Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Chief technology officer of Ripple Labs, one of the co-founders of XRPL, David Schwartz has taken to Twitter to comment on some aspects of the recent SVB case. He also shared a recommendation about keeping funds in it.

Earlier, the company’s chief executive Garlinghouse officially admitted that Ripple had exposure to Silicon Valley Bank.

Reason for SVB’s insolvency remains unknown

Sschwartz tweeted that details about KYC policies or data about those to who the crypto-friendly bank extended loans does not reveal why the bank went bankrupt and “seems to have nothing whatsoever to do” with the SVB going bankrupt.

He added that “anyone who keeps uninsured funds on deposit with an insolvent bank is not a bright person”, basically urging users to withdraw their money from the insolvent bank.

Nothing about SVB's KYC policies or who they extended credit to seems to have anything whatsoever to do with how they became insolvent. And anyone who keeps uninsured funds on deposit with an insolvent bank is not a bright person.

— David "JoelKatz" Schwartz (@JoelKatz) March 20, 2023

As reported by U.Today earlier, the head of the fintech company Ripple, Brad Garlinghouse, made an official statement on Twitter, saying that Ripple did have a small exposure to the aforementioned bank as a banking partner – they kept a small part of their cash in it.

Still, SVB going bankrupt will not disrupt Ripple’s daily operations and no damage has been done, according to the CEO.

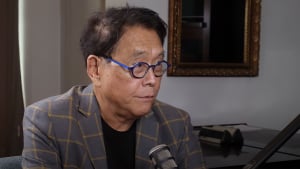

Bitcoin investor predicted Signature bank collapse

After SVB and Silvergate, another crypto-friendly institution, Signature Bank, went broke. Before that news was announced, a prominent investor and financial expert Robert Kiyosaki, widely known for his book “Rich Dad, Poor Dad”, tweeted that he expects a third bank to go down after Silvergate and SVB. Since he is a Bitcoin advocate, prior to that, he posted a recommendation for his followers to acquire more Bitcoin, physical gold, and silver coins.

Kiyosaki has been tweeting about an upcoming financial crisis since early 2020 when the pandemic began, and also tweeting about “fake USD” that the US government has been printing to support the economy and bail out large businesses and banks. By the way, SVB and Signature bank are also going to be bailed out.

As the former two banks became insolvent, Bitcoin price was propelled to the $28,000 level, since investors switched to the digital currency during times of instability in the banking sector.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov