Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

After a major 300-400% price increase on the spot market, the SHIB meme token faced almost a 40% correction and is currently trading with a 5% daily discount. In addition to volatile market movements, volumes on the derivatives market have also increased significantly, which is the first indication of a high number of overleveraged positions on the market.

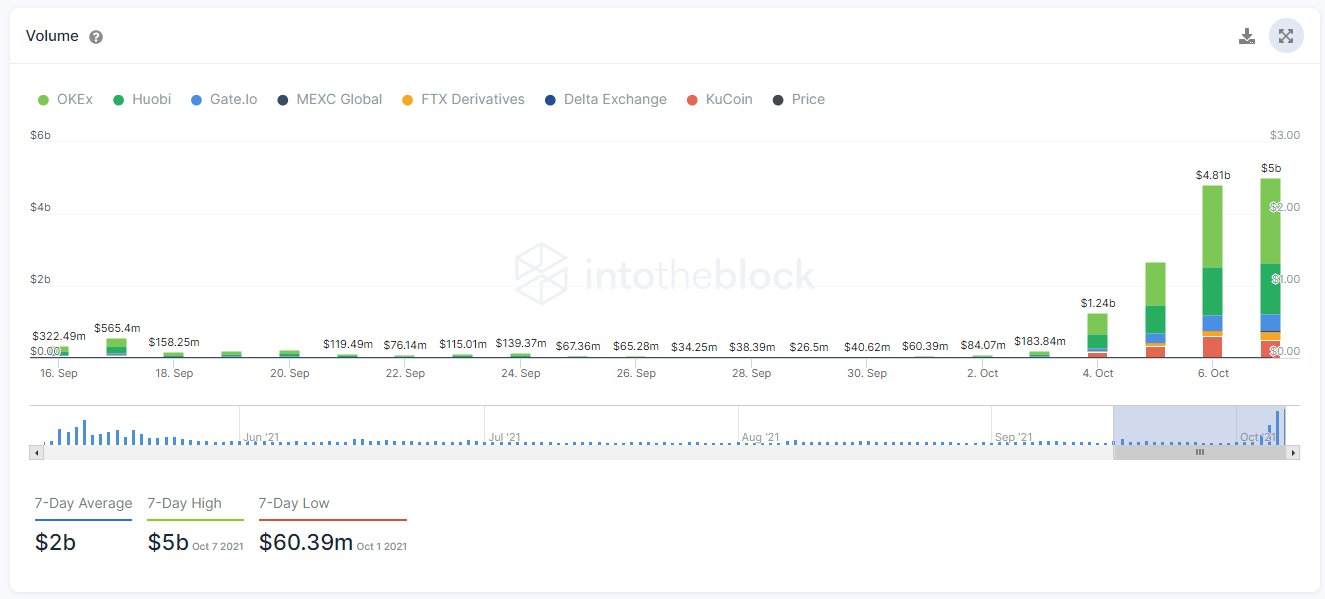

SHIBA perpetual swaps faced a 78x volume increase compared to Oct. 1. The volume has crossed the $5 billion mark for the first time ever. The high activity on the derivatives market is an indication of a number of things happening on the market.

Overleveraged growth

High volume on the derivatives market for any position is usually followed by the high number of leveraged positions, which allows traders to buy more than they can actually afford. By lending funds to traders, exchanges create more demand for an asset and move its price significantly higher than is possible without leverage.

Abnormal volatility

Leveraged long positions fuel the growth on the market, but once traders decide to exit their positions and take profits, other traders have to execute their buy orders. But since the market is highly leveraged, the number of buy orders usually does not keep up with the price, which then leads to the formation of a thin orderbook. After selling pressure increases, the price of an asset rapidly falls due to the inability to keep up with sell orders.

At press time, SHIB trades with 5.5% of the daily loss, after correcting for almost 40% overnight.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin