Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Ripple, a significant player on the cryptocurrency market, has faced questions about its extensive sales of XRP. Ripple's Chief Technology Officer David Schwartz recently explained the company's reasons for these sales.

Schwartz pointed out that Ripple is the largest holder of XRP, and the only practical alternative to selling is to continue holding it indefinitely.

Ripple's Q1, 2024, report provided detailed information about its XRP holdings. These holdings are divided into two categories: XRP that is immediately available in Ripple's wallets and XRP that is locked in on-ledger escrow accounts.

These escrow accounts will release XRP monthly over the next 42 months. Ripple does not have access to the escrowed XRP until it is released according to this schedule. Most of the XRP released each month is returned to the escrow account, reflecting a controlled release strategy.

As of March 31, 2024, Ripple held 4.8 billion XRP, with an additional 40.1 billion XRP in on-ledger escrow.

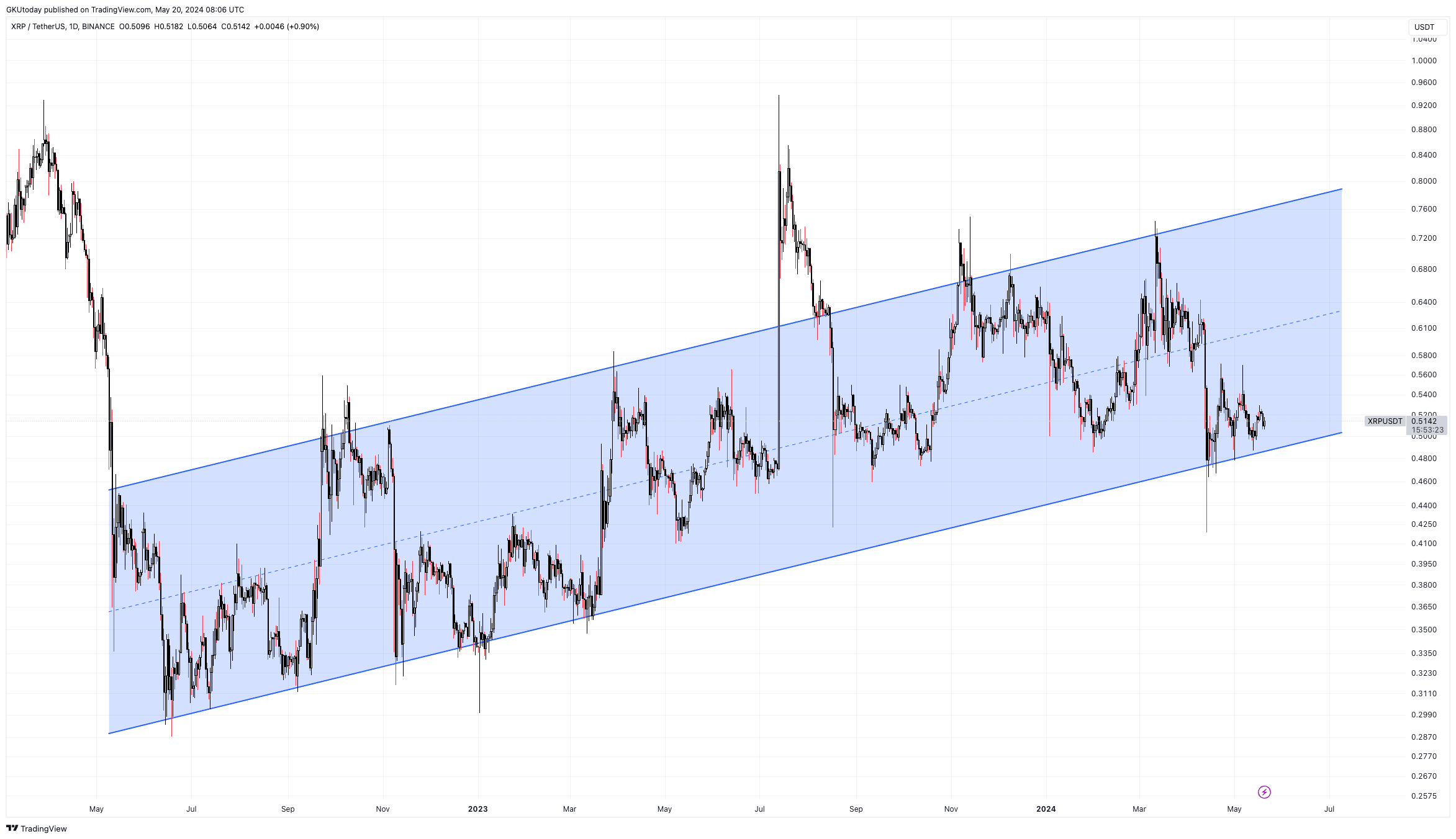

XRP price outlook

Currently, the price of XRP is around $0.50 per token. Reviewing the price chart, XRP has been trading in an upward corridor since May 2023, with the upper dynamic resistance now at $0.80 per token. However, the token is currently near its support level, where it has remained for the past month after experiencing a 22% decline in mid-April.

The question remains whether XRP can recover from its recent downturn and what role Ripple's continued token sales will play in this process.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin