Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

The price of major cryptocurrency Bitcoin (BTC) hit a new six-month high this morning, currently trading at $69,519.52, according to a chart on Binance.

After a prolonged decline since March, when BTC hit its current high, a dynamic resistance line was broken just five days ago, sending the major cryptocurrency's price down more than 5.4% over the next five days. Bitcoin has never been closer to a new high in these many months than at this moment.

Impressive? Yes, but not to Peter Schiff. The renowned financial expert, banker and cryptocurrency critic eloquently described the event as "meaningless." It is meaningless, in Schiff's opinion, in contrast to gold, which the banker is an active proponent of, currently hitting a new high of $2,740 an ounce.

In the opinion of a banker whose Euro Pacific Bank has been frozen by the government of Puerto Rico, the fact that gold's rise to new heights is being completely ignored by the mainstream media, in contrast to the price action of Bitcoin, is unfair, to say the least.

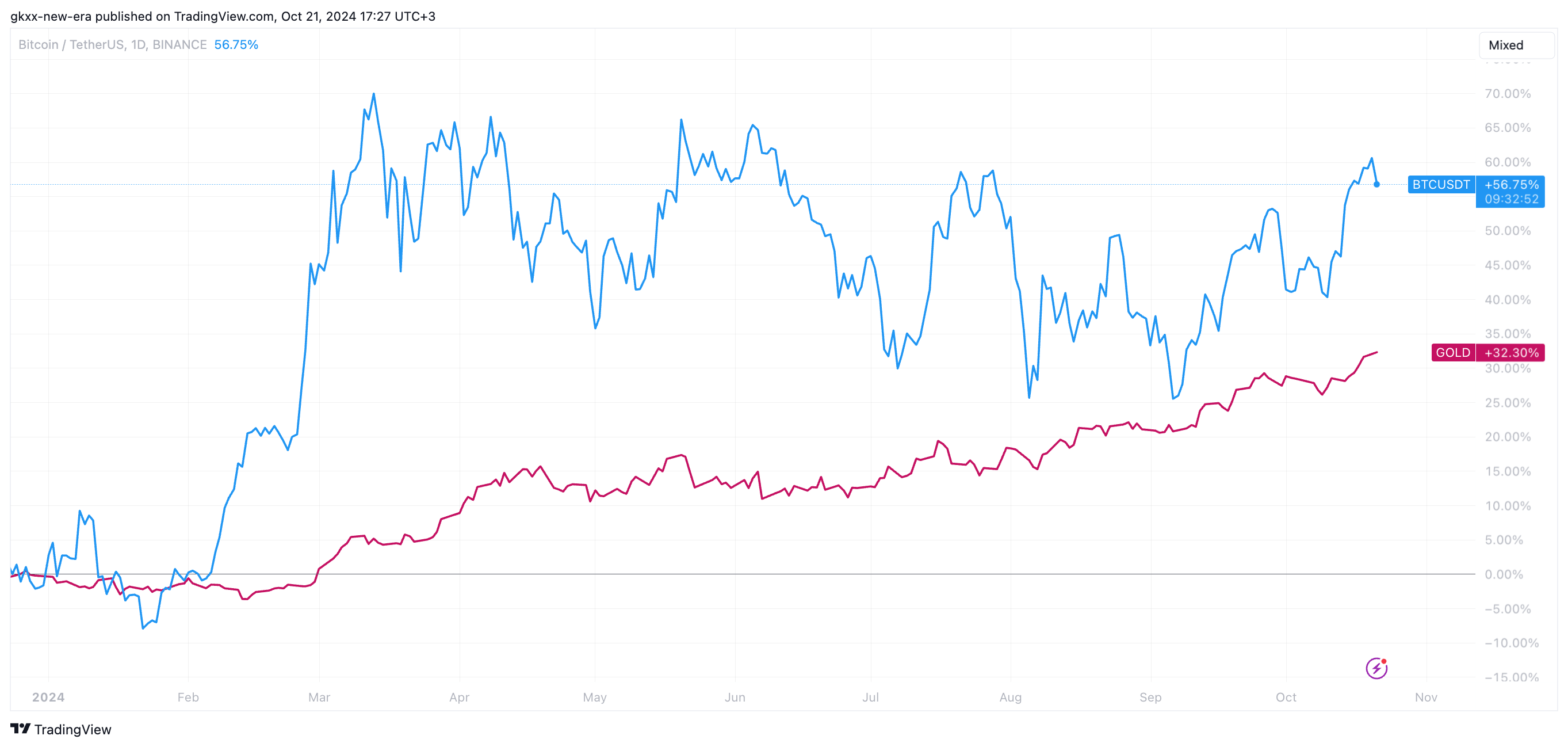

Gold v. Bitcoin

Reporters are either too ignorant of economics and finance to understand the significance of gold's rise, or it is a "deliberate" attempt to hide that significance from the public, according to Schiff.

Interestingly, while Peter Schiff is once again hailing the superiority of gold over the major cryptocurrencies, another well-known figure in financial circles, Peter Brandt, is predicting a rise of more than 400% in BTC quotes against gold.

However, according to the trader, this does not mean that gold will fall, and on the contrary, he also reveals that in addition to being long on Bitcoin, he is also long on precious metal futures.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov