What is happening?

The U.S. federal government is reportedly investigating Tether, issuer of the stablecoin USDT, for potential violations of anti-money laundering and sanctions laws, according to the Wall Street Journal.

As the newspaper claims, Federal investigators, led by the U.S. Attorney's Office in Manhattan, are examining whether third parties have used Tether to fund illicit activities, although no official charges have been filed.

Following this report, Bitcoin's price fell from $68,600 to $66,589, and Tether briefly dipped to 99.81 cents as the broader crypto market reacted to the news.

Tether CEO Paolo Ardoino, however, denied any ongoing investigation, stating on X that there’s no evidence to suggest Tether is under scrutiny.

Why Tether matters

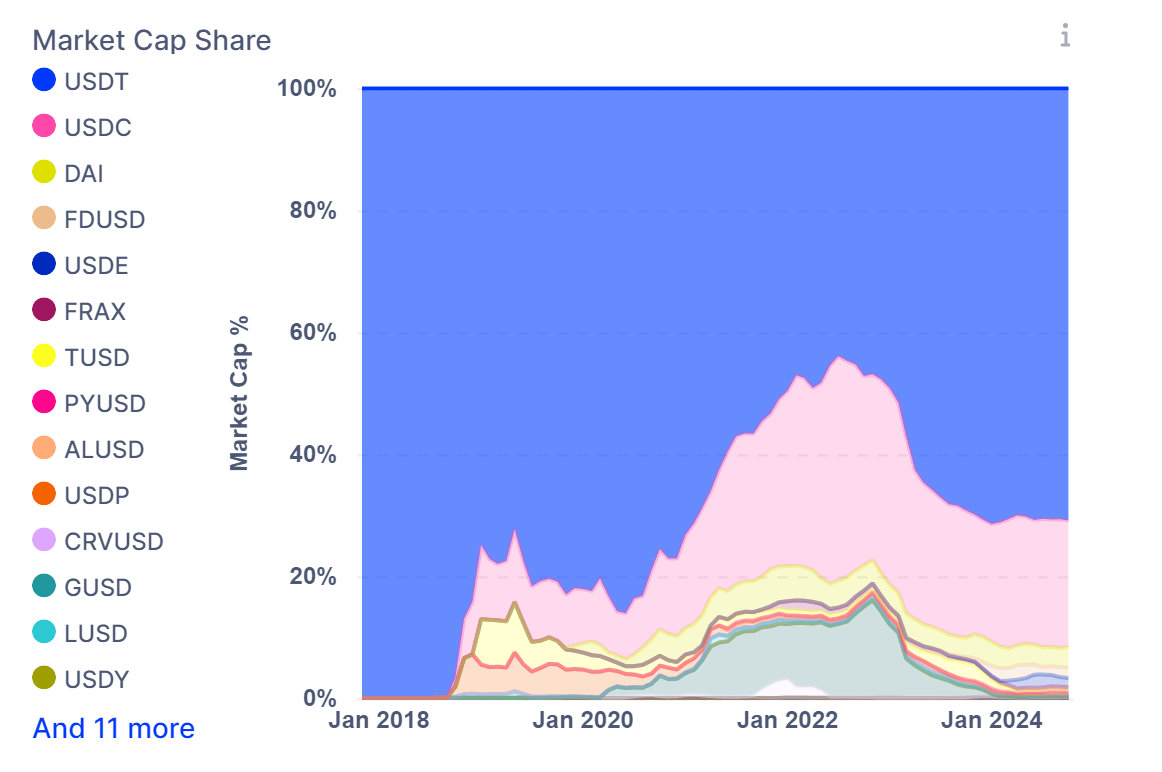

Tether, the issuer of the stablecoin USDT, offers a digital alternative to the U.S. dollar with a current market cap of approximately $120 billion.

USDT ranks as the third-largest cryptocurrency by value and is the most frequently traded due to its role as a dollar stand-in in crypto markets where traditional currencies are not accessible.

As stablecoins serve as primary gateways between fiat and digital assets, an expanding stablecoin supply often signals potential market rallies, hinting at increased buying power among investors.

Notably, in August, Tether minted $1.3 billion in USDT shortly after Bitcoin hit a five-month low at around $49,500, reflecting the high demand for USDT during market downturns.

USDT has achieved broad adoption, with 330 million on-chain wallets. This estimate excludes millions more who access USDT via centralized platforms. User growth has accelerated, with each quarter outpacing the previous one.

Tether, the stablecoin issuer, is reportedly considering lending part of its multibillion-dollar profits to commodities trading firms, marking a potential shift in an industry traditionally dependent on banks for credit, according to Bloomberg.

What's next for Tether?

The Treasury Department is reportedly considering sanctions on Tether due to its use by sanctioned entities, according to the Wall Street Journal. The publication noted that Tether has been under investigation for possible bank fraud by its backers for several years.

In response, Tether called the article “irresponsible reporting,” asserting that it contains “reckless allegations” without verified sources.

The firm emphasized that “no authorities have gone on record to confirm these rumors,” and that Tether is not aware of any active investigation. Tether also highlighted its cooperation with law enforcement to prevent misuse of its token, USDT, and other cryptocurrencies.

Alongside the Manhattan probe, the U.S. Treasury Department has reportedly considered sanctions against Tether due to its extensive use by individuals and groups under U.S. sanctions, according to the Wall Street Journal.

Previously, scrutiny focused on whether Tether held sufficient assets to support the $1 value of its token. In 2021, federal prosecutors in Washington cautioned Tether's top executives about potential charges related to allegedly misleading banks used for transferring funds.

The investigation later shifted to the U.S. Attorney’s Office in Manhattan, yet two years have passed without any charges or enforcement actions.

As of now, the U.S. Attorney's Office has not issued an official statement on the matter.

Despite the news, Tether’s USDT has shown resilience, dipping only briefly to about 99.69 cents.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin