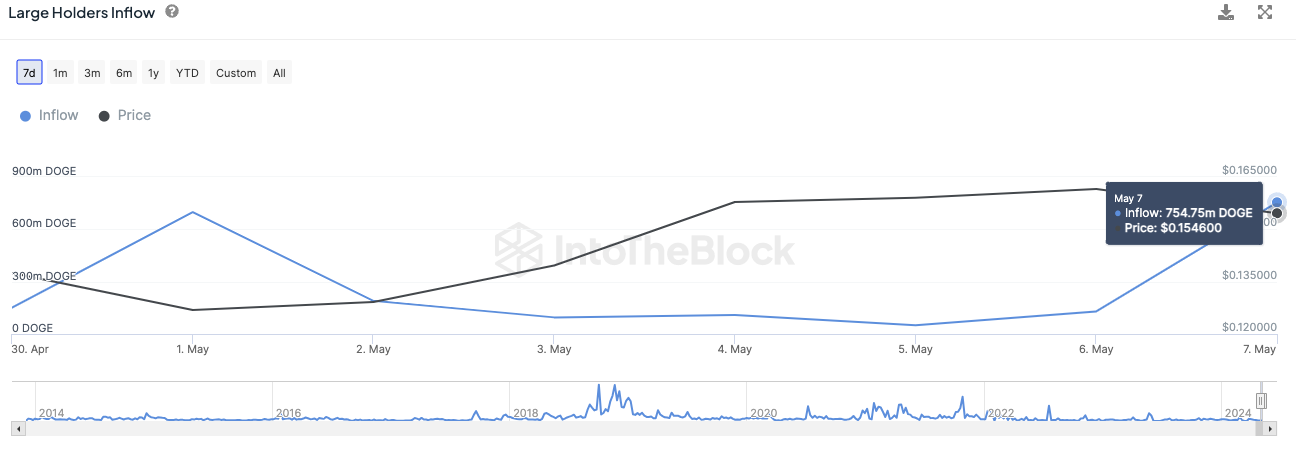

Dogecoin (DOGE) has demonstrated a remarkable surge in a critical on-chain metric over the past 24 hours, marking a notable 582% increase. Data from IntoTheBlock reveals a substantial rise in Large Holders Inflow, soaring from 129.63 million DOGE to an impressive 754.75 million DOGE, equivalent to approximately $116.98 million.

This surge in Large Holders Inflow suggests robust buying activity, primarily driven by influential entities such as whales and investors. These addresses typically acquire assets on centralized exchanges before transferring them to cold storage, which often indicates a bullish sentiment.

Notably, spikes in Large Holders Inflows have historically aligned with market bottoms, implying significant buying during corrections.

However, it is essential to consider the outflows from these addresses, as entities may conduct transfers for various operational reasons.

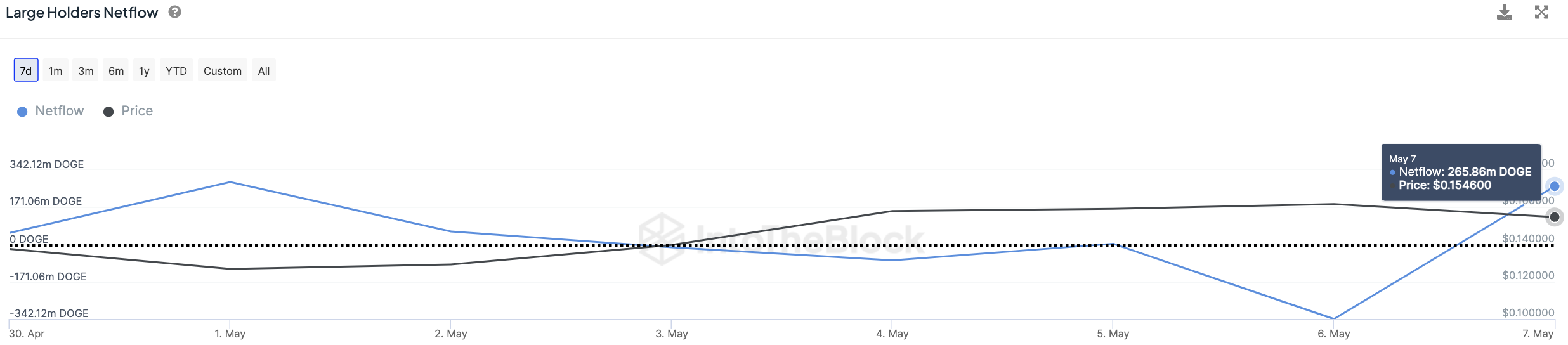

Analysis of the Large Holders Outflow reveals a modest increase from 471.75 million DOGE to 488.89 million DOGE, translating to approximately $75.78 million over the same period. Consequently, the Large Holders Netflow stands at 265.86 million DOGE, approximately $41.2 million in the past day.

The concept of Large Holders Netflow serves as a gauge for monitoring the shifting positions of whales and investors holding over 0.1% of the circulating supply. In essence, spikes in netflow imply accumulation by significant players, indicative of a bullish stance, while declines suggest reduced positions or selling activities.

The surge in Dogecoin's on-chain metrics underscores the increasing involvement of influential players in the market, signaling a potentially optimistic trajectory for the cryptocurrency. As DOGE continues to attract attention from investors and traders, its performance in these key metrics serves as a significant indicator of market sentiment.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov