Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

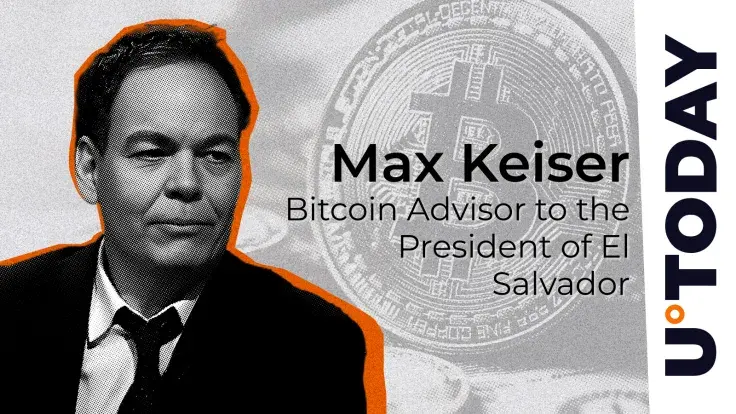

Max Keiser, Bitcoin maximalist and advisor to El Salvador’s president Nayib Bukele on all things Bitcoin, has published a tweet in which he revisited his ultra-bullish prediction for the future price of the world’s largest crypto.

"Bitcoin to trade over $220,000 very soon"

Keiser tweeted that Bitcoin is likely to skyrocket to a new all-time high of $220,000 due to a key reason – another safe haven asset, gold, reached a new all-time high of $2,713.88 per ounce for the first time in four years.

The previous ATH was hit in 2020, when the world faced the pandemic and investors began to enter gold to hedge themselves against low interest rates and the massive amount of quantitative easing.

It seems logical to think that once gold has soared to reach a new all-time high, Bitcoin is likely to do the same in the near future. Keiser believes that BTC will ultimately (and quickly) reach the $220,000 level that he has been predicting over the last few years.

This year in September the Fed Reserve decided to switch its stance from a hawkish to a dovish one as the interest rate was slashed by 50 basis points. The Fed hinted that until the end of 2024, a few more interest rate cuts are likely to take place.

Keiser bets on Bitcoin, not gold

In a tweet published earlier, Max Keiser said that he expects BRICS to announce the launch of a “gold-backed USD killer” at their conference which is taking place next week in Russia. In July, this organization that consists of several countries announced their intention to launch a payment system similar to SWIFT in order to weaken the domination of SWIFT and the US dollar in global markets.

They intended to use blockchain for building and running that system and a stablecoin backed by gold that would be based on it, hence US dollar would not be used on that platform.

Many financial experts expected this gold-backed crypto to launch last year in August but it did not happen. Among them was Robert Kiyosaki, the author of the popular book on managing finance “Rich Dad Poor Dad”. However, Max Keiser added in his tweet that “for every $1 gold moves, Bitcoin moves $20”, thus making a bet on BTC against gold.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov