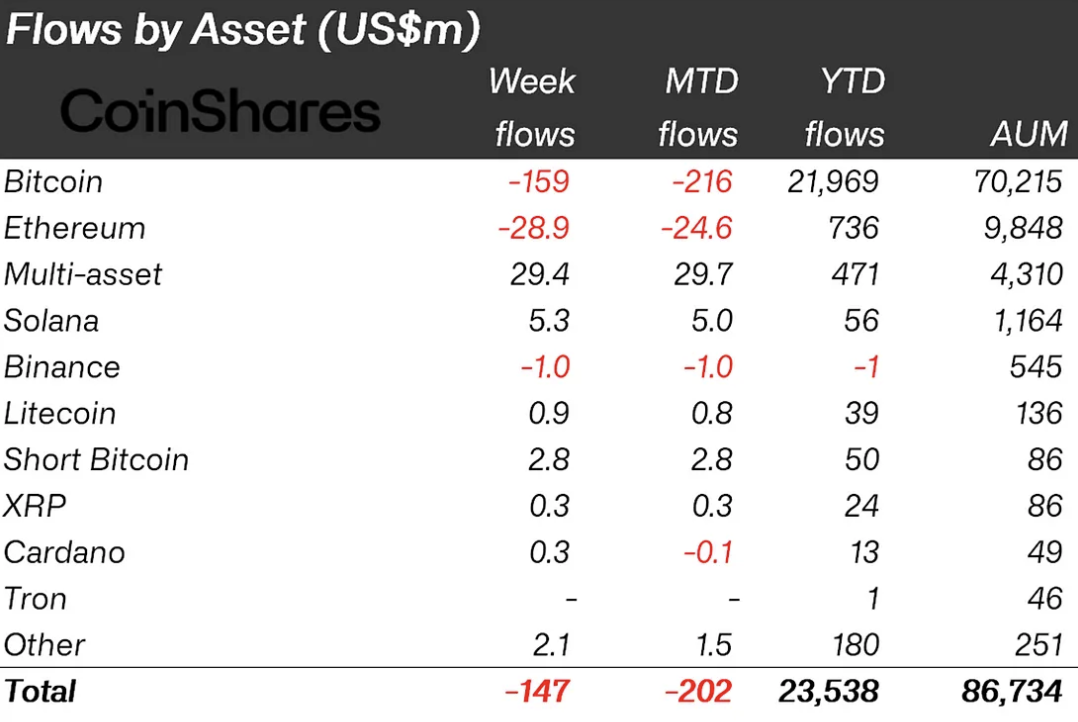

A new weekly report has come out from CoinShares on the movement of funds in the crypto-focused exchange traded products (ETPs) market. One of the main highlights of the latest research was the performance of Cardano ETPs, as investors using these financial vehicles for crypto investments poured 300% more money into them over the past seven days than the week before.

As a result, $300,000 was added to ETPs focused on the ADA token. Since the beginning of the year, Cardano has seen $13 million in inflows, and its ETP providers have a total of $49 million in assets under management.

By these parameters, Cardano is the last on the list of cryptocurrencies that have their own ETP at the end of the list, but at least it has them.

XRP shines green, Bitcoin and Ethereum go red

Another highlight may be the new round of inflows into XRP ETPs for the new consecutive month, as the seventh largest cryptocurrency continues to attract the attention of investors worldwide in direct and indirect ways like exchange-traded products.

This week's inflows into XRP ETPs totaled just $300,000, but since the beginning of the year, the figure is now $24 million, with $86 million in assets under management, which is significant.

Adding to the positive sentiment is the fact that Cardano and XRP saw inflows into their investment products amid massive outflows in those of Bitcoin and Ethereum. The overall weekly result for the market of crypto ETPs is still dictated by these two biggest cryptocurrencies, and by the end of the week it was $147 million of net outflows.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov