Automated cryptocurrency trading is the ultimate solution for those willing to spend less time in front of the computer and for those looking for a gradual return. Bitsgap is best known for its automated trading bots on a cryptocurrency spot market. It has recently announced the launch of a “Combo bot”, which has been created for the cryptocurrency’s futures market.

The advanced thing about the futures market is that you can generate returns not only on a rising market but on a falling. As the price declines, you can configure the Combo bot to take advantage of a plunge by selecting the “Short” strategy. The bot will execute the short-sell position. Conversely, if you expect the market to rally then you have an option to select a “Long” strategy and the bot will open a buy position.

Moreover, in futures trading, you can open leveraged positions. For example, you can open a $1000 position having only $100 on your balance. Thanks to a 10x leverage, which implies trading with borrowed money. Leveraged trading is tricky because your risk is 10x. In Combo bot you can set leverage up to 10x in “Isolated margin” or “Cross margin” modes.

How does the Combo bot generate returns?

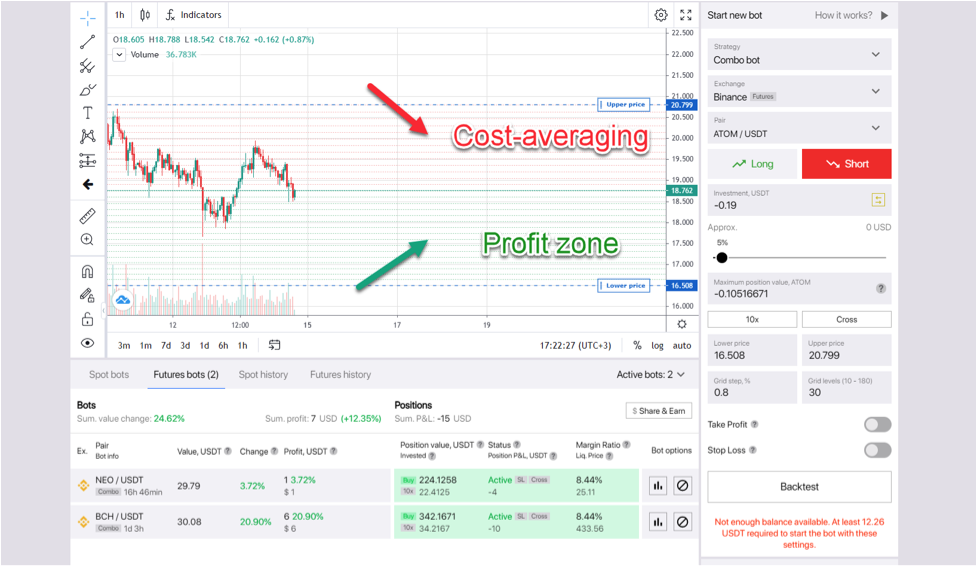

1. The technology behind the “Combo bot” is simple and effective. It is a combination of GRID and DCA algorithms. In a “Short” strategy the bot executes buy GRID orders to lock in returns as the price falls. DCA short-sell orders are located above the market price and if the price rises, then the bot will execute them to adjust the entry price (dollar-cost-averaging effect):

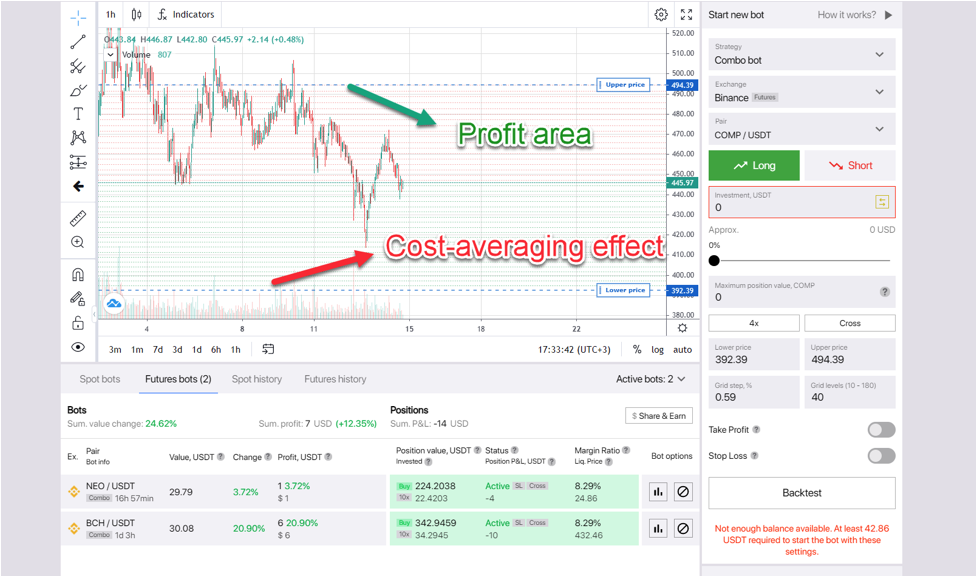

2. As the “Combo bot” can trade in two directions, the “Long” strategy is a perfect solution to achieve maximized returns on a rising market. As the price goes higher and establishes new higher-highs, the bot executes GRID sell orders to lock in returns. When the price swings downwards, the bot executes DCA buy orders to adjust the entry price (dollar-cost-averaging effect):

How to analyze the performance of my Combo bots?

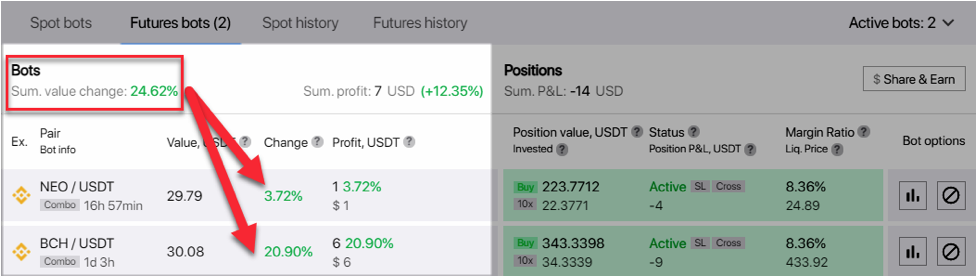

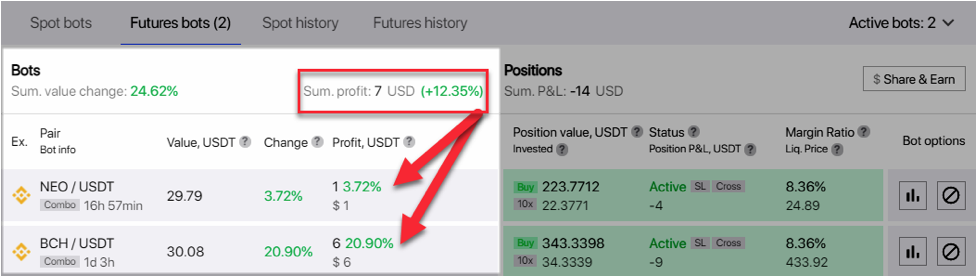

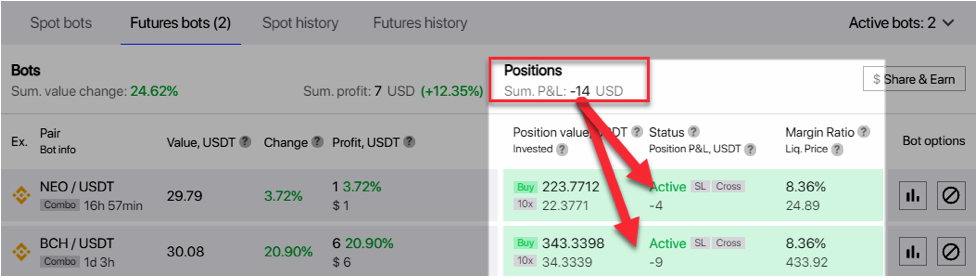

1. A sophisticated combination of some key metrics provides users with major insights into their bots’ performance. If you have launched several bots then in “Sum. value change” you can see the overall realized return in %.

2. “Sum profit” depicts the total realized return in USD value.

3. In the “Positions” section there is information about currently open futures contacts. Unrezlied return or loss in USD value. In the example below, we have 2 “Long” Combo bots with a 10x leverage. Other crucial metrics like “Margin ratio” and “Liquidation price” provided - this is your risk exposure.

Risk management is essential!

Trading futures contracts can bring you insane returns, but the cost for that is a substantial risk that you take by using leverage. Make sure you fully understand the underlying risks. At Bitsgap you can learn about the spot market automated bots in a risk-free demo-mode where you have virtual money to trade with. A good recommendation would be to experiment with time-tested Bitsgap’s spot bots to get yourself familiar with the GRID algorithm before trading Combo bot.

Disclaimer: This is sponsored content. The information on this page is not endorsed or supported by U.Today, and U.Today is not responsible or liable for any inaccuracies, poor quality, advertising, products or other materials found within the publication. Readers should do their own research before taking any actions related to the company. U.Today is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the article.

Dan Burgin

Dan Burgin Alex Dovbnya

Alex Dovbnya Denys Serhiichuk

Denys Serhiichuk