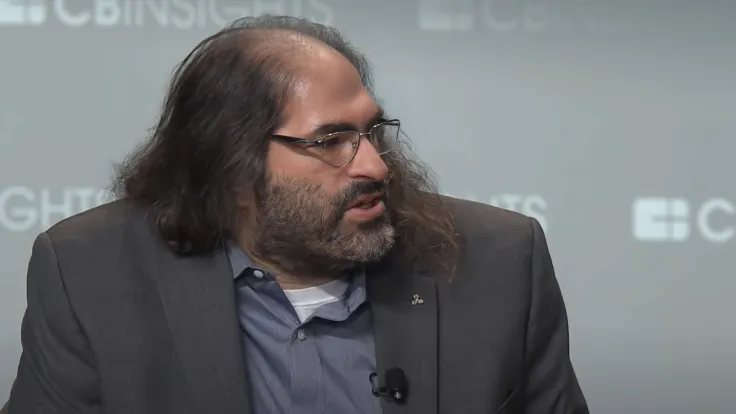

In a recent tweet, Ripple CTO David Schwartz says that U.S. prosecutors bringing federal charges against MoviePass means “nothing” for cryptocurrencies given that it’s just a run-of-the-mill securities fraud case. Schwartz believes that there is nothing unusual or groundbreaking about the case.

Mitch Lowe and Ted Farnsworth, two former MoneyPass executives, have been accused of misleading investors by federal prosecutors.

MoviePass assured investors that its moviegoing plan, which offered unlimited tickets for $9.95 per month, would eventually become profitable by making it possible to obtain important information from subscribers because of artificial intelligence-powered technologies.

However, the prosecutors believe that the executives made deliberately misleading statements in order to amplify the shares of Helios and Matheson Analytics, MoviePass’s parent company. In fact, the prosecutors claim that the technologies touted by Farnsworth and Lowe didn’t exist in the first place.

FBI assistant director Michael Driscoll says that such fraudulent schemes erode faith in markets.

The lawyers of the executives insist that they acted in good faith. They are confident that facts will demonstrate this.

Ripple was sued for violating federal securities laws with its massive XRP sales in the U.S. Securities and Exchange Commission back in December 2020. The high-stake case, which is expected to have significant implications for the industry, is expected to resolve in the first half of 2023.

Alex Dovbnya

Alex Dovbnya Denys Serhiichuk

Denys Serhiichuk Gamza Khanzadaev

Gamza Khanzadaev Tomiwabold Olajide

Tomiwabold Olajide