While Ethereum (ETH) validators are unstaking their treasuries en masse, other groups are rushing into the ETH validation ecosystem. This imbalance might signal about mixed sentiment in the large ETH wallets' segment.

$7 billion stuck in Ethereum (ETH) validator queue

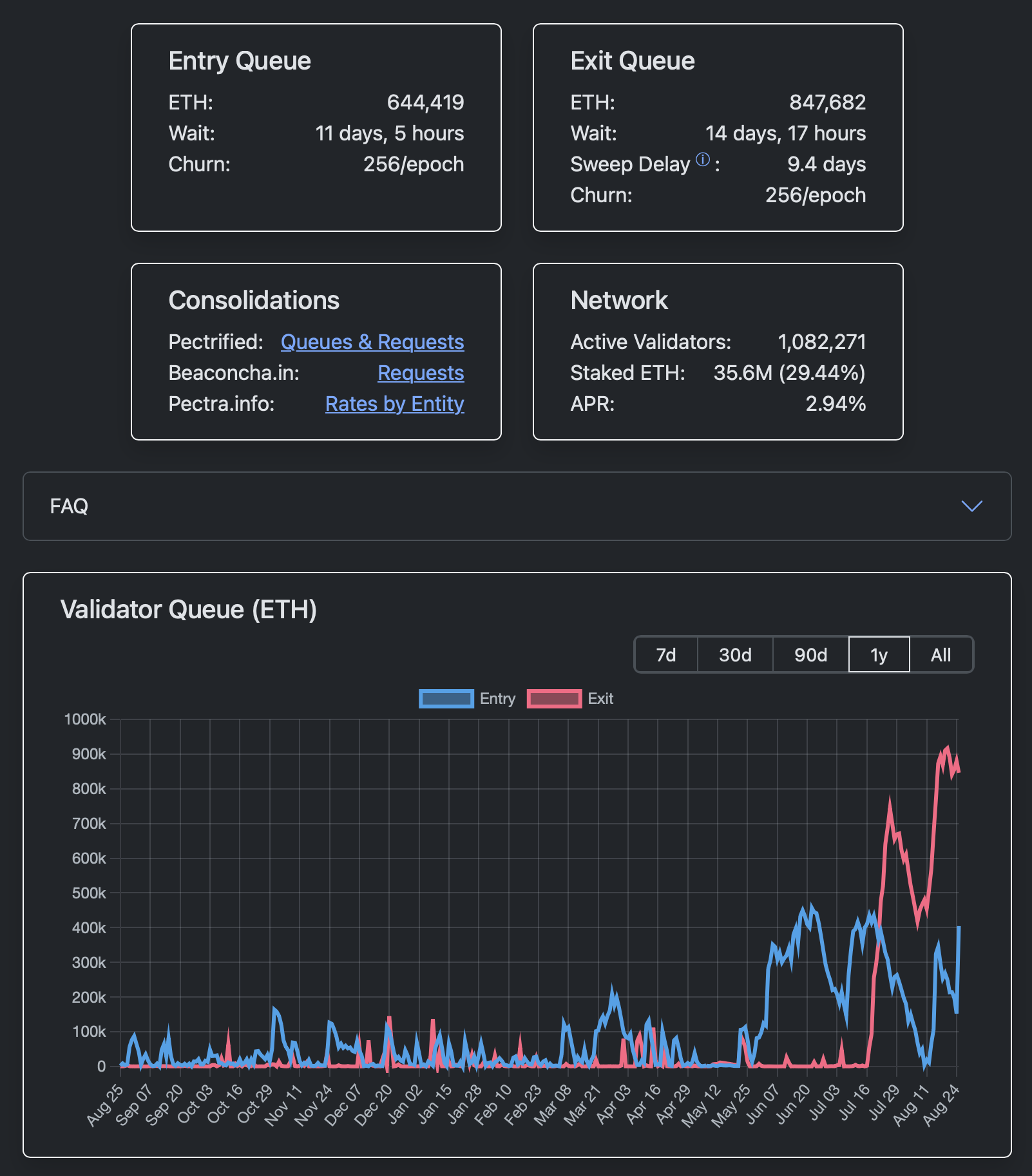

The Ethereum (ETH) validation entry queue — the list of potential validators interested in staking their holdings in order to obtain periodic rewards — started rapidly surging. In just two days, it added over 400,000 ETH and hit a multi-month high over 644,000 Ethers.

As a result, it takes over 11 days now to withdraw ETH allocations from staking. The last time such an increase in staking period was observed was over two months ago.

At the same time, the Ethereum (ETH) unstaking queue started to calm down following its peak on Aug. 20, 2025. After hitting an unbelievable 970,000 ETH, it has now dropped below 850,000 ETH.

In total, about $7 billion in liquidity is waiting to either join ETH staking mechanism or leave it. It signals the mixed expectations of large ETH market participants.

Ethereum (ETH) community optimistic after debated ATH

The interest in withdrawing is most likely associated with the opportunity to fix profits at the current price level. The interest in locking ETH on validators is, by contrast, a signal of growing optimism about its price performance.

As the ecosystem is saturated, Ethereum (ETH) staking annualized rewards dropped below 3% compared to the normally observed 4%.

As covered by U.Today previously, on some cryptocurrency exchanges, the Ethereum (ETH) price reached its new all-time high last Friday.

At the same time, CoinGecko and CoinMarketCap do not confirm the previous ATH from 2021 being smashed for the Ether price.

Gamza Khanzadaev

Gamza Khanzadaev Godfrey Benjamin

Godfrey Benjamin Tomiwabold Olajide

Tomiwabold Olajide Yuri Molchan

Yuri Molchan