Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

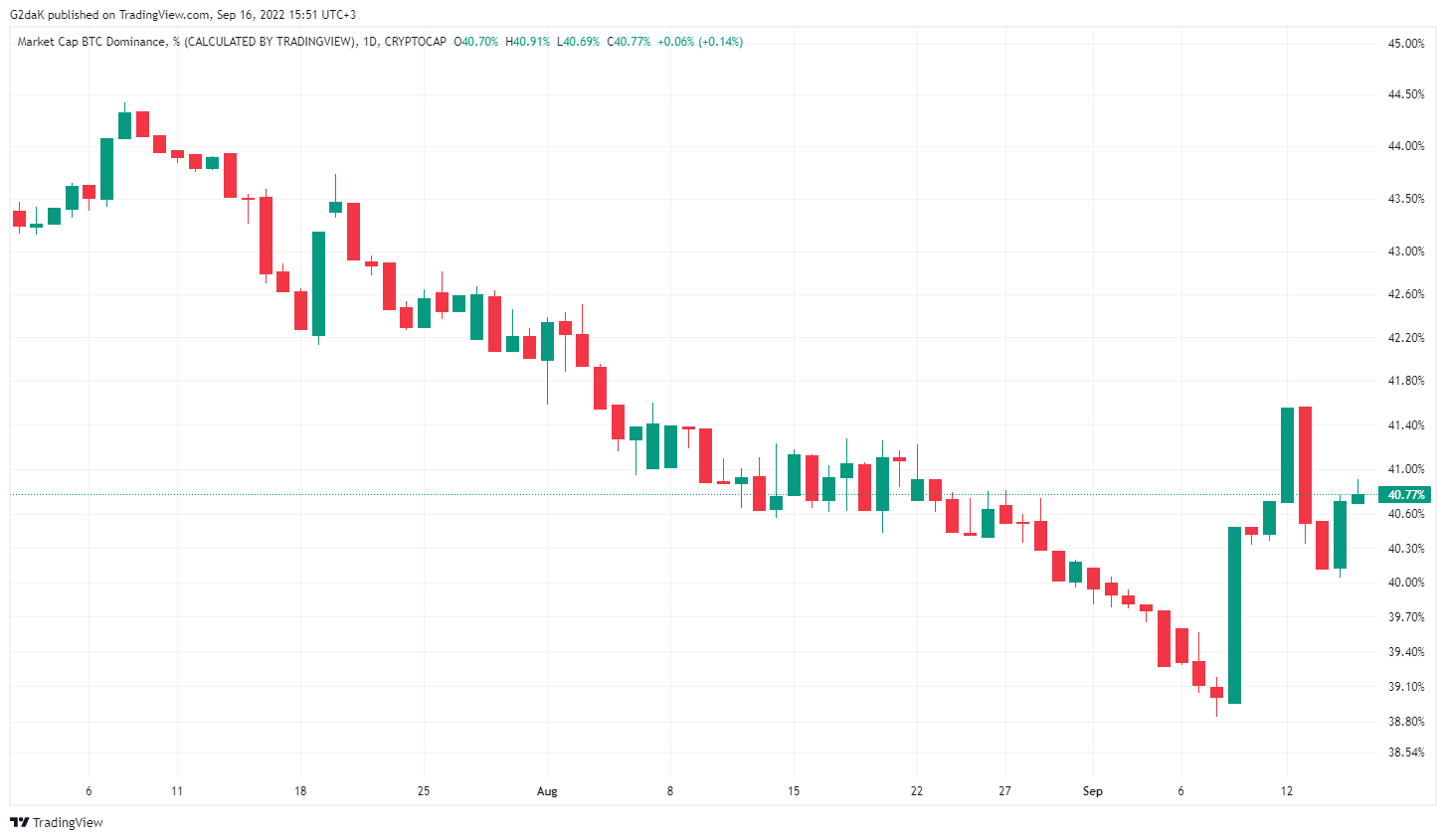

Bitcoin dominance after yesterday's successful transition of Ethereum to a proof-of-stake consensus showed an increase of more than 2%. The index, which was at four-year lows at the end of last week, began to grow closer to the date of the important event for the main crypto market altcoin.

Reaching 38.84% at the moment, Bitcoin temporarily became uninteresting to investors who were pouring money into Ethereum. Nevertheless, for the five days that preceded the event, on-chain analysts observed strong profit-taking on ETH with a parallel rise in the price of BTC.

As became clear later, more savvy investors were moving money from Ethereum to Bitcoin in advance, especially given the latter's strongest internal fall in two years on an extremely negative CPI report.

Now Bitcoin's growing dominance is helping it to stay in the green, despite a more than 1% drop in the S&P 500 Index, with which BTC closely correlates.

Current state of crypto market

Unfortunately, despite the fact that the crypto market has temporarily broken away from the movement of traditional finance, it is still necessary to follow the indexes of the U.S. stock market.

So, the S&P 500 went above the important level of $3,950 to $3,900 and is currently trading at those levels. If the buyer fails to retain the level of $3,900 within two days, we should expect a further decline, where the first target will be the block of $3,700-$3,640. For Bitcoin, which so far is holding on thanks to rising dominance, this means a possible move below $19,500-$19,000 levels.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin