Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

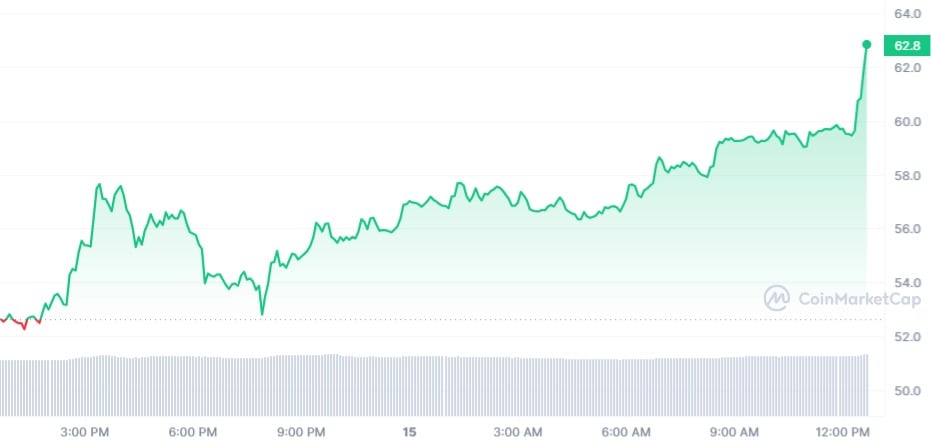

Solana (SOL), with its current price action, can be said to have changed the "gold standard" in the altcoin world. At the time of writing, Solana is up 17.88% to $62.07, a clear case of growth decoupling from Bitcoin. This price surge, which comes on the back of a 12.65% surge in trading volume to $3,355,376,632, comes at a time when BTC and other altcoins are struggling to keep their prices stable.

While Solana shrugged off the impact of the FTX saga a few weeks ago when its price retested the pre-FTX bankruptcy levels, the current outlook shows its price has even been extended, hitting a new 18-month high.

It remains unclear what the current source of optimism in the Solana ecosystem is, but we have seen a revamp that is encompassing, with impacts seen in Grayscale Trust's adoption, the protocol's DeFi volume boost as well as its spot exchange trading surge.

Agreeably, Solana deserves all of the positive optics it is getting today as it spent the better part of the year building its ecosystem and adding value that users can truly hang onto.

Solana (SOL) price set for new discovery

Now that Solan (SOL) has outperformed itself in the year-to-date period, it has effectively entered into a price discovery phase to erase as much of the 76.24% loss the coin harbors to breach its all-time high (ATH) figure of $260.

With the new goals defined, there is a limited chance the liquidation scare that comes with FTX selling off its assets will have an impact on the price stability of Solana moving forward. With the protocol soaring by 45% in the trailing seven-day period, and by 173% in the past month, there is a consensus that its biggest payday for the year is still ahead.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov