As became known, Solana (SOL) has experienced an unprecedented surge of 1,966% in fund inflows in the past week, firmly establishing itself as a standout leader in alternative cryptocurrency-focused investment products over the past week.

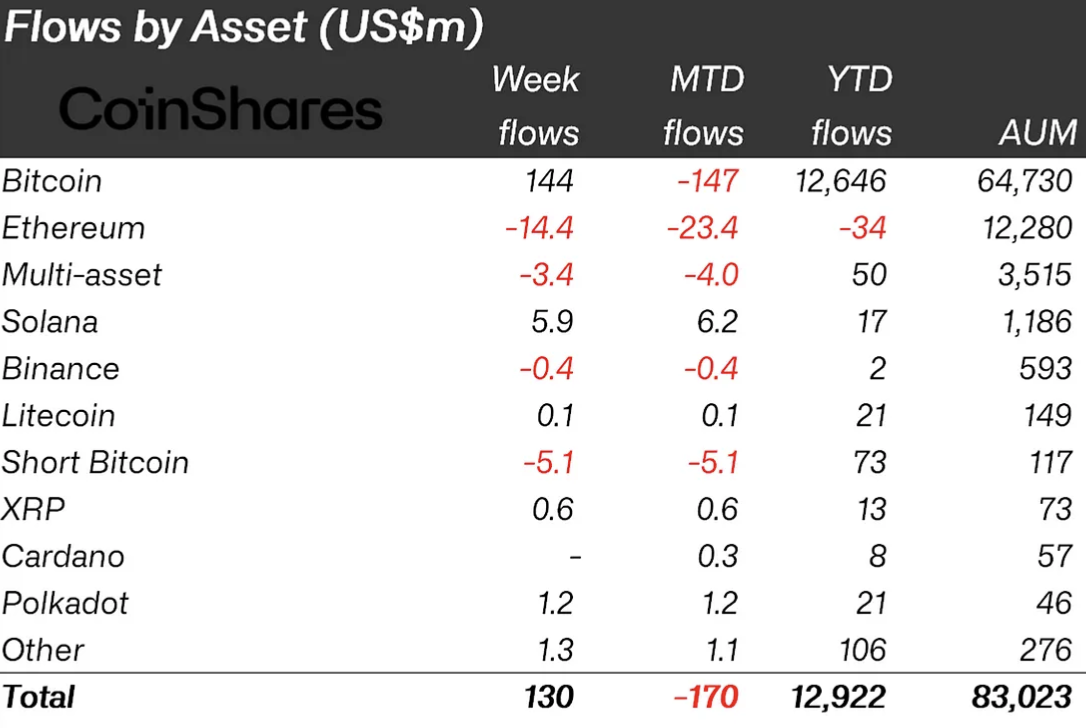

According to the latest report from CoinShares, a substantial $5.9 million was directed toward SOL-related products within this short time frame. This surge not only reaffirms SOL's dominance but also marks a nearly twenty-fold increase in inflows into Solana ETPs, totaling an impressive $17 million since the beginning of the year.

Contrary to this notable uptrend in SOL, the broader market landscape paints a different picture. While investment products for digital assets witnessed a commendable $130 million inflow, volumes for ETPs experienced a significant decline, dropping from April's $17 billion to $8 billion.

This trend suggests a diminishing involvement of ETP investors in the cryptocurrency ecosystem, now constituting only 22% of the total volume on global reputable exchanges.

When Solana ETF?

Amid growing interest from traditional investors in SOL, speculation arises regarding the feasibility of a Solana ETF. However, the potential for such an ETF is closely tied to the fate of the Ethereum ETF. With it facing regulatory obstacles, the path to a Solana ETF appears equally challenging.

Notably, regulatory ambiguity surrounds Ethereum ETF status, with the SEC's classification of SOL as an unregistered security in last year's case against the Kraken exchange adding to the uncertainty.

As investors await clarity on the ETF front, the prospect of a Solana ETF remains speculative, contingent upon regulatory developments and the resolution of Ethereum's ETF dilemma.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin