Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Amid a tumultuous week for the crypto market, ETH whales have made substantial moves, cashing out millions before Ethereum's price downturn. In the past four days of market downtime, three smart traders have offloaded a staggering 26,946 ETH, equivalent to a jaw-dropping $95.7 million. Their combined profits stand at an impressive $39 million, according to data from Spot On Chain.

The first trader, identified as "0xb82," executed a strategic move, selling 7,300 ETH for $24.4 million in stablecoins via Binance, netting a handsome profit of 22.7%, which is equivalent to a remarkable $4.59 million. Not far behind, "0xebf" deposited 8,870 ETH, valued at $33.1 million, onto Binance on March 16, reaping an estimated total profit of $25.3 million, an impressive 55.8% gain.

Lastly, "0xa43" sold 10,776 ETH for $38.2 million on March 15, realizing a notable $9.14 million profit, equating to a 31.5% gain.

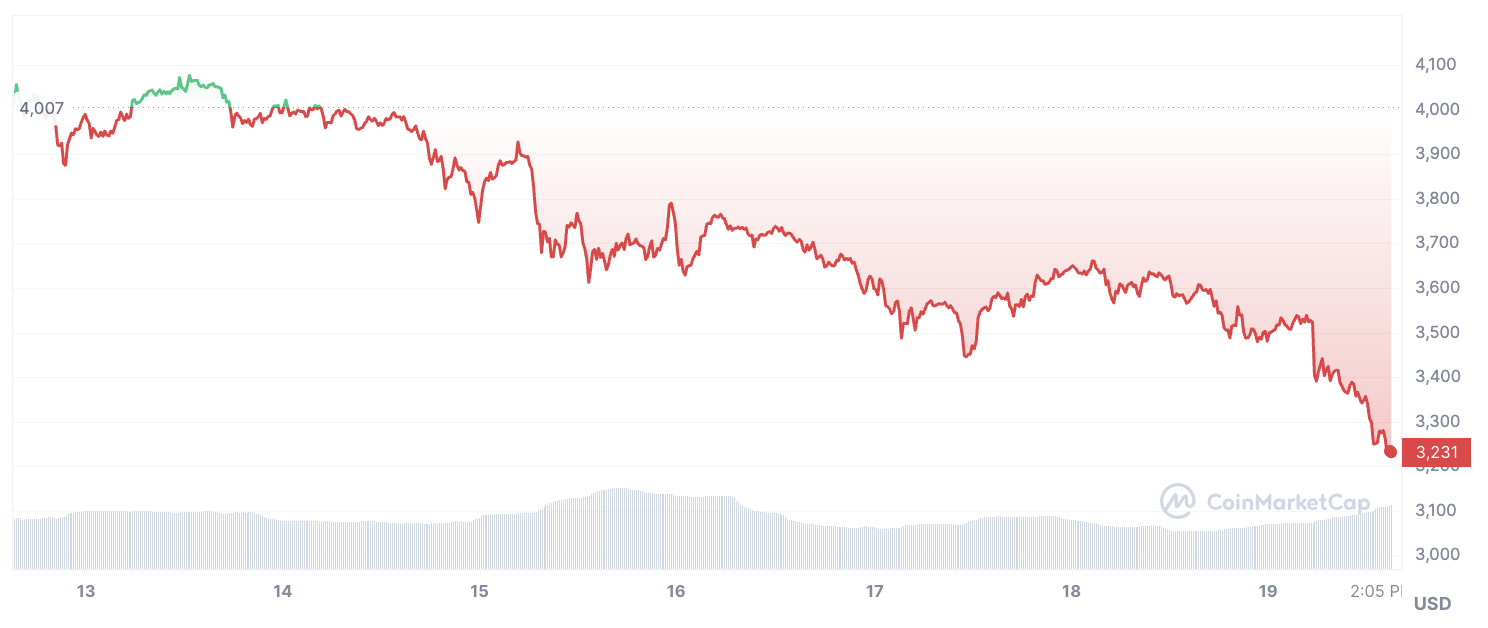

These moves come against the backdrop of Ethereum's price plummeting over 11% since the start of the week. After reaching a two-year high of $4,093 last week, Ethereum faced a significant sell-off, driving its price down to $3,200 per ETH.

CoinGlass reports that within the past 24 hours, positions totaling $120 million were liquidated, with an estimated 85% of them being long positions, suggesting a wave of sell-offs and profit-taking among investors.

The mass cash-outs by ETH whales amid the price drop raise questions about the future trajectory of Ethereum and the broader cryptocurrency market. Whether the main altcoin finds a foothold will largely be both the cause and the consequence of how events develop further.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov