The Crypto Fear and Greed Index, a popular tool for gauging market sentiment, has dipped into the "fear" zone for the first time since Jan. 22.

After dropping to the value of 38, the market is currently at its most fearful since last September when Bitcoin temporarily experienced a sharp reversal together with U.S. tech stocks.

Historically, such periods of fear present good buying opportunities. After the index declined to 40 on Jan. 22, Bitcoin ended up resuming its rally in early February.

The fluctuating market sentiment is also a perfect case for studying trading psychology. When Bitcoin tapped $42,000 for the first time on Jan. 8, the index rose to a whopping 93. Yet, the index plunged to the aforementioned 38 after Bitcoin dipped to $43,000 yesterday.

Bitcoin recovers, but institutional demand cools

Bitcoin has now recovered to an intraday high of $48,637 on Bitstamp, soaring over seven percent after yesterday's sell-off.

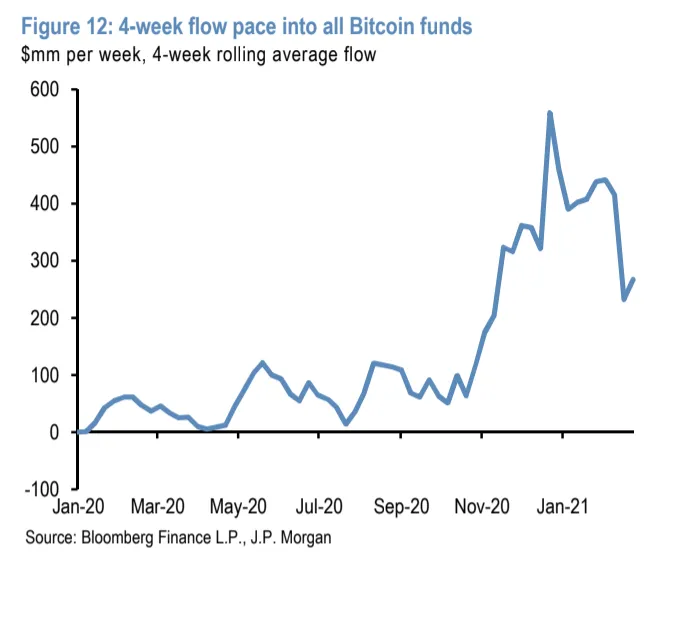

This relief rally, however, could be kneecapped by waning institutional demand. In its recent research note, JPMorgan highlights that the four-week rolling average of flows into funds has subsided as of late.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin