Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

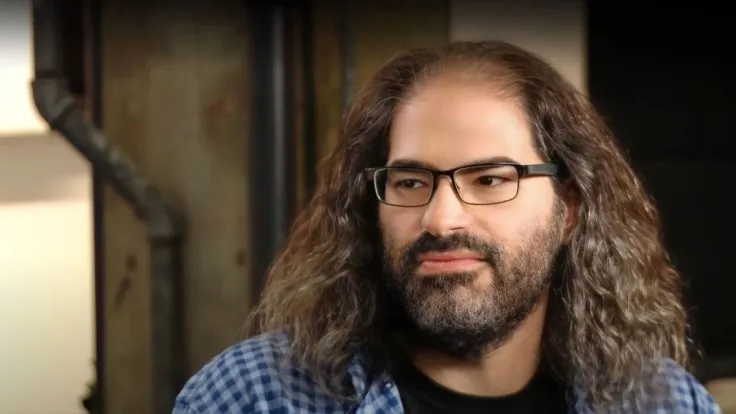

Ripple CTO David Schwartz, in response to questions on whether the company had exposure to the collapsed SVB, says an official statement will soon be issued. He refrains from saying anything until a statement is made.

Ripple will issue a statement shortly. I can't say anything until they do.

— David "JoelKatz" Schwartz (@JoelKatz) March 12, 2023

The sudden collapse of SVB Financial Group, which rocked the global financial markets and left billions of dollars belonging to businesses and investors stranded, made it the largest bank to fail since the 2008 financial crisis.

The bank, which operated under the name Silicon Valley Bank, was shut down by California banking regulators on Friday, and the Federal Deposit Insurance Corporation (FDIC) was named as receiver for a subsequent sale of its assets.

The details of the tech-focused bank's sudden collapse were unclear, but it appeared that the Fed's aggressive interest rate increases during the previous year, which had severely tightened financial conditions in the start-up sector where it was a prominent player, might be to blame.

USDC issuer Circle recently disclosed that $3.3 billion of its $40 billion in USDC reserves were held in the troubled Silicon Valley Bank (SVB). In addition, the Bank is one of Circle's six banking partners that it employs to manage roughly 25% of its cash-based USDC reserves.

As a result, the USDC stablecoin has lost its dollar peg, trading at $0.95 at the time of publication.

CryptoLaw founder John Deaton reacted to a user's comment on the list of companies that have disclosed their exposure in SVB so far, including Circle ($3.3 billion exposure), BlockFi ($227 million exposure) and others.

If @Ripple didn't have exposure you would already know that.

— John E Deaton (@JohnEDeaton1) March 11, 2023

The user quipped, "No Ripple," to which Deaton responded, "If Ripple didn't have exposure you would already know that."

At the time of writing, an official statement from Ripple was not yet available.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov