Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

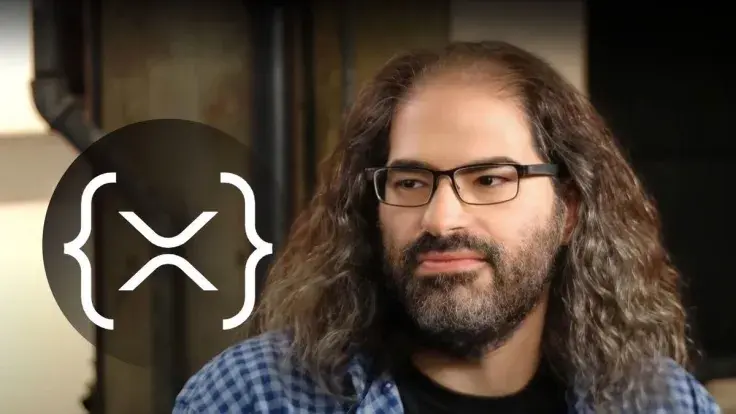

Ripple Chief Technology Officer (CTO) David Schwartz has published a post on the X platform to comment on the announcement recently made by Ripple President Monica Long in the company’s blog, which was then shared by Ripple on X.

Schwartz explained that Ripple is now putting focus on integrating the technical and financial features of XRP Ledger in its own business. This is being done, per the Ripple CTO, to allow its clients to enjoy the benefits of DeFi in a secure and compliant manner around the world. The Ripple post speaks about the company aiming to become “the #1 digital asset infrastructure provider for financial services by building the core components,” and it also explains how Ripple’s product strategy has evolved for this.

Ripple opening new office in Geneva

Stating that the first major bet in the blockchain sphere for Ripple was cross-border payments, President Monica Long made a small recap of the company’s recent significant milestones achieved in this industry.

In particular, she named the 2023 acquisition of digital asset custody technology provider Metaco that works with top banks around the world, including BBVA Switzerland and HSBC, a major step to make the future of blockchain payments a reality. Metaco is going to function as Ripple Custody in the near future with a plan for a new office to be opened in Geneva soon. As the next step here, Ripple intends to add its Liquidity Hub into their global payments solution.

Ripple's stablecoin to help institutional DeFi

Monica Long also touched on the recently announced Ripple’s plans to roll out its own USD-backed stablecoin RLUSD on both XRPL and Ethereum blockchains. As soon as the launch takes place, RLUSD will be immediately made part of the Ripple Payments solution along with XRP to expand use cases in transnational payments for institutional clients and serve their growing needs in this area.

Overall, Ripple’s plans include providing financial institutions with better ways to on-ramp and off-ramp funds in crypto and fiat currencies they choose. Besides, according to the blog post, the stablecoin will provide developers with new opportunities of building apps with new capabilities to create new use cases and land them more new users.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov