Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Popular meme cryptocurrency Dogecoin (DOGE) has not been out of the headlines for days now, and while much of it has been about the excellent performance of the DOGE price, the last few days have also been about what is going on with Dogecoin behind the scenes.

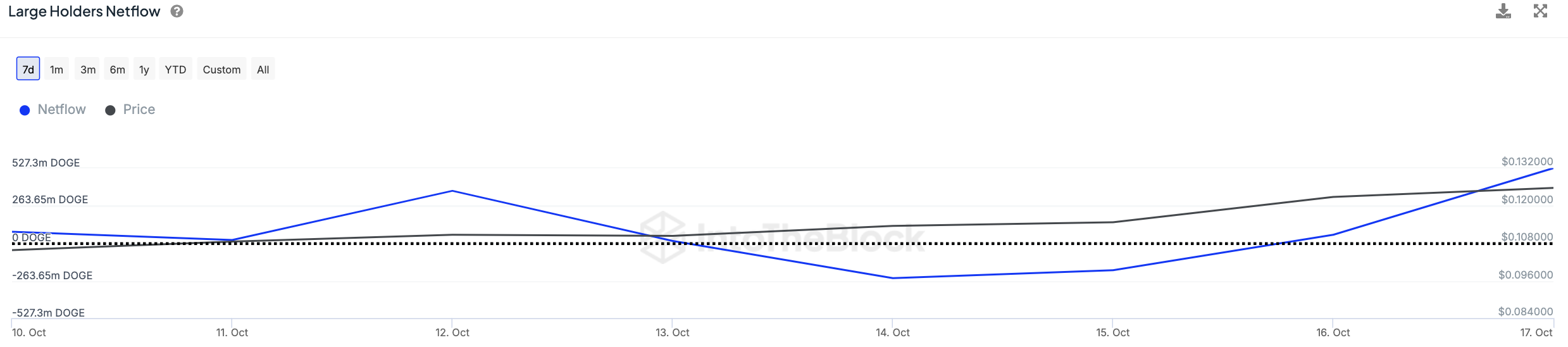

According to data from IntoTheBlock, net inflows of the meme cryptocurrency into wallets holding at least 0.1% of the Dogecoin supply in circulation have increased by an impressive 899% over the past 24 hours. This brings the cumulative number of DOGE bought by whales, minus coins sold, to 527.3 million coins, equivalent to around $63 million.

Looking deeper into the data, we can see that both the inflows and outflows of these whales have increased over the past day. But if the outflows amounted to 640.1 million DOGE, the inflows exceeded 1.17 billion DOGE.

Thus, we can say that at least the last 24 hours have been marked by bullish activity on the part of Dogecoin whales.

Dogecoin (DOGE): Price outlook

However, it is better to consider this data in the context of the price of the popular meme cryptocurrency, which has risen by almost 20% since the beginning of the new week.

The price of DOGE ended each of the days of this week in positive territory, and almost each of these days was accompanied by an increase in net inflows into whales' wallets.

At the same time, the metric's move into positive territory only occurred the day before yesterday, meaning that whales initially sold off DOGE's rise, and only now has the selling pressure eased and the buying pressure built up.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov