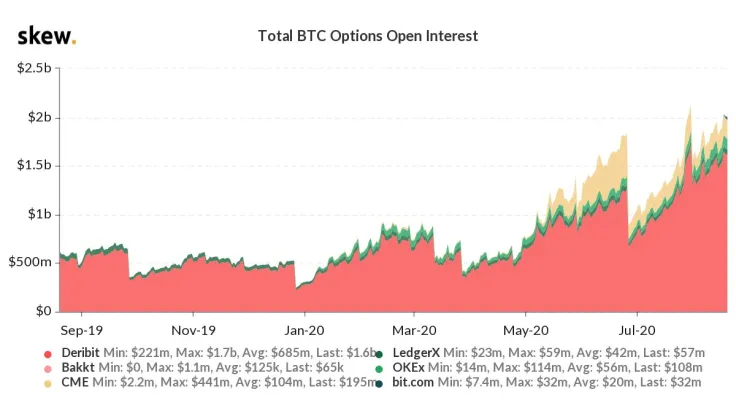

Open interest (OI) in Bitcoin options, which indicates the total number of contracts across all exchanges, has once again crossed the $2 bln mark, according to derivatives data provider Skew.

It is now on track to surpass the all-time high that was recorded on July 30, meaning that more money is now flowing into this burgeoning market niche.

Major developments in the options markets

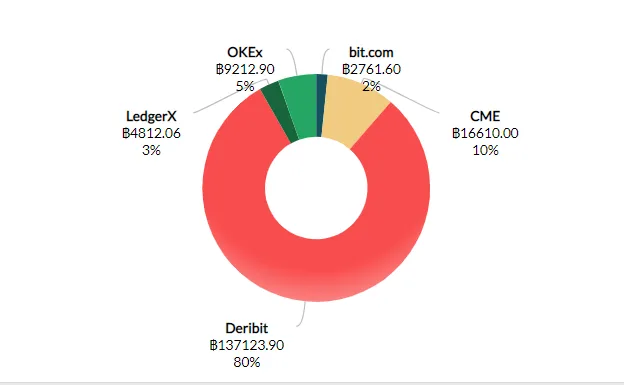

Dutch trading platform Deribit remains an undisputed leader when it comes to Bitcoin options with a whopping 80 percent market share.

Bit.com, the derivatives exchange launched by Singapore-based Matrixport Technologies, rolled out Bitcoin options on Aug. 17.

The new entrant now occupies 2 percent of the total OI, coming close to edging out LedgerX (3 percent).

CME and OKEx are in second and third place, respectively. The former now accounts for a tenth of the burgeoning options market.

As usual, nothing but tumbleweeds can be seen in Bakkt’s corner as the OI and volume of the Intercontinental Exchange-owned exchange continues to flatline at literally zero.

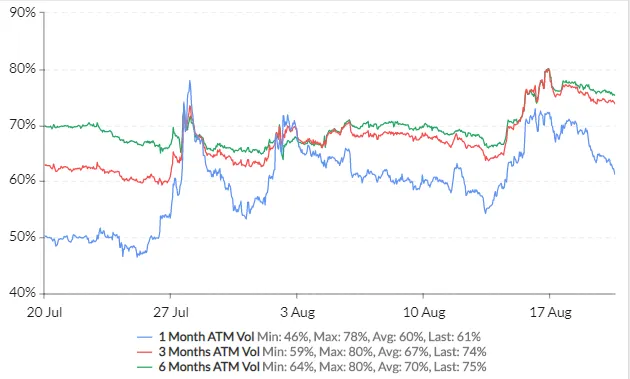

Bitcoin's implied volatility waning

Unlike futures, options—as the name suggests—allow market participants to bet on Bitcoin's future moves without having an obligation to actually execute the trade.

Bitcoin’s one-month implied volatility, which reflects the level of expected fluctuations, has dropped by 10 percent over the last four days (from 72 percent on Aug. 16 to 62 percent on Aug. 20).

After soaring to a new yearly high of $12,477, the Bitcoin rally hit a pause button. The top cryptocurrency is currently changing hands at $11,815 on the Bitstamp exchange after a slight recovery.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin