Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Developed by a team of blockchain and fintech veterans, the Chainge application addresses one of the most pressing Web3 bottlenecks of 2022, i.e., truly seamless and secure interoperability between heterogeneous distributed networks.

Bringing cross-chain roaming to the DeFi sphere: What is Chainge?

Chainge is a multi-product decentralized finance application that introduces the ethos and practices of cross-chain interoperability to the “yield farming” and DEXes spheres.

Technically, it is an ecosystem of instruments for frictionless liquidity providing, trading and investing. As such, what is special about Chainge’s array of products?

- Seamless value transfer across a multitude of mainstream and new-gen blockchains, powered by the patented Fusion DCRM technology.

- All-in-one approach: DEX, LP toolkit, wallet, decentralized escrow, spot, futures and options modules in a single dashboard;

- Chainge’s system utilizes no cross-chain bridges: it is not vulnerable to Wormhole-style attacks;

- Low fees for end users due to the revolutionary design of cross-chain interactions;

- Unparalleled level of privacy for all transactions: all Chainge cross-chain operations are in stealth mode.

- High range of blockchains (16 and counting) and 85+ integrated assets allows for a more flexible portfolio diversification.

What is DeFi?

Decentralized finance, or DeFi, refers to a wide range of on-chain software programs that rely solely on smart contracts while executing basic financial operations. Despite being known since 2017 (Etherdelta, IDEX, Kyber), DeFi protocols went mainstream in Q2-Q3, 2020 - during the so-called 2020 DeFi Summer. Aave Finance (AAVE), Compound Finance (COMP), Balancer (BAL) and Uniswap (UNI) are the most popular DeFis.

Simply put, DeFi infrastructure includes three types of protocols. First and foremost, decentralized cryptocurrency exchanges (DEXes) need to be mentioned: they allow noncustodial on-chain conversion between different crypto assets.

Then, decentralized lending/borrowing protocols comprise a crucial category for the DeFi sphere: it allows crypto enthusiasts to collateralize their cryptos to obtain a loan.

Last but not least, there are a lot of decentralized stablecoins like DAI, SAI, FEI and UNITE in the DeFi segment. Their peg to underlying reserves is controlled by sophisticated algorithms: as such, they are also called algorithmic stablecoins.

All operations in the DeFi sphere are executed in a peer-to-peer manner: no centralized party can interfere in the process or control private keys, funds or users’ identities.

What are liquidity pools?

For sustainable progress and truly decentralized operations, all of the mentioned categories need liquidity, i.e., constant inflow of cryptocurrency. Liquidity can be injected by investors or, in DeFi-specific language, liquidity providers or LPs.

To incentivize potential LPs to participate in the operations of this or that DeFi, its team customizes a payout program: liquidity providers accrue a share of the protocol’s revenue. Rewards may be yielded daily or monthly; users can “lock” liquidity in stablecoins, large caps or even the native coins of DeFi protocols.

Chainge: Multi-platform app for cross-chain liquidity

Chainge Finance lowers the barrier for LPs in the DeFi sphere by creating a holistic cross-chain ecosystem for multiple blockchains. Simply put, LPs can leverage liquidity in different assets on different chains to build a flexible and diversified investing strategy.

DCRM technology: 85 assets, 16 blockchains

Leveraging new-gen smart contracts the Fusion DCRM technology is the only viable and commercially used cross-chain value transfer toolkit. As per the estimations of Chainge representatives, DCRM is utilized by apps on Fantom and Nerve, and is currently responsible for 70% of total cross-chain market turnover.

As of early Q1, 2022, Chainge’s DCRM harnesses 16 different blockchains and a total of 85 cryptocurrencies. Recently, Chainge scored a partnership with Elrond Network (EGLD), which is among the top EU-incorporated new-gen blockchain heavyweights.

Chainge amassed $150 million in total value locked (TVL) across all of its instruments, with a $1 million avarage daily trading volume.

Liquidity pools vs Futures Liquidity Pools

As its cross-chain liquidity ecosystem is seamless and highly scalable, Chainge introduced an array of liquidity pools for different assets with highly competitive APYs and no impermanent loss, such as the Futures Liquidity Pools.

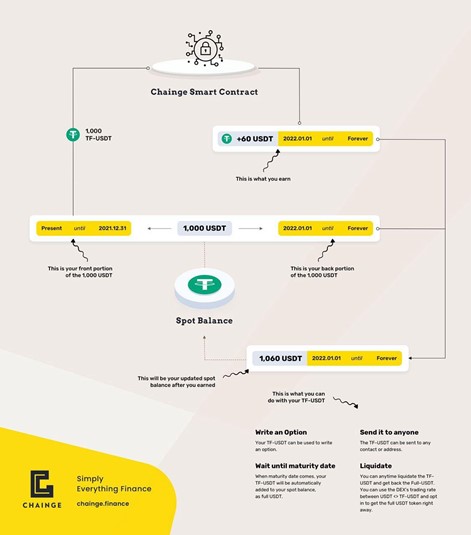

Liquidity on Chainge can be injected into a native “yield farming” vehicle dubbed Time Framing (TF). This is quite different from other yield farming modules meaning the assets always remain on the users’ address and can be liquidated at any time in the Futures DEX. So basically, LPs can time-frame their cryptocurrency for a predetermined period of time and then pair them up with spot assets in order to obtain rewards but without the risk of losing their assets.

All rewards gained in the Earn by Time Framing mechanism (TF-USDT, for instance) can be effortlessly reinvested into Chainge’s liquidity ecosystem, together with “fresh” USDT liquidity. You can find out exactly how it works and how to do it in the article here

Currently, Chainge’s Time Frame module accepts a wide array of cryptos, including Bitcoin, Ethereum, Tether, TRON, Binance Coin, Fusion, Huobi Token, Uniswap, PancakeSwap, Mdex, ChainLink, AAVE, Enjin Coin, Alpha Finance Lab, Synthetix, 1inch, SushiSwap, Compound, yearn.finance, Decentraland, The Graph, Basic Attention Token, 0x, UMA, Curve DAO Token, Balancer, Swipe, Badger DAO, BakeryToken, DODO, Venus and so on.

Escrow module

The Chainge decentralized escrow module is available to anyone who wants to buy or sell something (assets/ commercial goods/ services) while having the security that the other party will hold up their end of the deal.

The whole process in the Chainge app is automatic and decentralized, which means there’s no need for a third party’s involvement or traditional escrow services that charge ridiculous fees.

The main advantage virtually anyone can benefit from is security. No one ever has to doubt the safety of an agreement and can do business with complete strangers in a safe, decentralized environment — which is a huge step towards an ideal, secure financial ecosystem.

Even crypto enthusiasts with basic crypto or fintech skills can try Chainge’s decentralized escrow. It is available in the “Banking” section of Chainge: every user can either initiate interaction with escrow or accept an invitation to interact with an escrow initiated by a counterparty.

Derivatives DEX platform

Last but not least, Chainge introduced a native decentralized cryptocurrency exchange for derivatives, i.e., options and futures. Chainge pioneers the DeFi futures trading segment. With Chainge, users can enter on-chain trading with their previous experience of CFD trading on centralized or TradFi platforms.

Chainge is open for listing applications: early-stage products can add their tokens to the derivatives’ toolkit of the platform. Currently, there are 410,000 accounts in the Options DEX and Futures DEX of Chainge’s trading module.

Roadmap

Despite being launched in 2021 and still being in the early-stage phase, Chainge witnessed a number of massive accomplishments. It developed and deployed smartphone applications to the App Store and Google Play digital marketplaces. On Google Play, it has 8,135 reviews with almost a 5.0 average score; it also has a mark of 5.0 in the App Store.

Chainge’s editors and PR department created feature-rich web interfaces and produced educational content on YouTube, Medium, Twitter, etc.

In the very near future, Chainge is going to implement a unique cross-chain liquidity aggregator, thus solving the liquidity issue which is now a common problem for most DEXs on the market.

Closing thoughts

Chainge, a next-gen cross-blockchain ecosystem, brings seamless roaming to heterogeneous blockchains and DLTs. It allows crypto holders to operate liquidity across different blockchains.

It released a cross-chain spot, futures & options DEX, Time Frame “yield farming” module for LPs and a Decentralized escrow module.

As of Q1, 2022, Chainge offers the most secure & efficient cross-chain environment in the DeFi space in addition to their incredibly smooth UX. Definitely worth trying out.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin