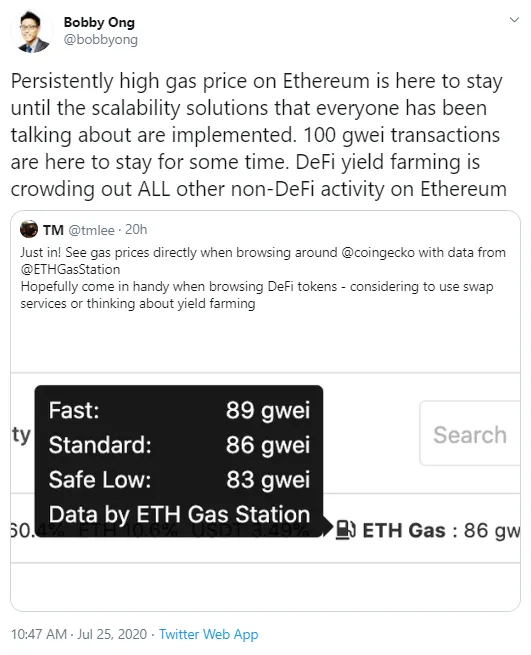

CoinGecko’s co-founder and COO Bobby Ong has taken to Twitter to say that even though high gas prices are likely to remain until new scalability solutions are rolled out on Ethereum, yield farming remains very popular and is pushing out all other non-DeFi activity from the second biggest blockchain.

‘100 gwei transactions are here to stay so far’

Bobby Ong replied to a tweet published by the CoinGecko CEO TM Lee, who shared gwei prices for transactions on Ethereum – slow, standard and fast ones, with the latter being the highest.

TM Lee assumed that this data may be helpful to those who is thinking of dipping their toe in yield farming (i.e. lending their DeFi tokens to startups to receive high returns on their investment).

Ong believes that high gas transactions on Ethereum are here to stay for until Ethereum implements the promised scalability solutions (which are assumingly part of the long-expected and long-delayed Ethereum 2.0 upgrade).

The CoinGecko COO added that at the moment DeFi yield farming is much more popular than all other activity on Ethereum not to do with DeFi.

‘DeFi is going to bring about another full-fledged bull run’

Founder of the recruiting agency working in the blockchain industry 'Proof of Talent' Rob Paone has also posted a tweet that describes DeFi as a sphere most popular for making money.

He believes that DeFi is going to see a new full-scale bull run, since more new funds are entering and people are telling each other what big yields they are making there.

‘Major threats/challenges for Defi for next few years’

Head of Product at Messary ,Qiao Wang, has taken to Twitter to publish what he thinks to be the main threats and/or challenges that the DeFi sphere is likely to face in the next few years.

He mentions the necessity for scaling (and again he talks about high fees here), encountering regulators, such as FATF, having to compete with Libra and other similar projects too.

Dan Burgin

Dan Burgin Alex Dovbnya

Alex Dovbnya Denys Serhiichuk

Denys Serhiichuk Gamza Khanzadaev

Gamza Khanzadaev