Although XRP investment products saw their weekly inflows collapse by 80%, CoinShares data reveals a detail that flips the picture in favor of those bullish on this cryptocurrency.

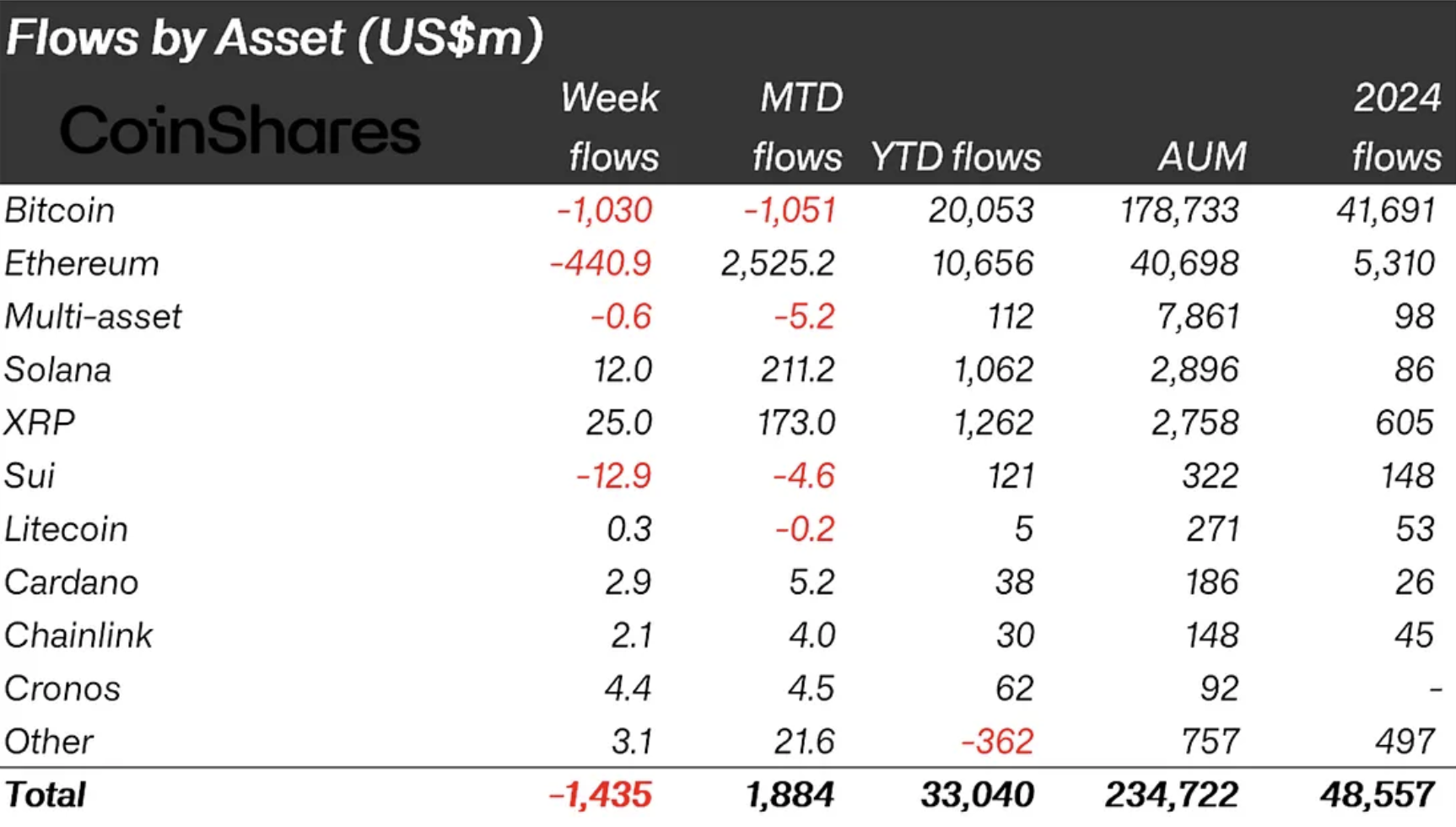

The fresh report records only $25 million flowing into XRP funds, compared to $125.9 million the previous week. It may seem that demand for the asset has cooled, though the bigger picture tells a different story.

Thus, the headline for the week was actually a massive $1.435 billion net outflow across all digital asset products, which makes XRP recording a $25 million inflow a rare positive entry, while the rest of the market bled capital heavily.

Add to that $173 million in total inflows for August, year-to-date allocations at $1.26 billion and the figure of assets under management barely moving from the $2.76 billion mark. This shows that, although the pace of new buying has slowed, investors have not retreated, and XRP’s base capital position remains secure.

XRP stronger than Bitcoin

In contrast, Bitcoin saw $1.03 billion leave funds during the week, pushing its month-to-date figure into negative territory at -$1.05 billion. Ethereum lost $441 million during the week, though its month-to-date figure remained positive thanks to prior strength.

Outside of XRP, only smaller inflows into Solana ($12 million), Cardano ($2.9 million) and Chainlink ($2.1 million) offset some of the downturn. Most altcoins either stagnated or recorded outflows.

The takeaway? In a week dominated by heavy withdrawals across the board, XRP not only avoided negative numbers; it actually drew in new capital. This basically says that XRP is one of the few tokens that continues to attract institutional investment as the market heads into September.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov