Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

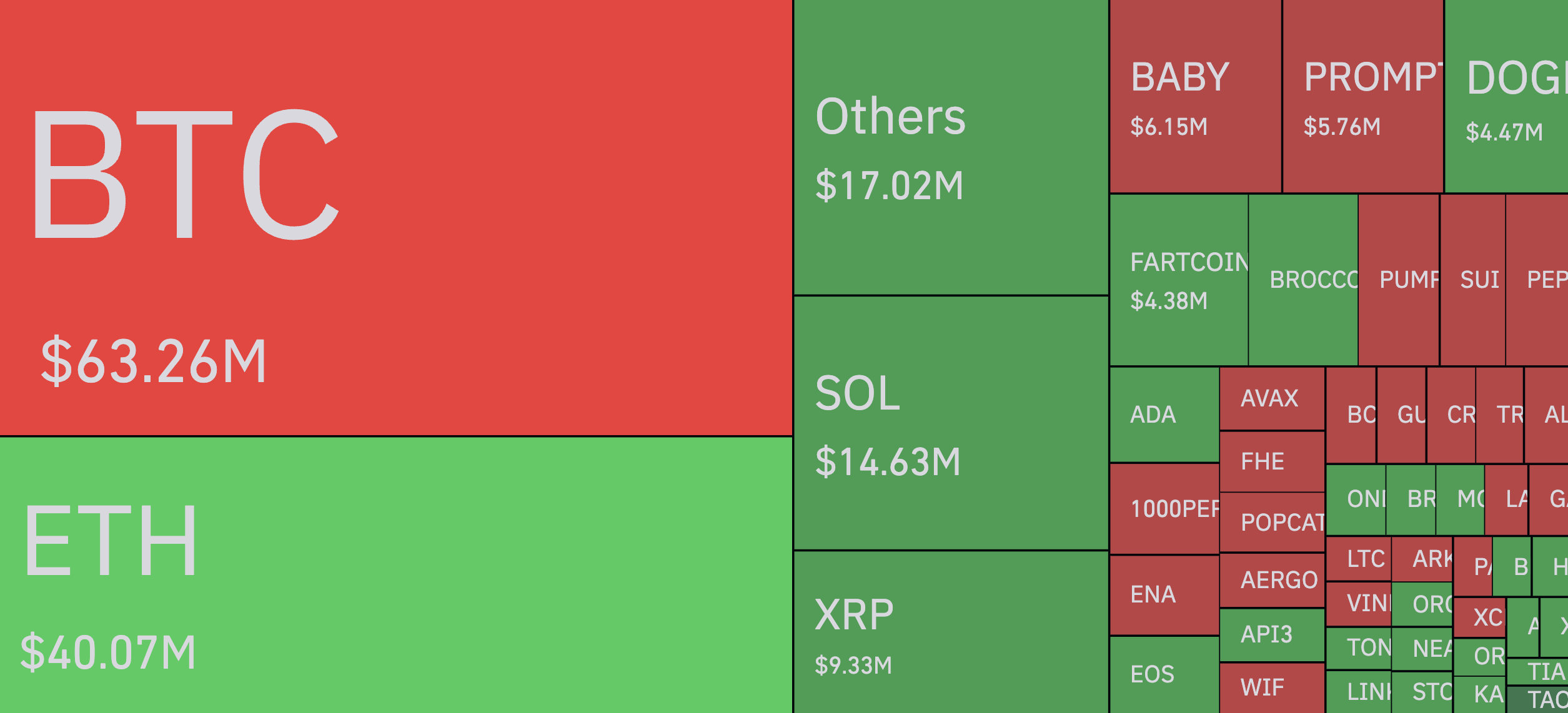

A 346% liquidation imbalance is exactly what happened today as Bitcoin (BTC) flushed out $52 million in longs against just $15 million in shorts, flipping sentiment and price direction without any macro trigger or breaking news — just a correction born purely from market structure going too far in one direction.

The initial result wasn’t dramatic on the surface, but the effect was clear: price dropped, leverage reset with Bitcoin slipping above $86,000 before fading back below $84,000, suggesting not so much a collapse as a mechanical reset after bearish traders were caught leaning too hard into a narrative that had already run out of momentum.

This wasn’t a moment of FOMO or euphoria, just a reality check — one where an over-leveraged market quietly tipped over and forced liquidations to clean up the excess. While $67 million in total liquidations over a short period isn’t a massive number in isolation, the ratio or the imbalance is what matters here, because it reveals just how concentrated sentiment had become and how little downside buffer existed once the tide turned.

No CPI data, no Fed minutes, no sudden move in rates — just the natural consequence of leverage-heavy setups overstaying. You can see the results on the chart, which show how quickly prices bounce back once weak positions are cleared.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov