Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

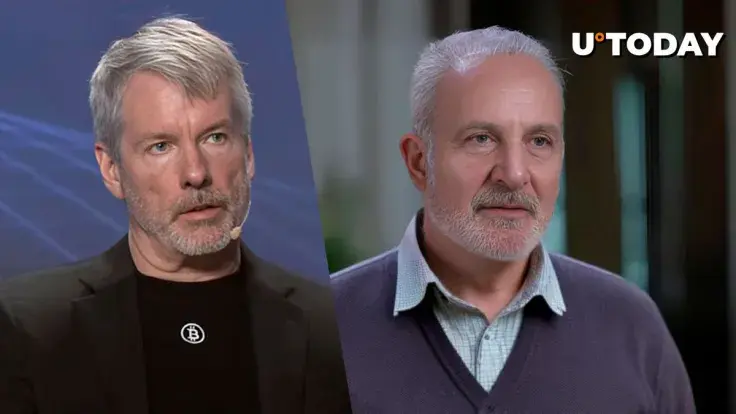

CEO of MicroStrategy Michael Saylor received advice from well-known Bitcoin critic Peter Schiff in a recent Twitter exchange that could best be described as sarcastic. Schiff suggested that Saylor take out a second loan of $1 billion and invest it in DJT stocks, which he claims are more valuable due to their higher volatility in response to Saylor's assertion that the value of Bitcoin is derived from its volatility.

Schiff's reasoning aims to ridicule Saylor's conviction that Bitcoin is a volatile asset that is worth investing in. If value were solely determined by volatility, he suggests that Bitcoin would be a poor investment compared to highly volatile traditional stocks. Saylor and many others see long-term potential in Bitcoin, as shown by their never-ending conviction in the asset.

But Saylor's most likely dismissal of Schiff's opinions stems primarily from his understanding that volatility by itself does not determine an asset's future potential. As an emerging asset class that is expanding quickly, Bitcoin's volatility is a reflection of this. In contrast to DJT or other conventional stocks, the volatility of Bitcoin is associated with its larger function in transforming the financial system by providing decentralization resistance to censorship and the possibility of widespread global adoption.

In addition, Saylor has continuously stated that he views Bitcoin as an inflation hedge, basing his investment strategy on the asset's long-term worth rather than its volatile price. As a testament to his belief in Bitcoin's potential growth, his company, MicroStrategy, has a sizable amount of the cryptocurrency held in its treasury.

Schiff, however, is still dubious about Bitcoin and frequently calls it out as a speculative bubble. His fundamental skepticism about digital assets, and particularly Bitcoin, is the basis of his advice to Saylor. Saylor is unlikely to take Schiff's advice seriously, given their different views on Bitcoin and their very different investment strategies.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov