Amid the carnage on the cryptocurrency markets, more and more investors are increasing the share of stablecoins in their portfolios. As such, the right moment has come to study the features of USD Coin, the second largest stablecoin and one of the most promising assets of the segment.

USD Coin (USDC) inches closer to historic "flippening": Details

USD Coin (USDC) is a U.S. Dollar-pegged stablecoin issued by Circle Inc. payments provider. While it has the second largest market capitalization as of June 2022, it has all the chances to become the leader of the segment:

- USDC is the fastest-growing stablecoin by market cap: its net capitalization rallied 52x in the last 23 months;

- USDC surpassed USDT as Ethereum’s largest stablecoin in February 2022;

- USDC eclipsed USDT in daily transactions on the Ethereum count;

- Accounts with over $1 million in equivalent prefer USDC over USDT;

- USDC managed to keep it pegged to the fiat U.S. Dollar amid the May-June 2022 volatility spikes, while other top-tier stablecoins failed to do so.

In this guide, we will cover the latest developments of USD Coin (USDC), review its core features and observe its prospects for the coming months.

What is a stablecoin?

A stablecoin is a digital asset (blockchain-based asset, cryptocurrency) that has its price pegged to this or that real-world (fiat) currency, precious metal or index. Largely, stablecoins are pegged to the U.S. Dollar (USD) and Euro (EUR). Also, there are stablecoins pegged to the Chinese Yuan (CNY), Mexican Peso (MXN), Gold (XAU) and Silver (XAG).

First-ever stablecoins BitUSD and NuBits were created in 2014. Stablecoins gained popularity as they are useful as a blockchain-based fiat equivalent necessary for both traders and holders. It is much easier to exchange Bitcoin (BTC) or Ethereum (ETH) to a stablecoin than to fiat currency.

There are centralized and decentralized (algorithmically backed) stablecoins. Centralized stablecoins (USDT, USDC, BUSD, GUSD, TUSD) are backed by cash and commercial papers stored by the issuers of stablecoins. Auditors periodically check whether these "baskets" are healthy. Decentralized stablecoins (DAI, FEI, FRAX, MIM, USDD) have their pegs guaranteed by a sophisticated architecture of smart contracts.

What is USDT?

Launched in late 2014, the United States Dollar Tether (USDT or Tether) is the most popular stablecoin and the ongoing leader of this segment by market capitalization. As of June 2022, its market cap exceeds $67 billion in equivalent while, at its peak, it was over $82 billion.

USDT is issued by Tether Limited; CTO of Tether and Bitfinex Paolo Ardoino is its key figurehead. Tether (USDT) is backed by a balanced basket of U.S. Treasuries, commercial papers (short-term loans to U.S. companies) and by a small number of non-U.S. bonds.

Introducing USD Coin (USDC), fastest-growing stablecoin in Web3

Since its launch in 2014, U.S. Dollar Tether (USDT) has retained its leadership in the stablecoin segment. However, in 2022, USD Coin (USDC) is closer to a historic "flippening" than ever before.

What is USDC?

USDC, or USD Coin, is a Dollar-pegged stablecoin launched in 2018 by Circle Inc. Since its first releases, USDC has been maintained by Centre, a large fintech consortium that includes professionals from different spheres. In turn, Circle is helmed by veteran entrepreneur Jeremy Allaire.

Various platforms, various use cases

Like other stablecoin majors, USD Coin (USDC) is minted on various blockchains. As of Q2, 2022, USDC is issued on Ethereum (ETH), Algorand (ALGO), Solana (SOL), Stellar (XLM), Tron (TRX), Hedera (HBAR), Avalanche (AVAX), Flow (FLOW) and Polygon (MATIC).

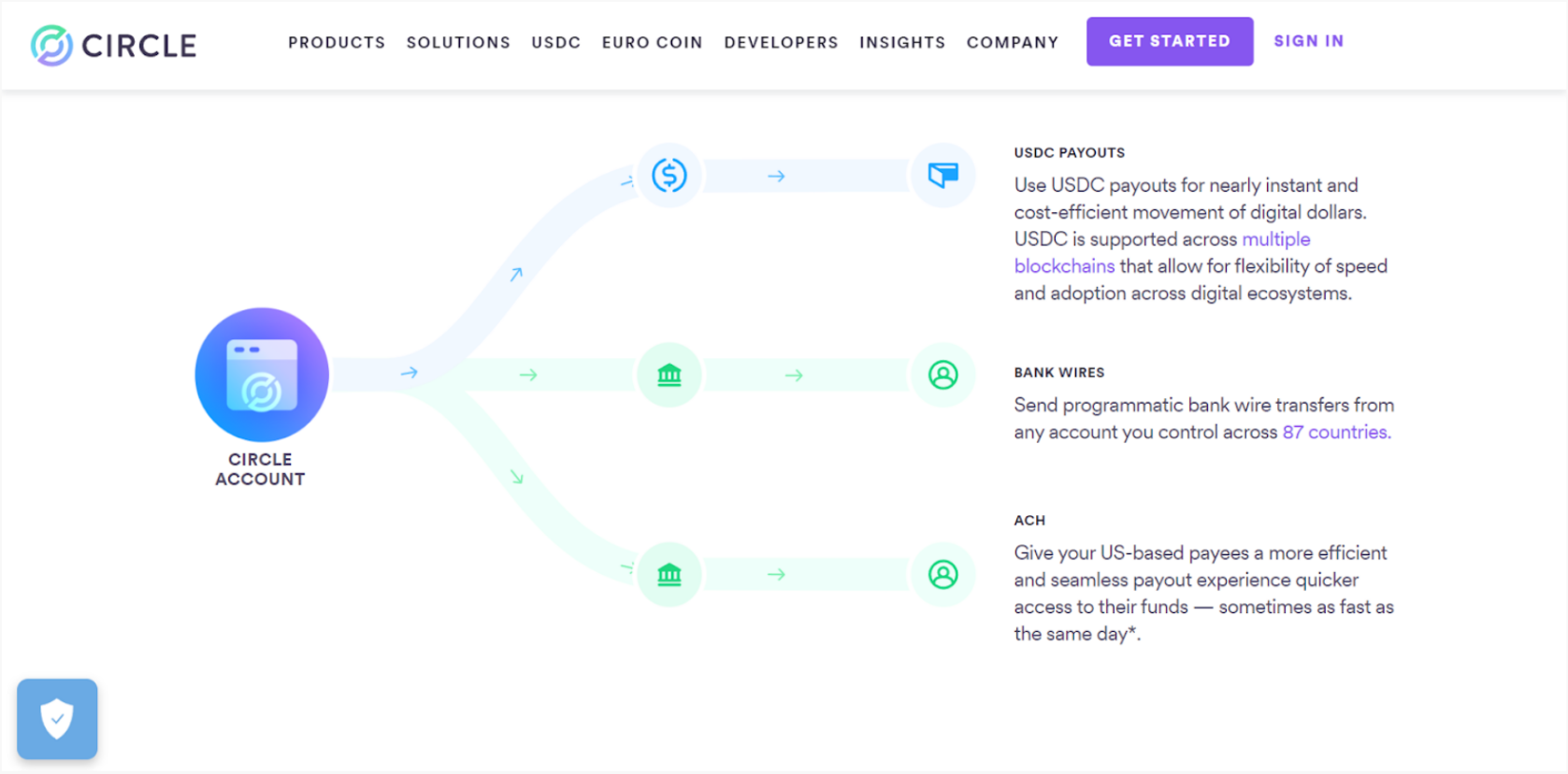

Also, Circle Inc. offers instruments designed to move USDC through cards, ACH and wire transfers. Also, USDC multi-chain swap instruments allow users to move USDC between various blockchains in a seamless manner.

Largely, USDC is used by retail investors for trading and investing in crypto. However, its technical toolkit makes it attractive for institutions as well. Per Circle, USDC is used by traditional and crypto-native businesses (e.g., for blockchain games and NFT marketplaces). USDC is integrated into cross-border remittance mechanisms as its transfers are almost fee-less.

USDC is 100% backed by the U.S. Dollar; out of its $55.2 billion in reserves, $14 billion are in cash while $41.2 billion are in short-duration U.S. Treasuries.

The most "stable" stablecoin

USD Coin was in the spotlight amid the market collapse of May-June 2022. Due to the exit of liquidity from Anchor Protocol (ANC), the Terra (LUNA) asset and TerraUSD (UST) stablecoin plunged to almost zero values.

As such, the selling pressure resulted in spiked interest in stablecoins. Due to this imbalance, almost all major stablecoins have de-pegged. For instance, USDT "dipped" below $0.9 in pairs with fiat USD; decentralized stablecoins demonstrated even scarier dropdowns.

Amid this carnage, USDC's 1:1 peg was almost unaffected. Its price even spiked to $1.02; many investors chose it as an alternative to USDT and DAI.

Circle Yield, Accounts, Payouts: Circle for businesses

To leverage the full stack of opportunities unlocked by USD Coin (USDC), Circle introduced a number of products for the B2B and B2C audience. For instance, Circle Yield solution allows users to generate 1% on every deposit in 1-12 month programs.

Circle Account is designed to let crypto holders use USDC as an autonomous digital banking instrument. With Circle Accounts, users can buy USDC straight from the issuer and leverage the coins in various lending/borrowing designs. Also, Circle Account removes the need for additional centralized services in cross-border remittances and business transfers.

Last but not least, the Circle Payouts mechanism is designed to streamline the process of crypto usage in retail: entrepreneurs can have their money transfers automated. Circle Payouts instrument can be treated as a bridge between the Web2 and Web3 worlds; it makes digital payments accessible in 85+ countries worldwide.

|

USDT |

USDC |

|

|

Launched |

Q4, 2014 |

Q4, 2018 |

|

Blockchains |

Ethereum, Tron, Solana, Omni, Avalanche, Algorand, EOS, Liquid, SLP |

Ethereum, Algorand, Solana, Stellar, Tron, Hedera, Avalanche, Flow, Polygon |

|

Market capitalization (June, 2022) |

$67 bln |

$55,2 bln |

|

Backed by |

85,64% cash, cash equivalents and other short-term deposits, commercial paper 4,52% corporate bonds, funds and precious metals 3,82% secured loans 6,02% other (including digital tokens) |

74,6% short-duration U.S. Treasuries 25,6% cash |

|

Operator |

Tether Operations Limited |

Circle Incorporated |

|

Reviewed |

Moore Cayman (audits) |

Grant Thornton (attestation reports) |

Bottom line

USD Coin (USDC) by Circle is a reliable centralized stablecoin and promising alternative to U.S. Dollar Tether (USDT). Its adoption gained traction in 2021-2022; it has already surpassed USDT by a couple of metrics.

USDC is issued on virtually all mainstream programmatic blockchains; it is also integrated into the feature-rich payments infrastructure of Circle Inc. As such, USDC is suitable for many retail and entrepreneurial uses.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov