Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

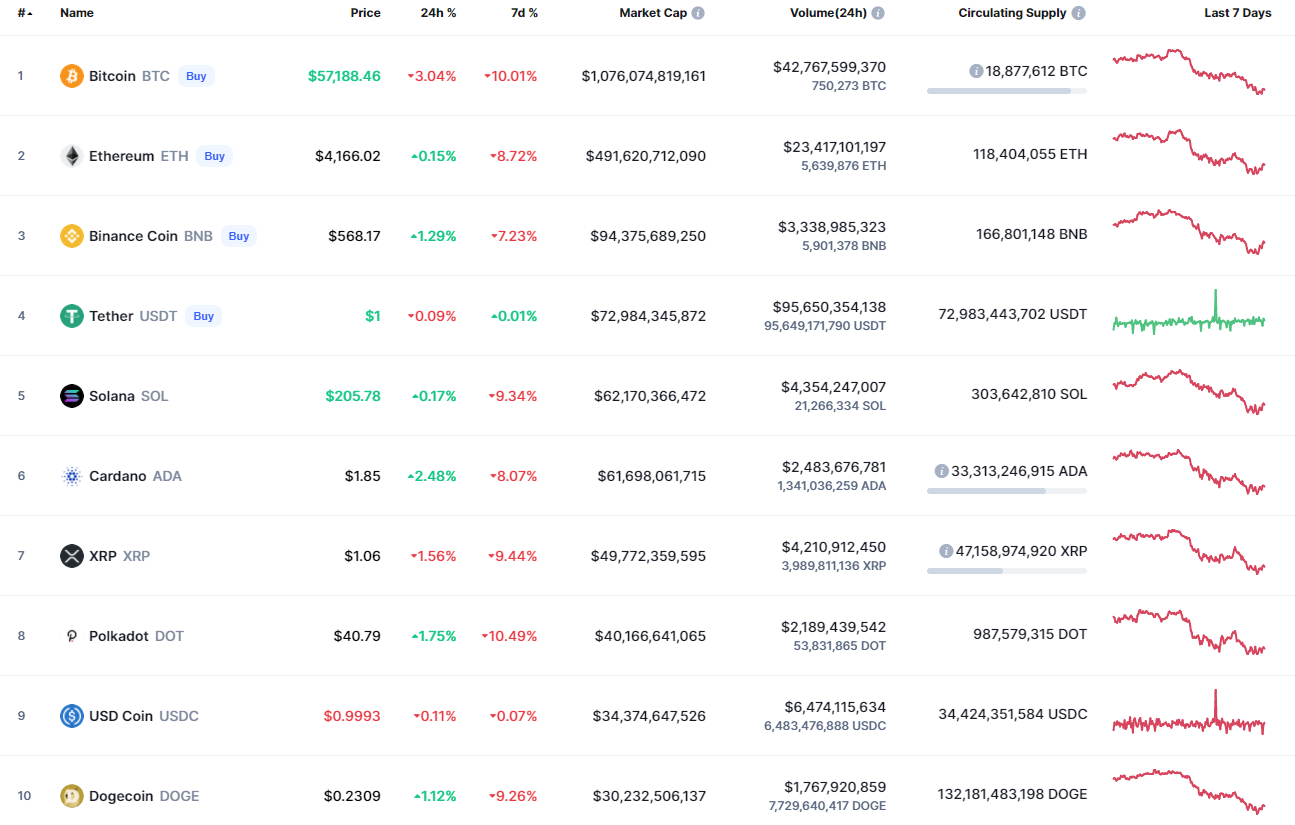

Cryptocurrencies are slightly recovering after a sharp dump yesterday; however, some coins remain in the red zone.

BTC/USD

Bitcoin (BTC) is the main loser from the top 10 coins as its rate keeps falling, going down by 3% since yesterday.

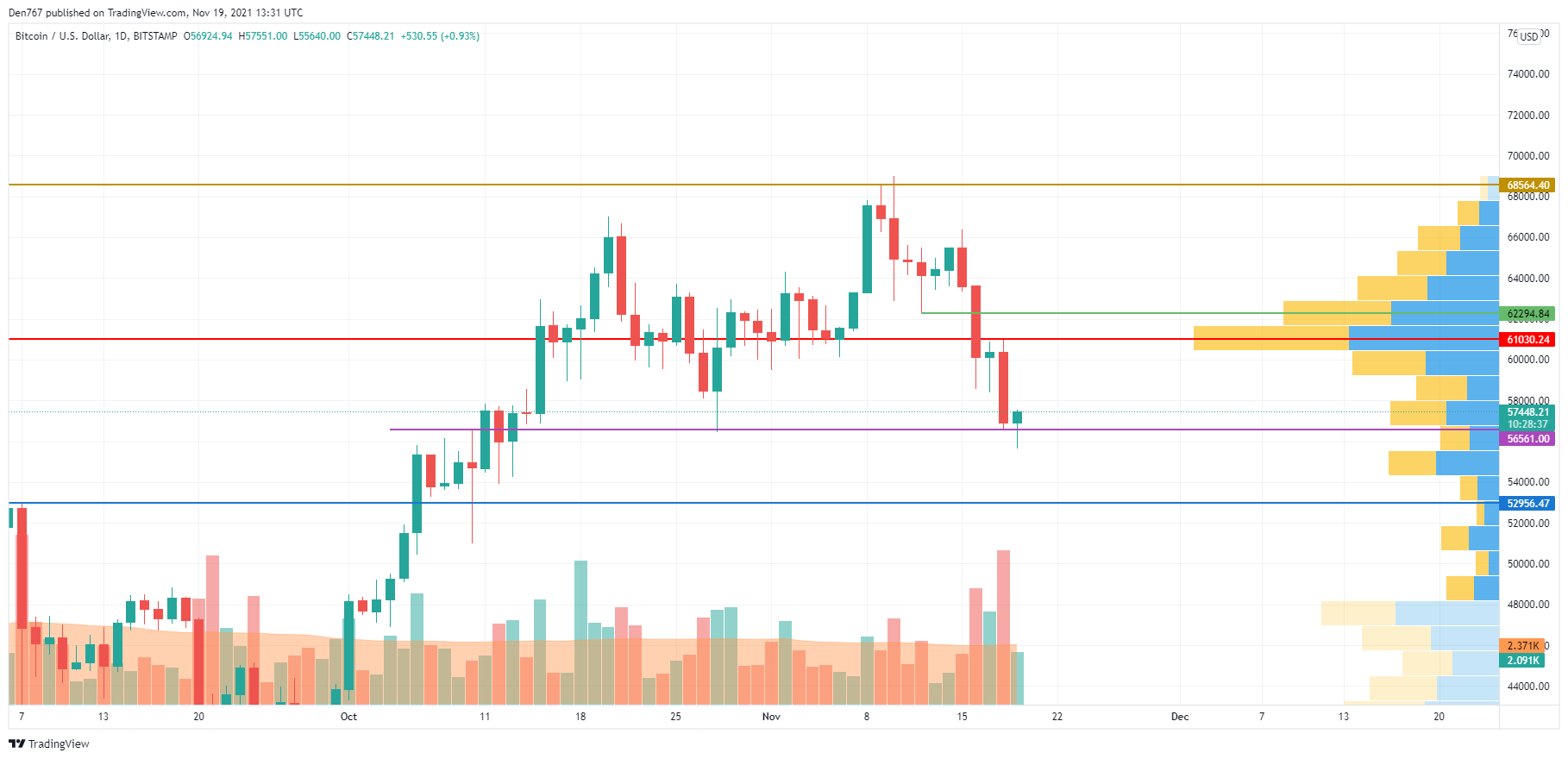

Bitcoin (BTC) has bounced off the purple support line at $56,560, which means that bulls keep controlling the situation and are not going to give up. The buying trading volume is also going up, confirming bulls' power.

If the main crypto can come back to $58,000, there is a high chance to see a continued correction to the vital level at $60,000.

Bitcoin is trading at $57,441 at press time.

BNB/USD

Unlike Bitcoin (BTC), Binance Coin (BNB) is rising by 1.18%.

Binance Coin (BNB) is coming back to the bullish end of the daily chart. The rise is accompanied by a high trading volume, which means that there is a possbility of seeing the ongoing growth.

If this comes true, the next resistance at which bulls may face some difficulties is the recently formed resistance at $602.70.

Binance Coin is trading at $573.80 at press time.

ADA/USD

Cardano (ADA) is the biggest gainer from our list, going up by 1.48%.

Cardano (ADA) is trading simiarly to Binance Coin (BNB) as it has also come back to the bullish zone. At the moment, one needs to pay close attention to the mirror level at $1.932. If bulls can break it and fix above, ADA has the potential to keep the rise to the liquidity area around $2.10. Such a scenartio is relevant until the end of the month.

ADA is trading at $1.857 at press time.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin