Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

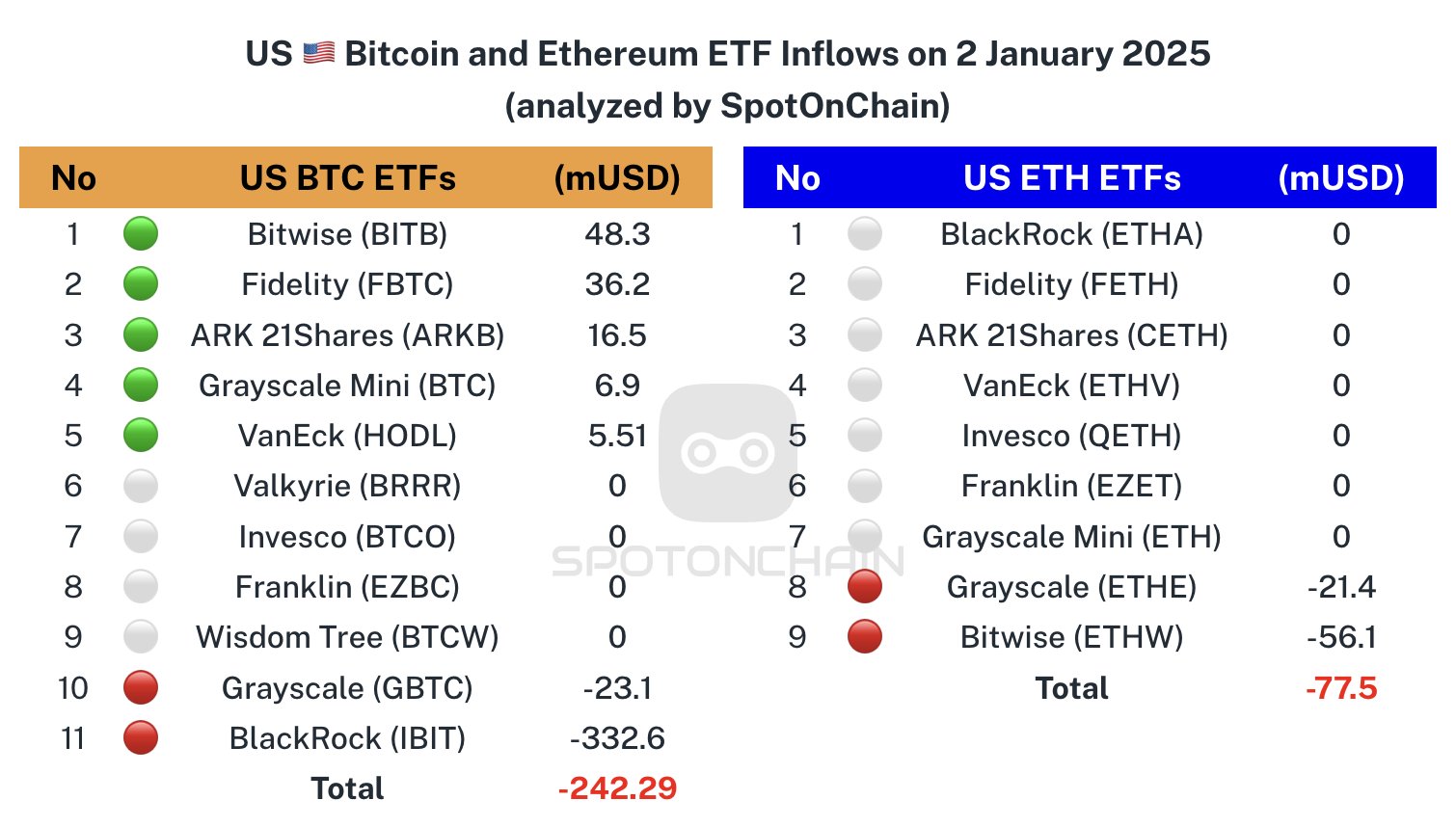

BlackRock's iShares Bitcoin Trust (IBIT) started 2025 with a big outflow of $332.6 million, which is about 3,413 BTC. This is the ETF's biggest single-day outflow since it started, bigger than the previous low of $188.7 million, equal to 1,933 BTC, on Dec. 24, 2024.

Even with the early hiccups in the new year, IBIT had a solid run in 2024, pulling in a total of $37.2 billion in inflows. BlackRock's Ethereum ETF (ETHA) also had some serious investor interest, raking in $3.53 billion during the same time.

As of now, BlackRock has about 548,505 BTC worth $52.81 billion and around 1,071,415 ETH worth $3.68 billion.

Cryptocurrency market reacts with negative

How this will affect the broader cryptocurrency market remains to be seen. But, as we can see right now, the quotes of digital assets experience pressure today and a dip. This may be caused by the fact that Bitcoin saw a bear reaction from the $97,700 zone, which right now serves as major resistance for the price of the leading cryptocurrency.

There's an outlook for Bitcoin, that now there is an attempt to form a classic visual pattern “head-shoulders,” which will be activated at the breakdown of the neckline — around $92,000.

If that happens, from here we can expect a deep correction to the area of $80,000-$70,000. This will mark a 30% decline from the relevant all-time high for BTC, which is a healthy textbook correction needed for continuation of the upward trajectory.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov