In its latest Financial Stability Report published Monday, the U.S. Federal Reserve ranked cryptocurrencies and stablecoins among its top risks to U.S. financial stability over the next 12-to-18 months.

Fed risk matrix ranks cryptos and stablecoins just behind U.S.-China tensions

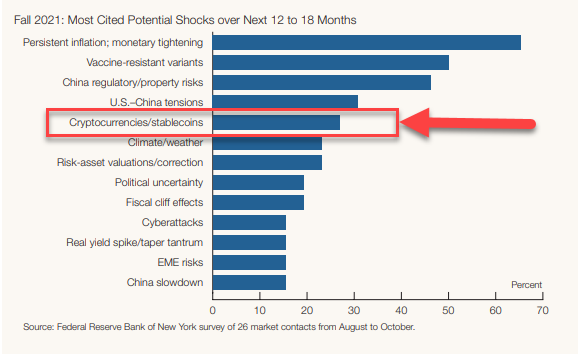

The Fed report is printed twice a year, once in the spring and again in the fall, and its current edition includes this chart below from Page 67, that rates crypto/stablecoins as the fifth most serious risk to financial stability - tucked between U.S.-China tensions and climate issues.

Image by federalreserve.gov

Why are stablecoins such a threat?

The report section regarding stablecoins described them as digital assets that are issued and traded on blockchains, which are “purported” to be pegged to a stable off-chain asset such as gold, fiat currencies, or government bonds. The report also noted that the value of stablecoins has exponentially grown fivefold during the past 12 months to $130 billion as of October 2021.

Here are the main reasons for concern cited in the Fed’s publication:

- The largest stablecoins by market cap promise to be redeemable at any time at a stable value in U.S. dollars, but each token is not necessarily backed 1:1 with a fiat equivalent. Instead, some stablecoins are backed by commercial bonds, which may lose value or become illiquid. If those assets lose value, stablecoin issuers may not be able to meet redemption demands.

- Stablecoins have structural weaknesses similar to certain money market funds, that make them susceptible to liquidation runs by investors who could drain their accounts all at once.

- The report states that these shortcomings could be magnified by a lack of transparency and governance standards regarding some of the assets backing stablecoins.

- Lastly, the potential use of stablecoins in payments and their capacity to grow can also pose risks to payment and financial systems.

Reasons why the Fed publishes this report

The total report is more than 80 pages and covers many other topics beyond cryptos and stablecoins. The Fed states early in the document that the purpose of the report is to provide its perspective on the resilience of the U.S. financial system, while striving to “...promote public understanding and increase transparency and accountability for the Federal Reserve’s views on this topic.”

Whether the specific stablecoin threats are real or overblown FUD, they were real enough for members of the Fed to include in this report. However, it could be argued convincingly that all four bullet points cited as stablecoin vulnerabilities could also apply to most fiat currencies, including the U.S. dollar. That’s especially true when considered within the context of the government’s fiscal and monetary policies over the past several years.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov