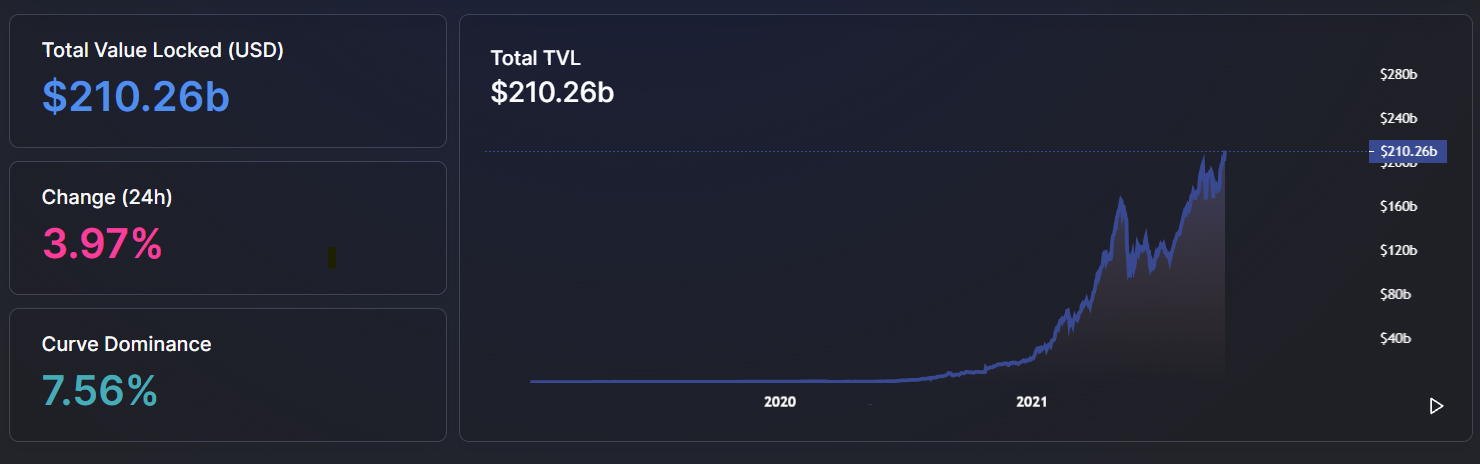

Numerous projects tied to the DeFi industry have enjoyed rapid growth recently, with Fantom TVL reaching $7 billion with a 140% rise, AnySwap with 114% growth and the industry's total value locked reaching a new ATH of $210 billion, according to DeFiLiama.

The largest TVL contributors remain Curve, AAVE and MakerDAO with $43 billion of value locked in total. At press time, the industry's TVL remains at $210 billion, with a negative change of 4% today.

The main reason for industry growth is most likely tied to overall inflows of funds back into the cryptocurrency market. Previously, the ATH in TVL for the DeFi industry was reached back in May, when the Bitcoin sell-off started.

The total value locked in DeFi has been growing since July, sometimes outperforming Bitcoin and the altcoins market. The popularity of the industry is tied to the passive income solutions that most DeFi platforms offer. Users are able to take and give loans in stablecoins by overcollateralizing.

Ethereum still remains the most popular chain in the industry with the majority of projects functioning on it despite high fees and constant periods of network congestion.

Previously, the Soros fund manager expressed her thoughts on the cryptocurrency industry and shared that the fund is researching the DeFi industry, which might indicate the fund's intention to invest in the industry in the future.

Dan Burgin

Dan Burgin U.Today Editorial Team

U.Today Editorial Team