While Bitcoin hodlers are no strangers to volatile price moves, it clearly doesn't apply to U.S. stock market investors who are currently caught in the worst sell-off since 2008.

Now, all assets are tanking across the board, and analyst Brian Patrick Eha noticed that the S&P 500, the index that is used to track large-cap equities, resembles your casual Bitcoin dump.

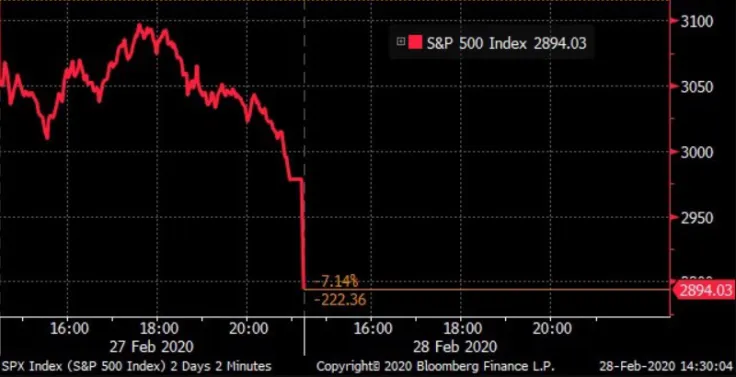

Some $3.4 trillion (thats "trillion" with a T) has been erased from the S&P 500 in the past six days. Haven't had a week like this since 2008.

— Brian Patrick Eha (@brianeha) February 28, 2020

The S&P 500 chart looks more like a Bitcoin dump. https://t.co/6vKk3TiGfv?from=article-links pic.twitter.com/euMIpeBBRs

Trillions of losses

Over the past six days, the S&P 500 erased a whopping $3.4 trln due to a growing number of coronavirus cases around the globe. To put this into perspective, this is 21.7 times the current market cap of Bitcoin. As reported by U.Today, this is the fastest correction in the entire history of the U.S. stock market.

Hungry bears can't get enough of this carnage with the benchmark index taking yet another three percent hit on a bloody Friday.

It seems like traditional investors do not have the hodl mentality of the cryptocurrency community that can stomach 80 percent drawdowns, which is exactly what happened to BTC in 2018.

Gold failing as a safe haven

With equities getting massacred the whole week, one would normally expect gold prices to rally. However, precious metals are now even more bruised than risk-on assets, with gold and silver plunging four percent and six percent respectively.

Treasuries appear to be the only asset class that managed to stay above the fray, which is reminiscent of the 2008 financial crisis. The yield on the 10-year note has recently witnessed a sharp drop and came close to reaching its all-time low.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov