Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

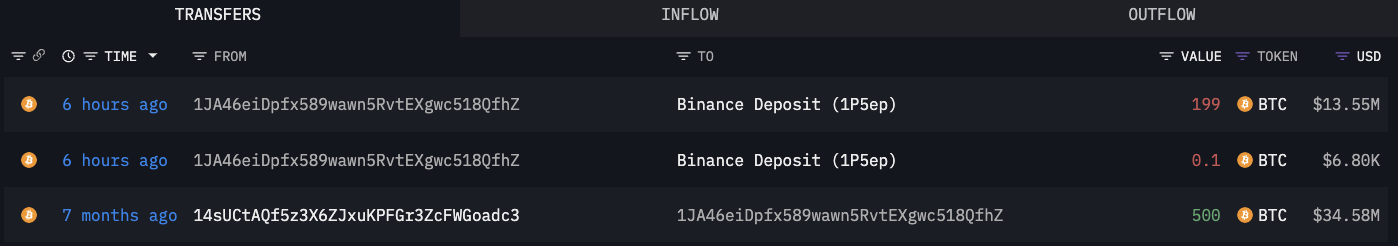

A "diamond hands" Bitcoin investor, which has been holding the major cryptocurrency for the last five years, has made headlines by selling 199 BTC, valued at approximately $13.55 million, just over one hour ago, as Lookonchain reported. Initially, this anonymous investor had withdrawn 801 BTC, worth around $8.25 million, from the Huobi exchange, at a price of $10,297 five years ago.

However, in the last month, they sold 500 BTC for about $32.13 million. After these transactions, the investor currently holds 301 BTC, equivalent to roughly $20.42 million, resulting in a total profit of $44.28 million.

Meanwhile, the price of the major cryptocurrency continues to circle around the crucial $68,000 level. With no sellers in sight, the consensus opinion at this stage is that if the price holds there and the growth continues toward $70,200, it could mark the beginning of a new wave of growth.

This logic is based on the fact that BTC has reached the target of $68,550, which is the final target from a technical point of view, with $52,500 as the starting point and key support currently at $65,800.

On the one hand, consolidation below this level in the longer term would open the door to levels as low as $63,000 and $55,800 per BTC. On the other hand, as long as we are closer to $70,200, the tug-of-war rope is on the bulls' side.

From this point of view, if the price of Bitcoin remains in a sort of equilibrium, the actions of the so-called "diamond hand" whale are fully understandable and rational, as they are just adjusting the risk to the current not-so-clear picture, still saving most of the holdings as the bullish bias remains the main one.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov