Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

One of the biggest cryptocurrency exchanges in the world, Binance, is reportedly short on its supply of Cardano as investors are moving the coin away from exchanges and using it in alternative decentralized solutions and wallets.

Why does exchange increase the interest rate?

Binance's staking feature is created to control the supply of various cryptocurrencies on the platform, as the outflow trend is still on the market since 2021. Whenever the exchange's supply is running short, it uses various techniques for attracting more funds to their wallets.

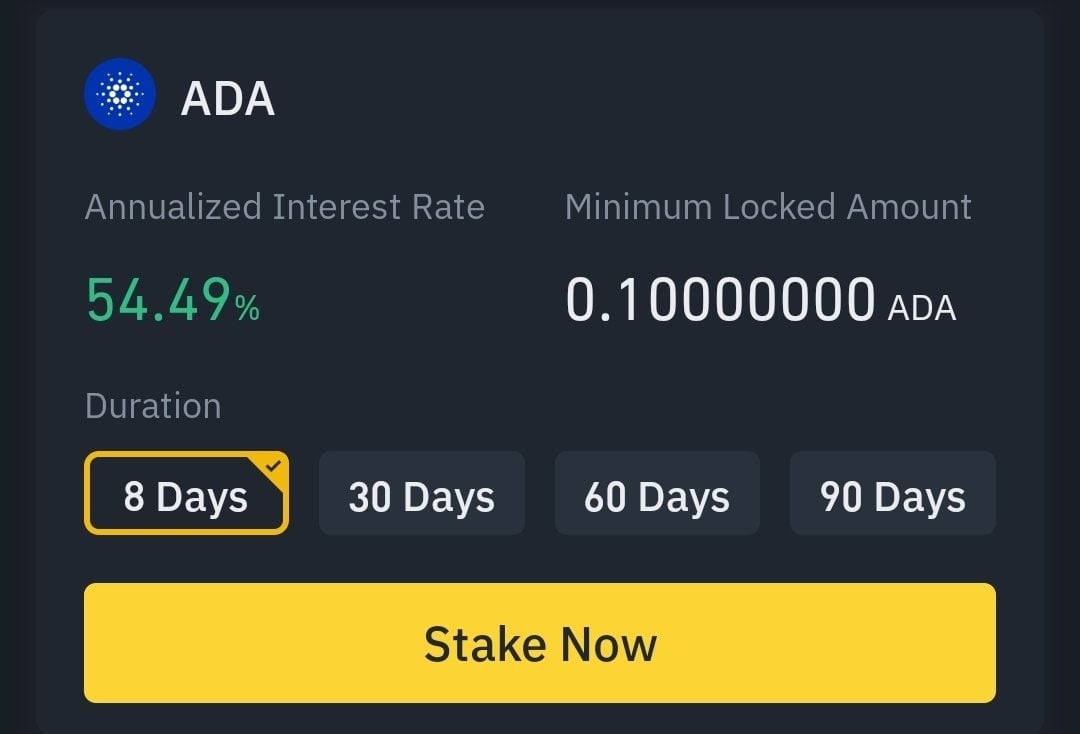

With Binance, the platform offers a relatively high interest rate for anyone who deposits their ADA coins. Compared to stablecoin staking, which offers around 10% APY, the rate of 54% is considered significantly higher compared to the average market offering.

As more traders and investors deposit their Cardano on the platform, the interest rate will slowly get down to an average value, which causes the stabilization of the supply of ADA on the exchange.

Usually, exchanges are using the supply to fund short-orders and pay income from open positions.

Cardano loses gained confidence

March was a considerably successful month for ADA, which gained over 50% to its value since the local bottom reached on March 14. After reaching $1.2, Cardano swiftly reversed below the $1 threshold and now trades at $0.9.

Following the retrace, Cardano dropped below the 50-day moving average, showing lack of buying power on the market and the bearish sentiment of long-term investors. Cardano remained in the prolonged downtrend for the last 230 days. During the downtrend, ADA lost 67% of its value.

Gamza Khanzadaev

Gamza Khanzadaev Arman Shirinyan

Arman Shirinyan Alex Dovbnya

Alex Dovbnya