Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

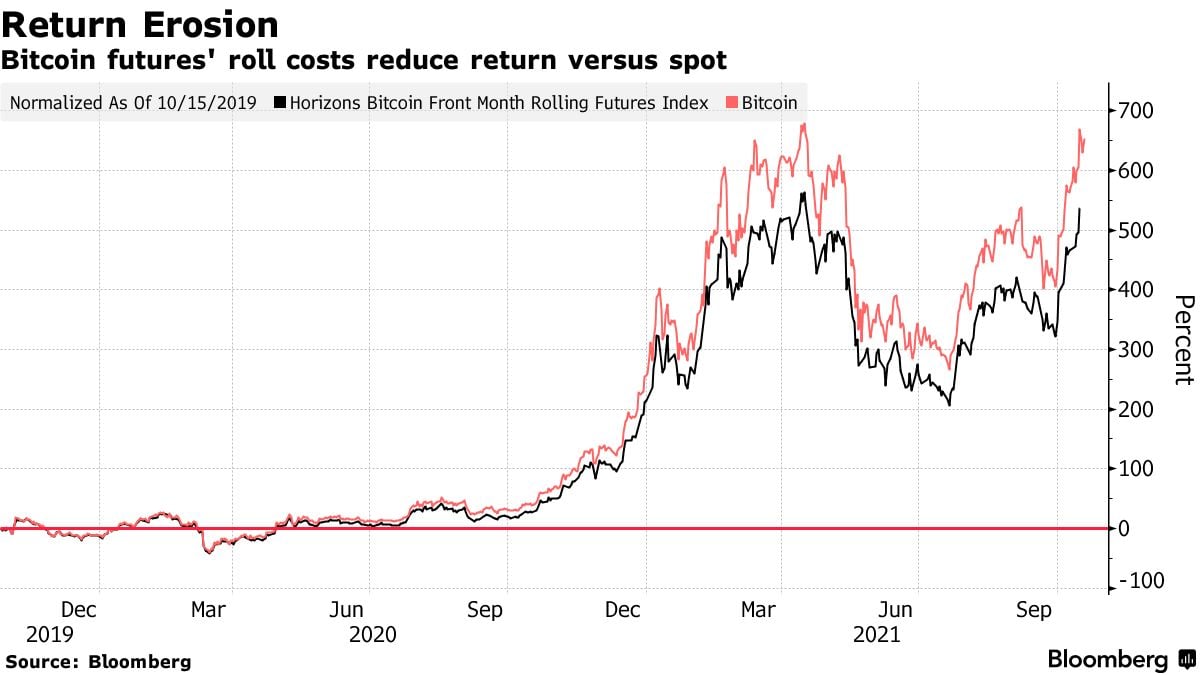

While the cryptocurrency industry waits for the drop of the first Bitcoin exchange-traded fund to be delivered shortly, Bloomberg has released an article in which the agency covers how and why traders might miss even greater rewards while trying to catch big gains from a "new" product.

The primary basis of such a statement is the Bitcoin futures curve. Futures contracts with long expiration dates usually trade at a premium to the price of the underlying asset. The main reason for that is that most traders believe, due to its nature, cryptocurrency will rise in the future.

But the main problem with current ETF products is the underlying asset. While the fund may be called "Bitcoin ETF," it's not actually tied to Bitcoin. The underlying asset here is Bitcoin futures contracts that become a reason for funds to lose some of their profits since they have to pay fees to enter a new contract. Since longer futures contracts trade at the premium, it is more convenient to enter short-term futures contracts and pay the fee.

For the mentioned reason, Genesis Trading's Noelle Acheson said that Bitcoin traders are overestimating the potential upcoming demand for derivatives-based ETFs since, as was mentioned, they have more underlying management costs. As an example, the BITO fund currently carries an expense ratio of 0.95%, while the average equity-based ETF will function at around 0.7%.

With the number of underlying expenses behind futures-based Bitcoin ETFs, traders and investors might not choose the mentioned funds for long-term crypto market exposure. Instead, it is more reliable to simply buy the asset itself rather than invest in the ETF, especially for retail traders.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov