount of selling trading volume, which is a bearish signal. All in all, traders can expect XRP to trade at around the $0.20 area soon.

XRP is trading at $0.2029 at press time.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov