KuCoin, a top-league cryptocurrency exchange, is among the most credible and powerful industry players.

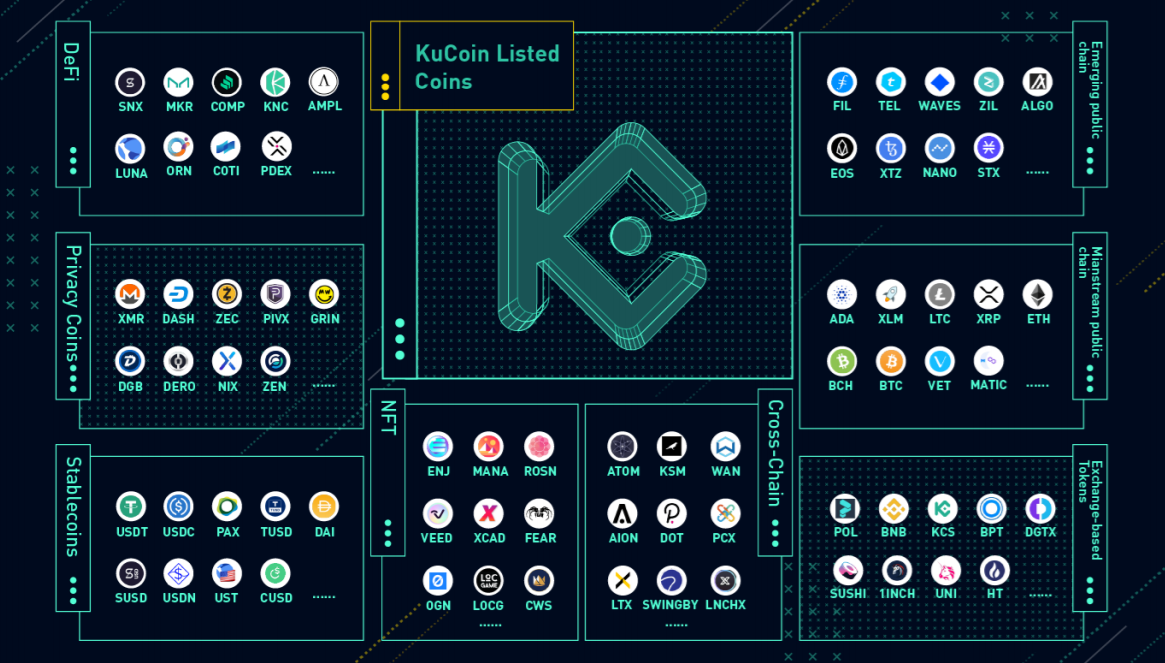

Launched in 2017, the Seychelles-incorporated platform listed 400+ trading pairs in the spot segment, while 64 pairs are available in the perpetual contracts section.

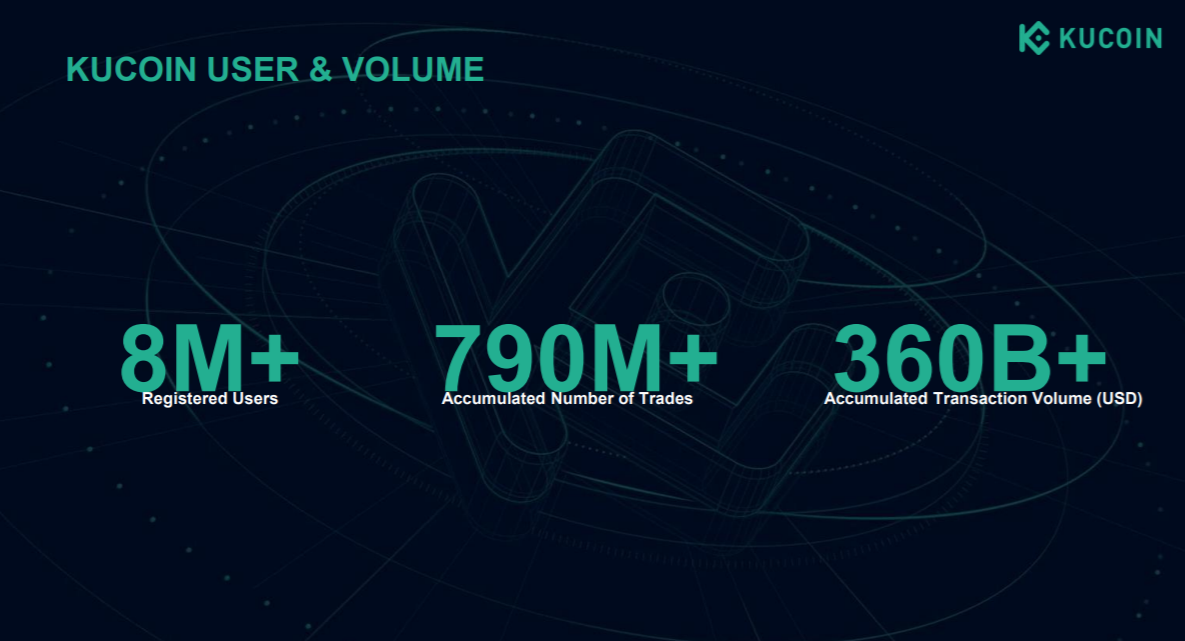

As of Q3, 2021, KuCoin onboarded more than 8,000,000 users while the net trading volume processed surpassed $360 billion.

In all, KuCoin offers more than 700 coins in all segments. The exchange was the first one to list many red-hot coins, such as ICP, BOSON, DAO and so on.

From the very beginning, its team adheres to the “community first” approach: KuCoin targets various groups of crypto enthusiasts across the globe. KuCoin has 19 local communities in North America, Europe, Asia, LatAm and CIS.

KuCoin’s holistic environment includes following elements to ensure seamless multi-instrument crypto trading and earning experience:

- spot trading;

- derivatives trading, Lite and Pro modes;

- Pool X Earn environment;

- ‘Buy Crypto’ fiat-friendly options;

- peer-to-peer trading module;

- crypto finance corner: lending, staking, and more;

- native trading bot.

To meet the requirements of its vibrant and passionate community, KuCoin is constantly advancing its ecosystem toolkit. In 2021, it implemented two cutting-edge instruments for traders with various levels of expertise: a multi-purpose trading bot and lending environment.

KuCoin for newbies: Buy and exchange crypto

Since its very first days, KuCoin has promoted itself as a “people’s exchange” so that every user, with no regard for his/her level of expertise, can purchase crypto tokens with KuCoin instruments.

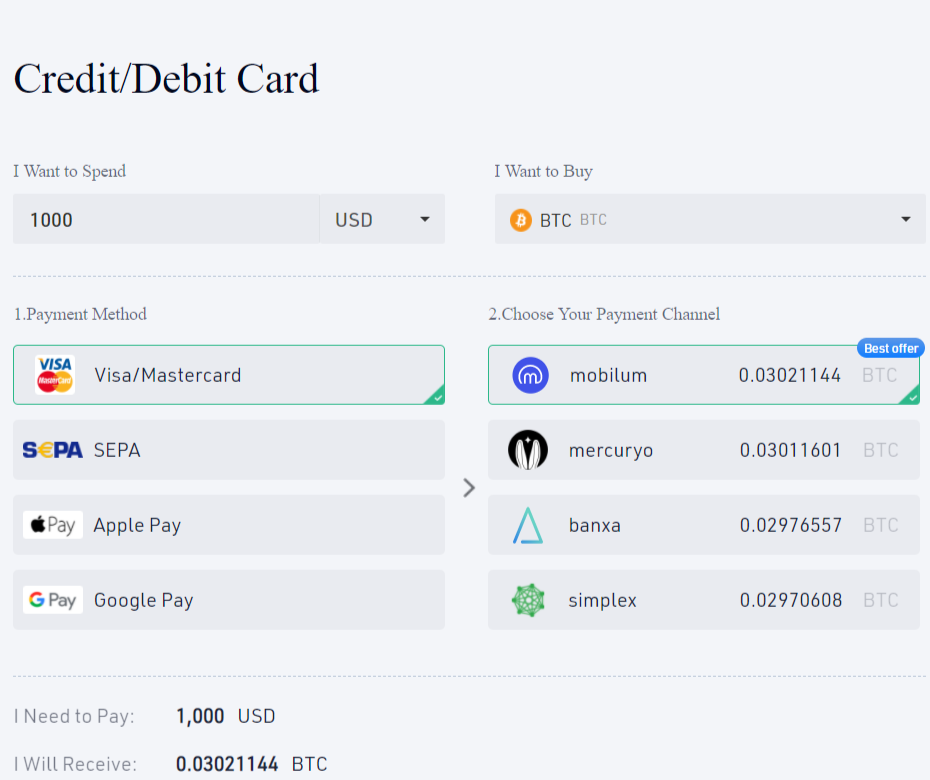

Thirty-two tokens, including Bitcoin (BTC), Ethereum (ETH), XRP, U.S. Dollar Tether (USDT), USD Coin (USDC) and Dai (DAI), can be purchased with credit and debit cards in the “Buy Crypto” segment of KuCoin.

The “Buy Crypto” instrument supports both mainstream card systems, Visa and Mastercard. Fiat payments are processed by leading paygates Simplex, Mercuryo, Banxa and Mobilum. Users can choose the type of card and paygate with which to buy crypto.

Also, Apple Pay and Google Pay payment instruments can be used for cryptocurrency purchases. “Old-fashioned” users can buy crypto with the Single Euro Payments Area (SEPA) account.

Alongside that, cryptocurrencies can be purchased in a peer-to-peer “Localbitcoins-like” manner. The P2P trading desk supports placing buy/sell orders for major cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), U.S. Dollar Tether (USDT), USD Coin (USDC) and KuCoin Tokens (KCS), core native assets of the exchange.

In this section, an advanced toolkit of payment methods is available, including Advcash, Revolut, Payeer, Zelle, Skrill, Uphold, TransferWise, PayPal and so on. An extended string of fiat currencies is also implemented: users can deposit U.S. Dollar, Euros, Australian Dollars and even Russian Rubles and Ukrainian Hryvnias. All orders are placed by the community members of KuCoin.

The easiest one-click option for buying cryptocurrency is available in the “Fast Buy” mode. Using “Fast Buy,” KuCoin customers can buy crypto heavyweights with zero fees in one click. Nothing but a payment instrument with fiat money and a valid crypto wallet is required. This function can act as an entry point to the digital assets world for all newcomers.

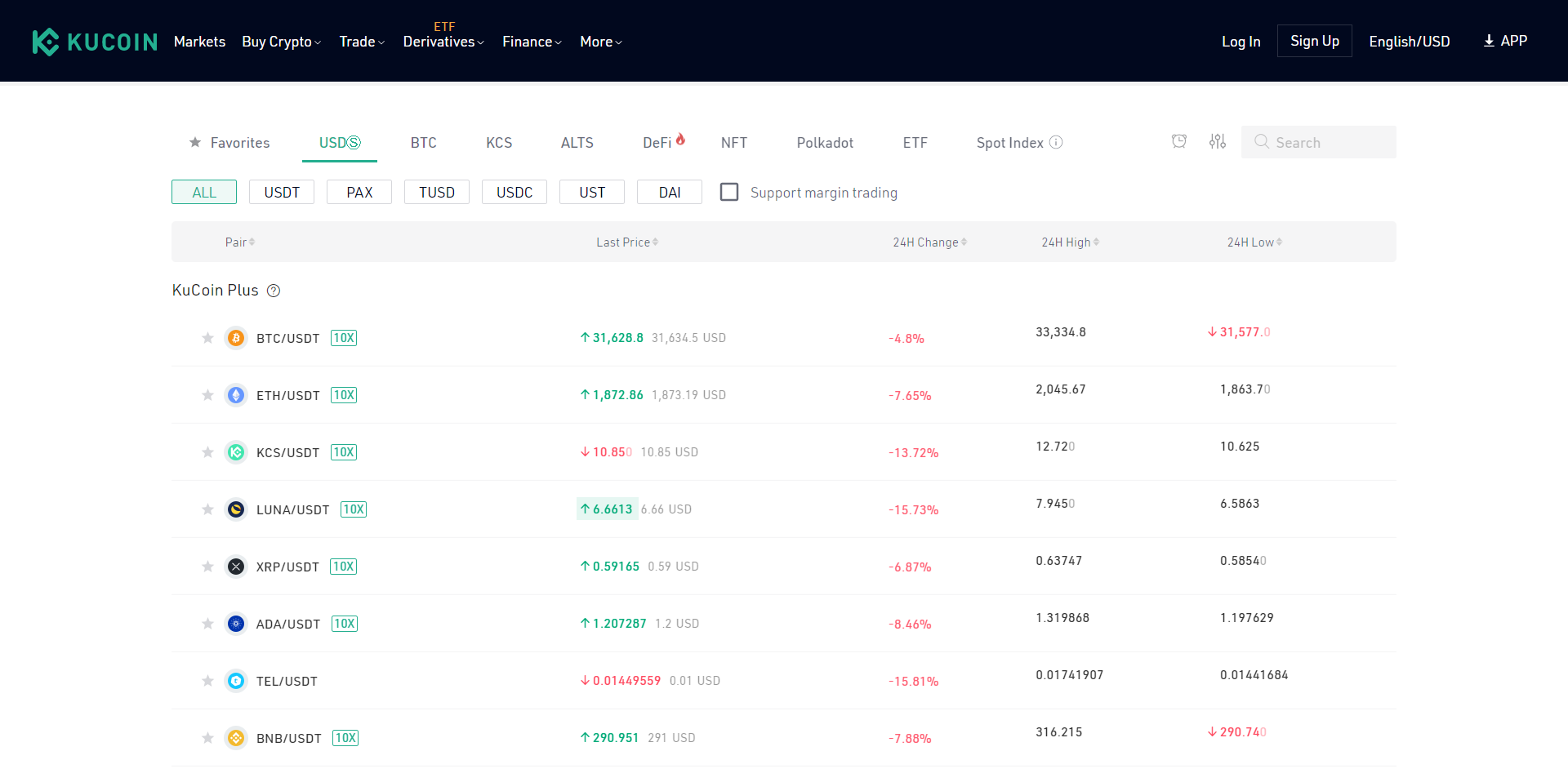

All exchange options are summarized in the “Markets” mode. Most reliable assets are listed in the KuCoin Plus section while the rest of the assets are added to the KuCoin Main Market dashboard.

All markets are demonstrated in categories: stablecoin-based, Bitcoin-based, KCS-based, altcoin-based, DeFi-token-based, NFT-oriented and Polkadot’s ecosystem markets. Leveraged tokens and Spot Indexes are available in separate segments.

An extended range of stablecoins is available in KuCoin Markets: U.S. Dollar Tether (USDT), Paxos (PAX), True USD (TUSD), USD Coin (USDC), Terra USD (UST) and Dai (DAI).

Users can customize the dashboard by choosing “Favorite” assets; they will be displayed at the top of the list.

KuCoin for traders: Spot and futures dashboards

An advanced list of options for traders is available in the “Spot” and “Derivatives” sections of the KuCoin exchange. The “Spot” section looks like a classic trading dashboard with price charts, order books, lists of orders, limit/market instruments, market depth diagrams, order histories and trade histories.

The price chart for KuCoin is provided by the TradingView service. As a result, traders can enjoy the richest toolkit of customization options: adjustable timeframes, many scales (logarithmic, relative, standard and so on) and different instruments for displaying charts (lines, pitchforks, brushes, text).

In the “Margin” section, trading with leverage is available. Experienced traders can fuel their accounts with borrowed funds to increase profits. In the “Margin” section, up to 10x leverage is available for traders.

Futures (perpetual futures) contracts are also available in the derivatives section. The KuCoin Futures module is among the market leaders when it comes to liquidity issues: currently, it is ranked third in market depth with the BTC/USDT pair.

Its dashboard looks slightly different from the spot dashboard, as it displays a leverage calculator, the ratio between short and long positions, the ranking of active traders with the most profitable strategies and other derivative-specific instruments. The Futures Pro and Futures Lite modes are designed for users with advanced and basic levels of expertise, respectively.

KuCoin traders can take part in the Futures Brawl competition. This contest allows all users to compete for lucrative prizes, such as iPhone 12 and one Bitcoin. At press time, the 10th phase of the Futures Brawl is up and running. This promo campaign will conclude on Sept. 22, 2021, at 9:00 a.m. UTC.

A total of $15,000 is allocated for the prize pool of every stage. Users obtain points for profitable trades in both directions, i.e., for successful short and long trades. The list of the most skilled traders with the highest scores is displayed in the Futures section, so the competition procedure is fully transparent.

Finally, the KuCoin trading engine offers various opportunities for API integration. Its instruments can be available on third-party services, while its data can be extracted for research and statistical purposes.

KuCoin Finance: Digital banking for the DeFi era

In the KuCoin Finance section, users can experiment with the cutting-edge instruments of the decentralized banking segment. To start, KuCoin introduced a liquidity mining ecosystem, Pool X. It offers many opportunities to earn on idle liquidity. Dozens of tokens can be locked into this pool with guaranteed rewards.

These rewards can vary from five to six percent for top-notch mainstream tokens (KSM, DOT) to almost 100 percent in annualized yield for early-stage assets. KuCoin users can lock the coins for one, three, seven, or thirty days, or more. Right now, 30 tokens are available in this program.

Some tokens are included in promotions and can be staked (“locked”) on privileged conditions. Also, users can delegate KSM tokens to support KuCoin in the auction for a parachain slot in the Kusama “canary network” of Polkadot (DOT).

Lucrative bonuses are available for simply holding KuCoin Coins (KCS). Even locking KSC tokens is not necessary within this program.

Finally, KuCoin has a referral program designed to allow its users to monetize their social exposure. The owner of a referral link can invite users and receive a share of trading commissions on his/her referrals.

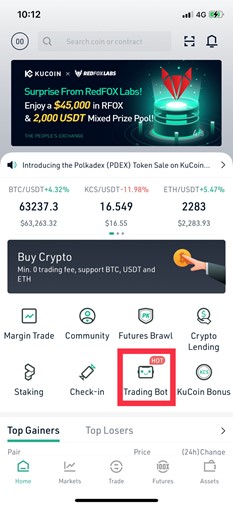

KuCoin brings AI-powered trading to the masses: Introducing KuCoin trading bot

Typically, crypto trading bots are delivered by third-party companies to be activated on certain exchanges. However, the KuCoin platform released its own family of trading bots to ensure seamless automated trading and an earning experience for its customers.

Trading bots should be referred to as the specific software programs designed to automatically place and execute trading orders on behalf of their users. Thus, trades are finalized with no need for the crypto owner to stay online and control price fluctuations manually.

To serve the needs of every interested trader, KuCoin implemented three strategies for its AI-powered automated trading instruments—dubbed Classic Grid, Futures Grid and DCA.

Classic Grid is KuCoin’s simplest strategy, designed for spot cryptocurrencies markets. Its system just places the “Buy” order as the price drops and “Sell” once as it climbs against the basic cryptocurrency (typically, U.S. Dollar Tether [USDT] stablecoin).

While setting their Classic Grid bot up, users do not need anything but the price range (minimum and maximum price) when the bot is active and the number of orders placed. This is used to calculate the interval for trading bot activity.

For instance, if Classic Grid is activated for Bitcoin’s (BTC) price range between $30,000 and $35,000 with a $1000 interval, the bot will place either buy or sell orders at $30,000, $31,000, $32,000, $33,000, $34,000 and $35,000. Also, the “Total Investment” metric sets the net amount of funds the client can spend with Classic Grid.

In the “Advanced” settings, the “Entry Price” and “Stop Price” levels can also be set to indicate when the bot buys or sells basic currency.

The Futures Grid bot works with the derivatives segment of KuCoin exchange. It allows opening and closing short or long positions with certain trading pairs (BTC/USDT, ETH/USDT and so on). The KuCoin team stresses that using Futures Grid is suitable for traders with various levels of expertise, “short-ists”—those who want to reduce risks while trading with leverage.

To set up Futures Grid on KuCoin, a user should choose the contract (trading pair), choose the type of position (short/long), specify the price range (the “territory” where the bot is active), enter the number of “grids” (the levels at which the bot takes profits) and the net investment amount. Also, the user should choose suitable leverage rates.

The DCA—Dollar-Cost Averaging—KuCoin trading bot injects new life into the most popular entry-level strategy for buying volatile assets. Within this strategy, traders spend a predetermined sum of basic currency to buy interesting assets in a certain period. For example, a trader may spend $1,000 every month to buy Bitcoins (BTC) on the 25th day of the month.

With the DCA KuCoin Bot, a trader should customize the net sum of money to spend on periodic automated purchasing, the interval (every day, every other day, every week, etc.), the basic and the target cryptocurrency (typically, USDT and Bitcoin/Ethereum) and the period of DCA Bot activity.

KuCoin’s crypto lending allows users to put their crypto to work

In 2020, cryptocurrencies lending became the name of the game on the digital assets scene. Market participants are particularly interested in reliable frameworks for the lending and borrowing of multiple coins.

Cryptocurrencies lending is the process of lending digital assets when either crypto or fiat money are pledged as collateral. As of now, cryptocurrency lending is available on centralized and decentralized platforms.

Crypto owners can lend their riches to obtain periodic interest from borrowers. Thus, cryptocurrencies lending has evolved into a passive income strategy for the plethora of crypto enthusiasts.

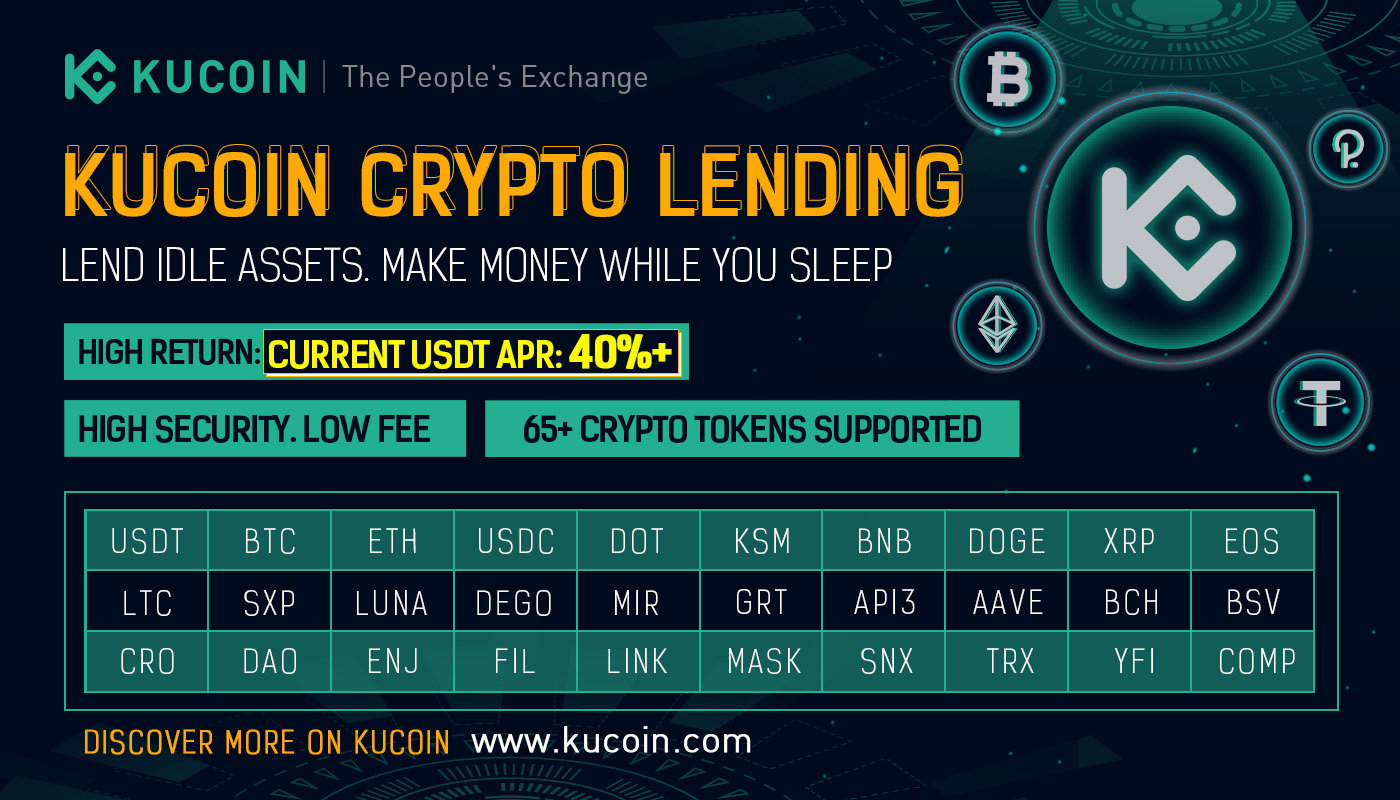

In early 2021, the KuCoin exchange unveiled its multi-asset lending/borrowing environment, dubbed KuCoin Lend. It allows all KuCoin clients to either collateralize their crypto to obtain a loan or to earn interest on idle assets.

In its inaugural release, KuCoin Lend supports more than 65 assets: crypto heavyweights (Bitcoin, Ethereum, Dogecoin, XRP, Eos, Litecoin), red-hot DeFi tokens (Terra, API3, Chainlink, Yearn.Finance, Compound Finance and so on) and promising early-stage coins (MASK, GRT, DEGO, etc.).

Top-notch stablecoins U.S. Dollar Tether (USDT) by iFinex and USD Coin (USDC) by Circle are implemented to make the lending/borrowing experience more predictable and seamless.

KuCoin teases very high annualized yields for those crypto holders who put their money in KuCoin Lend. Up to 40 percent can be obtained while lending crypto with KuCoin’s instruments.

KuCoin has also pioneered a number of interesting concepts in crypto lending. Namely, it offers an Auto-Lend option, in which all idle crypto is put to work to earn rewards. All lending done via KuCoin Lend can be instantly repaid at the request of users.

Closing thoughts

KuCoin is one of the leading cryptocurrency exchange and digital assets ecosystems of the entire crypto segment. It empowers users with an intuitive and rich toolkit of spot and futures trading tools.

KuCoin launched its KuCoin Finance section to allow its users to participate in liquidity mining and staking programs. KuCoin customers can earn on their idle crypto; up to 100 percent APY is offered for certain coins.

Top-tier exchange KuCoin has implemented AI-powered trading bots and a lending/borrowing ecosystem to empower its customers with all of the latest trends in crypto in 2021.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin