Institutional players can’t get enough of Bitcoin.

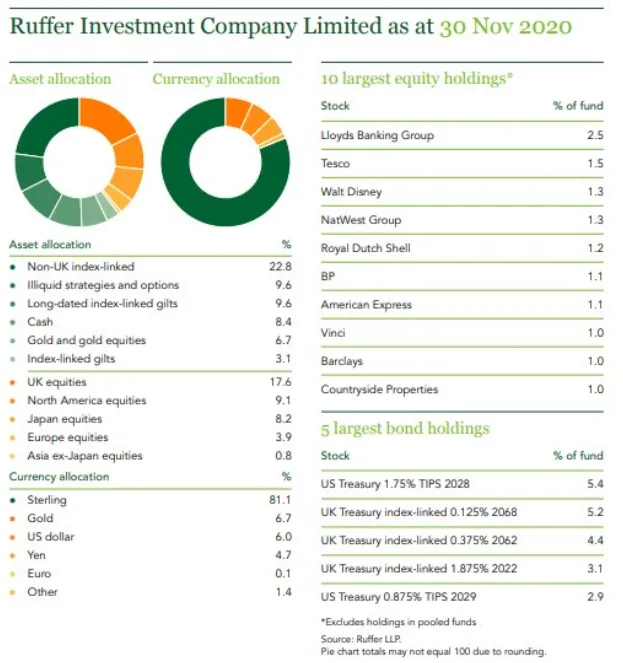

Ruffer Investment Company, a wholly-owned subsidiary of massive U.K.-based asset manager Ruffer, has announced that its portfolio now includes a 2.5 percent allocation to Bitcoin, the largest cryptocurrency.

Economist and crypto analyst Alex Krüger has estimated that it translates into a $15 million purchase.

The company describes its Bitcoin move as a “defensive move” that was made back in November:

We see this as a small but potent insurance policy against the continuing devaluation of the world's major currencies.

Following what appears to be an emerging trend, Ruffer Investment Company claims that it reduced its gold holdings in order to get exposure to Bitcoin.

Still, the yellow metal and related equities account for a much larger portion of its $620 million portfolio.

A stampede for Bitcoin

As reported by U.Today, insurance powerhouse Mass Mutual decided to put $100 million into Bitcoin that it believes will act as an inflation hedge last week.

Meanwhile, asset manager Grayscale recently surpassed $13 billion in assets under management (AUM), currently holding three percent of the total Bitcoin circulating supply.

No longer dismissing Bitcoin as a fad, institutional investors around the globe now see Bitcoin as a must-have in their portfolios.

The top is trading at $19,520 on the Bitstamp exchange at press time.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin