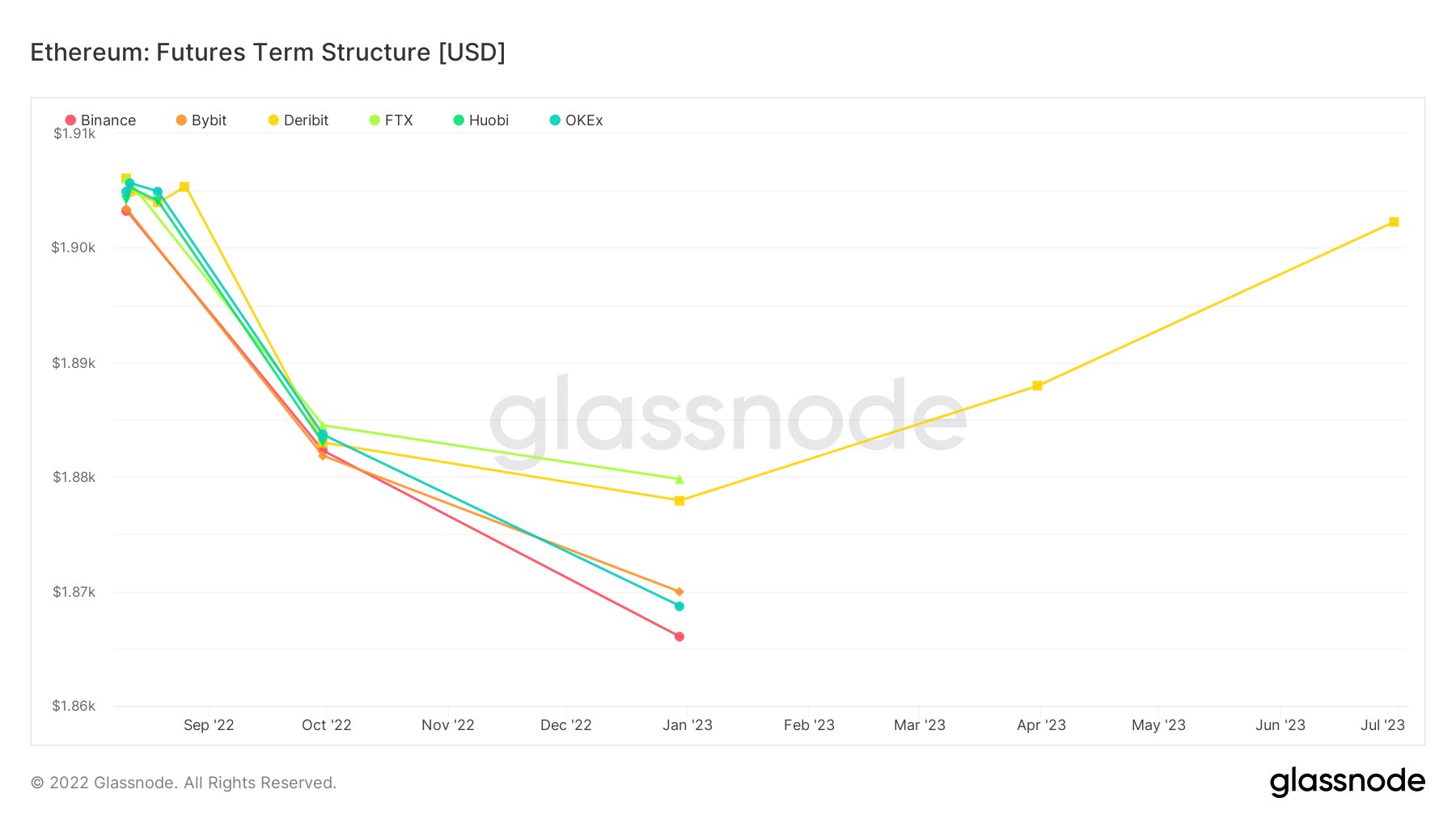

Arthur Hayes, the former CEO of the BitMEX cryptocurrency exchange, claims that the current Ethereum futures term structure may point to a significant rally after the merge.

Backwardation described a term structure where futures contracts trade lower compared to the cryptocurrency spot price.

While it might be seen as a reason to be bearish on the price of Ethereum, Hayes believes that Ethereum traders are hedging out Ethereum exposure on the cusp of the much-anticipated merge event. This adds additional selling pressure to the Ethereum spot market, according to the controversial entrepreneur.

After years of disappointing delays, some market participants believe that the upgrade could still go awry due to how monumental and technically challenging it is.

At the same time, Hayes is convinced that hedgers will have to cover their shorts, becoming net long again if Ethereum’s transition to proof-of-stake ends up being successful Speculators will also likely buy into the “triple halving” narrative. Market makers will have to reverse their positions by going long spot and shorting Ethereum futures.

Such a scenario could potentially push the price of Ether sharply higher.

As reported by U.Today, Ethereum developers recently confirmed that the merge is now on track the merge upgrade is going to take place on Sept. 15.

Last week, Hayes predicted that the price of Ethereum would be able to soar back to the $3,500 level after a successful merge event. In fact, he believes that the second-largest cryptocurrency could even touch $5,000 if this is accompanied by a Fed pivot.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov