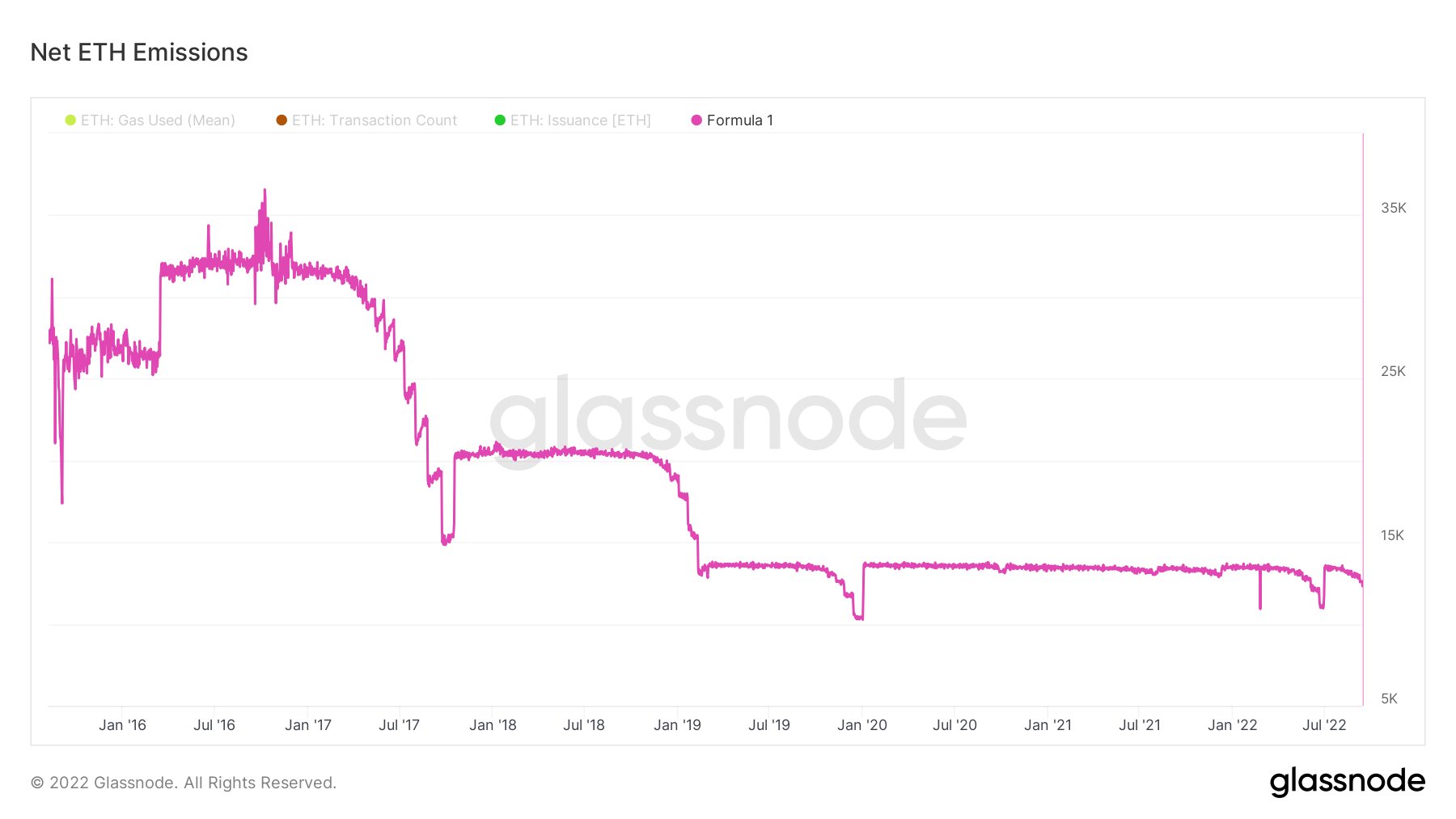

As reported by U.Today, Ethereum is expected to become deflationary following the Merge upgrade, with its issuance ranging between -0.5% to -4.5%.

Declining net daily issuance will increase the cryptocurrency’s scarcity, thus potentially boosting its price.

A year ago, Ethereum had its first deflationary day following the implementation of the London hard fork.

Jurrien Timmer, director of global macro at Fidelity Investments, noted that Ethereum hadn’t been rewarded with a high price-to-network ratio (unlike Bitcoin). However, this could change after the Merge, with Ethereum becoming scarcer.

Some Twitter users rejected Hayes’s analysis, arguing that the price chart is the only chart that actually matters.

In spite of the successful implementation of the Merge upgrade, the price of Ethereum has plunged by nearly 9% over the past 24 hours. The much-awaited upgrade ended up being a “sell-the-news” event.

Moreover, U.S. stocks renewed declines on Thursday, which pushed Bitcoin and other cryptocurrencies lower.

While the bullish case for Ethereum is clear, it remains to be seen whether it will buck the broader bearish trend.

As reported by U.Today, Hayes predicted that the Ethereum price would be able to reclaim the $3,500 level if the Merge ends up being a success.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov