In the U.S., the season of corporate earnings reports for the third quarter continues, which means we can receive some information about the crypto market from companies like Coinbase, the leading crypto exchange out there. The information is interesting, especially when it comes to Bitcoin and Ethereum, two of the biggest assets on the crypto market.

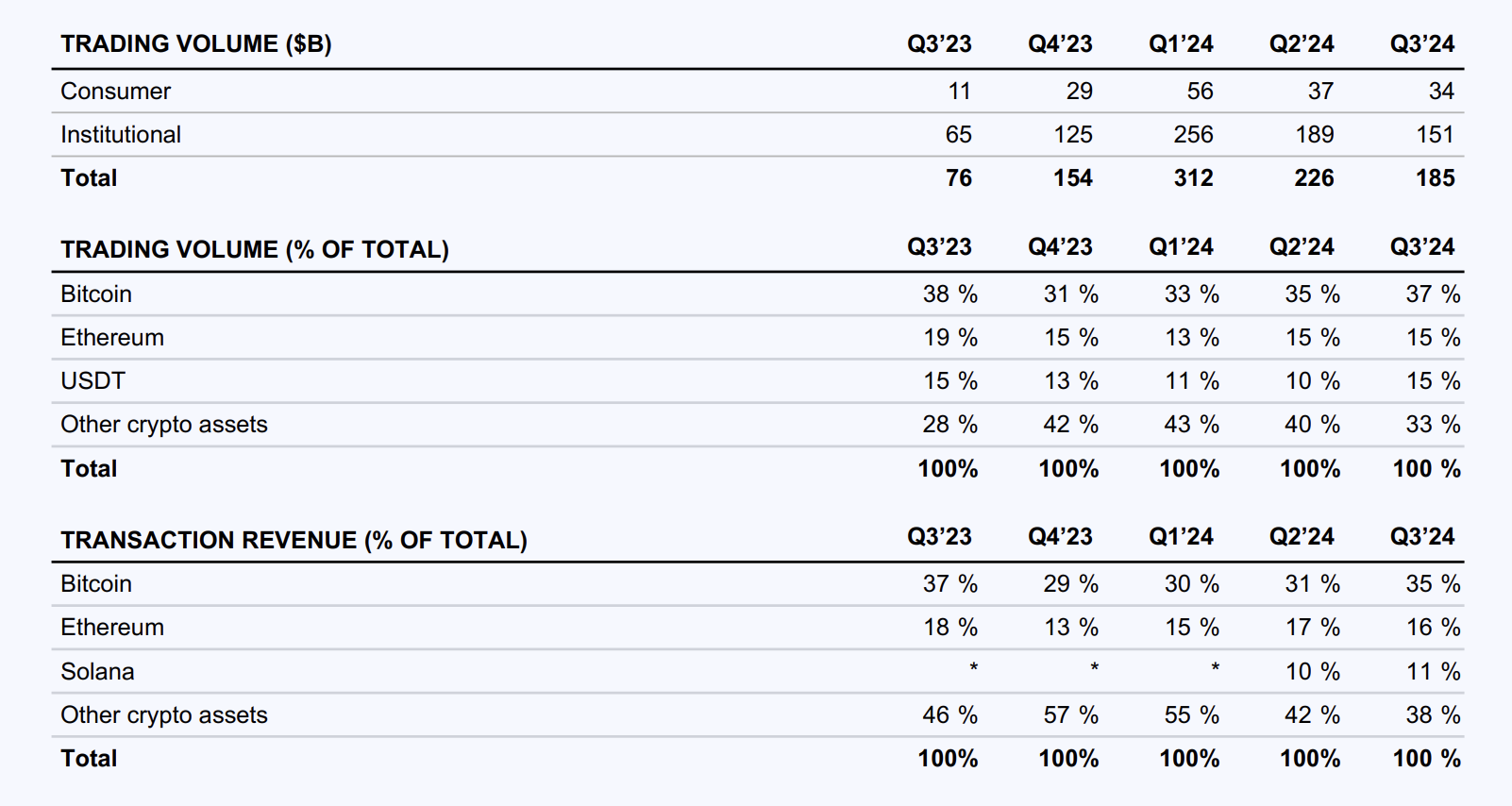

According to the quarterly report for the last period from July to September, the trading volume of Bitcoin on Coinbase increased by 2% to 37%, while the trading volume of Ethereum remained unchanged at 15%. The trading volume of the USDT stablecoin also increased by 5% to 15%.

All of this was financed by a decrease in the trading volume of other crypto assets, which naturally fell from 40% to 33%. In total, the trading volume on Coinbase amounted to $185 billion, of which 81.62% was accounted for by institutional clients.

In terms of transaction revenue, Bitcoin once again reigned supreme. Thus, the main cryptocurrency in this indicator grew over the three months from 31% to 35% of the total revenue. Ethereum cannot boast the same and had to move its share to 16%, which is 1% less than in the second quarter.

Interestingly, however, the same 1% was gained by Solana, which is one of the leaders of this cycle. In terms of size, Coinbase's transaction revenue amounted to $572.5 billion last quarter, down 26.68% from the previous quarter.

Thus, it can be said that Bitcoin continues to hold the attention of the public, while Ethereum, despite the general doubts about its validity in this cycle, is still dear to the hearts of crypto enthusiasts.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov