As a part of a periodic adjustment of the list of tokens available for liquidity operations on Binance Liquid Swap, an AMM-powered DeFi by Binance, the team of the world's largest exchange decided to remove the pool associated with a top-tier meme coin. What tokens are also unavailable on Binance's DeFi?

FLOKI/USDT liquidity pool on Binance Liquid Swap closes on Aug. 4

Starting from Aug. 4, 2023 (4:00 a.m. UTC), Binance Liquid Swap will sunset 31 liquidity pools based on various altcoins. FLOKI/USDT, a pool with the largest stablecoin and one of the most capitalized meme coins, is also on this list, per the official announcement.

Regarding the reasons for delisting, Binance (BNB) recalled that it periodically reviews the list of available pools in order to better concentrate liquidity for users and ensure an optimized trading experience, price and slippage.

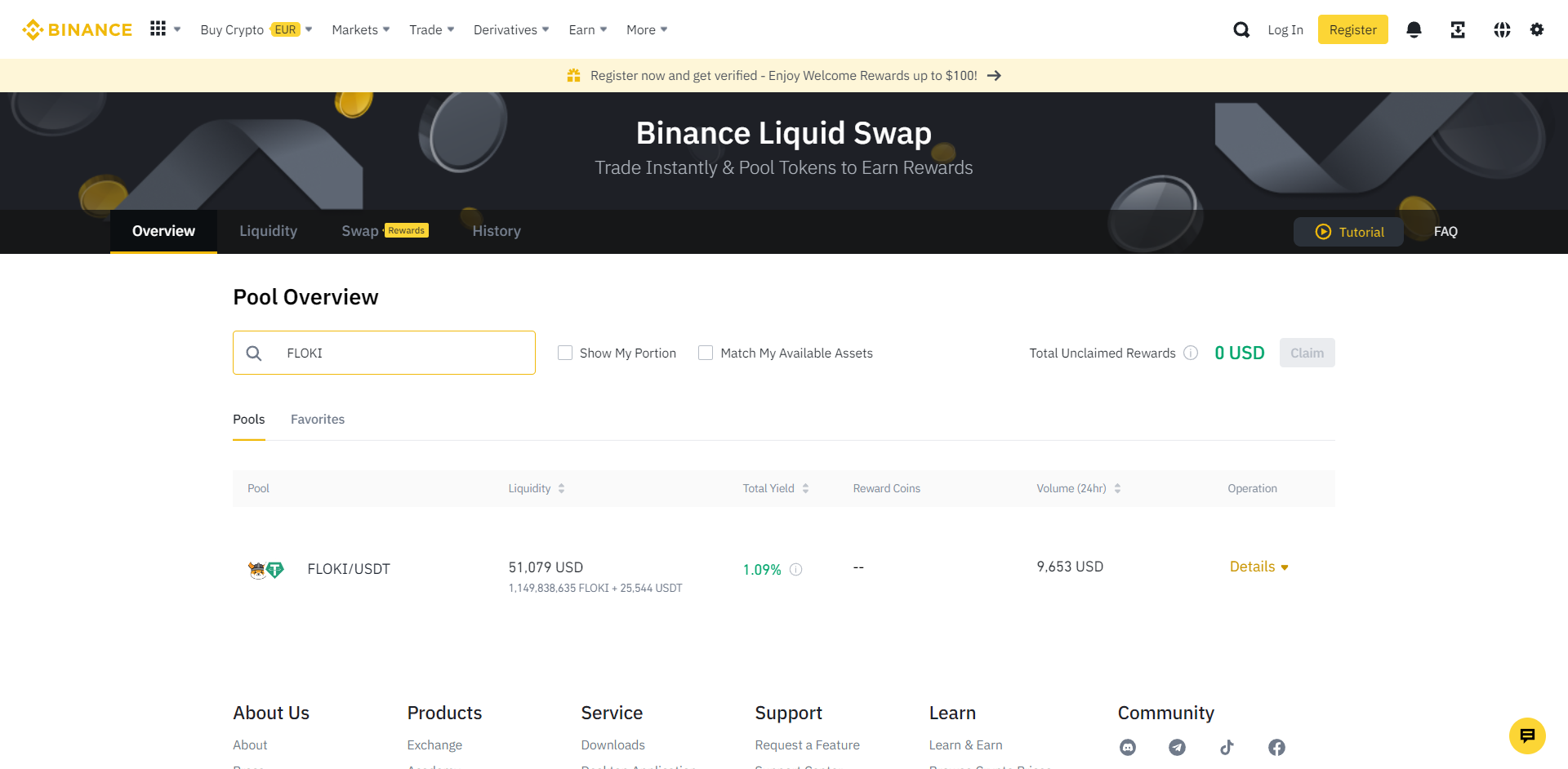

As of press time, there are $51,079 in FLOKI and USDT injected in the pool. It generates a 1.09% yield for liquidity providers.

Binance (BNB) representatives added that liquidity deposits will be halted on July 31, 2023. Users will not be able to bring more assets to the mentioned pools.

After the delisting procedure is completed, the liquidity will be moved to the spot accounts of Binance (BNB) users who traded on Binance Liquid Swap.

Spot trading pairs with FLOKI are unaffected

This announcement does not affect the corresponding pairs on spot and futures trading modules. Per Coinmarketcap's recent data, Binance (BNB) is responsible for 12.5% of trading volume generated by the FLOKI/USDT pair on various CEXes and DEXes.

Other pools delisted include those with DeFi altcoins GMX, Maker (MKR), assets of L1s Near Protocol (NEAR), Sui Network (SUI), tokens of Kusama/Polkadot ecosystem Kusama (KSM), Moonbeam (GLMR), GameFi assets Illuvium (ILV) and League of Kingdoms Arena (LOKA).

As covered by U.Today previously, Binance (BNB) recently introduced seed and monitoring tags to highlight the trading pairs with increased volatility. This advancement is set to streamline risk management for new and existing traders.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov