Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

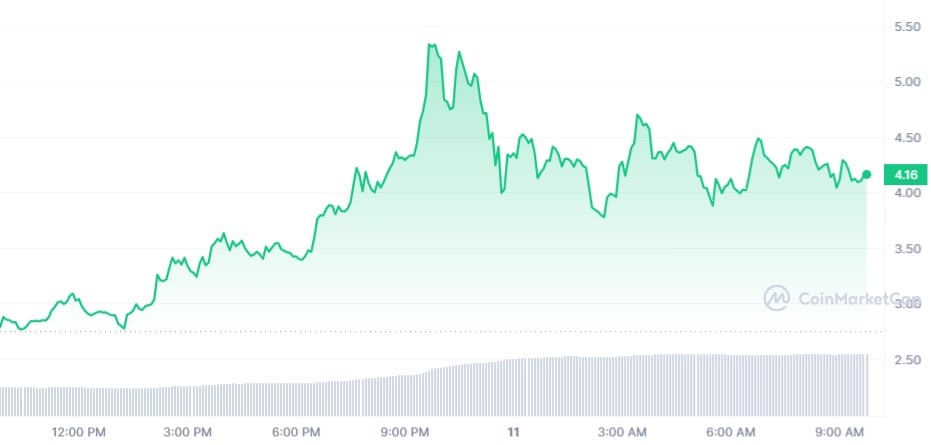

FTX Token (FTT) is on a major parabolic run that has pushed it to return profits to everyone who bought it at the start of the year. In a bid to sustain its latest uptrend, FTT soared as high as 53.30% with its price touching $4.10, a level that is by far the highest price point for this year.

Effectively, FTX Token has parred off all the losses it has accrued since the start of the year, a negative trend that came as a result of the implosion of the FTX derivatives exchange. Tracking the performance of FTX Token shows the main resurgence came in the past two weeks from the point Sam Bankman-Fried, the founder and former CEO of FTX, was convicted to date.

Perhaps, investors believed the negativity that surrounded FTX is now a thing of the past and attempts to face the future remain the key goal for now. With the excitement within the FTX ecosystem, the coin has printed seven-day growth of 250% and a monthly surge of 307%.

The consistency of these uptrends proves trust is gradually returning to FTT, an altcoin that once boasted of an all-time high (ATH) of $85.02.

Ultimate FTT trigger

The impressive bullish turnaround FTT has recorded in the past month comes after the news that the trading platform might be relaunched. Interested buyers have been narrowed down to include former President of the New York Stock Exchange Tom Farley, a figure that has been endorsed by the SEC Chairman Gary Gensler.

The perception is that key stakeholders believe the reactivation of FTX is possible when trust is regained and the new entity is made to follow existing safeguards. Notably, the exchange's current management has recovered as much as $7 billion to repay the firm's creditors, a move that has spelled a good omen across the board.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov