Technical Outlook

The technical outlook for Bitcoin is lackluster at best. With no major catalyst to drive it, the coin is languishing near long-term lows where it has been trading for many months. The world’s leading cryptocurrency is trapped in a tight range and does not look like it will break out any time soon. Indicators like stochastic and MACD concur; this token is range-bound and trending sideways for the short-term at least.

Description - Bitcoin price chart with Bitcoin Predictions 2018

Major support is above $6,000, and the token’s range appears to be narrowing down to a point near $6,400. This point is noteworthy as it is the balance point at which miners — most of them, anyway — are able to turn a profit. If the price of Bitcoin was to fall significantly below this level, it could force miners out of the market and spell the end for the world’s reserve cryptocurrency… That is not a possibility in our Bitcoin projections.

Our Bitcoin forecast is this: the price of Bitcoin will most likely trend sideways within the current trading range until the next major catalyst emerges. The token will likely trend near a point of the market equilibrium that appears to be near $6,400. When the catalysts emerge and there are several on the horizon, Bitcoin will break out of the range and start moving higher. How high it goes will depend on the catalyst.

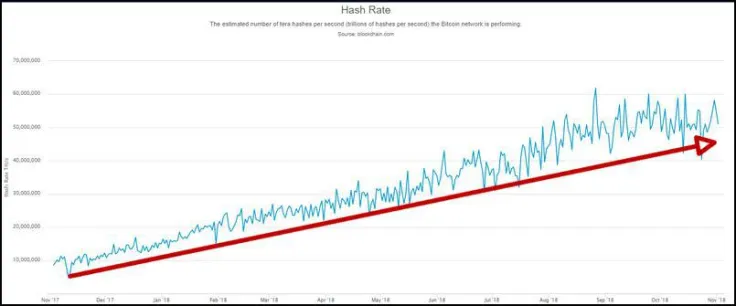

Bitcoin miners are supporting the market

The global hash rate data says that Bitcoin miners are still interested in the number one cryptocurrency by market cap and are supporting the market. The global hash rate, the amount of computing power spent on BTC mining, topped out this year when BTC prices hit their lowest levels but have since been trending at record-high levels. The miners are important for one fundamental fact: they are the source of all Bitcoins. Because it costs the miners about $6,500 per coin to operate their rigs, you can bet the price of Bitcoin won’t far fall below that level.

Description - Chart of Bitcoin hash rate growth since 2017

A Dwindling Supply will help drive prices higher

What most Bitcoin price predictions fail to mention is the ever-dwindling supply of Bitcoins. By dwindling, I do not mean the ever-increasing difficulty rate which makes finding new Bitcoins harder and harder. By dwindling, I mean the growing number of Bitcoins that are lost or irretrievably locked away.

-

Proof of Burn is a way to start new cryptocurrencies by burning another cryptocurrency. A public cryptocurrency burn is sending cryptocurrency to a prearranged and irretrievable BTC address for the purpose of shifting value from one token to another.

Estimates as recent as November 2017 had the number of lost Bitcoins at 4 mln. That number has jumped significantly over the last 12 months and now stands closer to 7 mln lost Bitcoins. The reasons for the loss are varied, but all point to one thing: less and less Bitcoins are available every day, and eventually, they will all be gone. To put this problem into perspective, think about this: there are only 21 mln BTCs ever to be mined, about 18 mln are already mined, and 7 mln of those are lost.

People lose Bitcoin on purpose?!

One of the primary reasons Bitcoins are getting lost is Proof-of-Burn. Proof-of-Burn is the concept that value stored in one token can be transferred to a new digital token. By burning coins in a public fashion, sending them to an unrecoverable address, the tokens are lost on purpose and are in effect an escrow account guaranteeing the value of the newly created cryptocurrency.

Regardless the reason, the bottom line for investors is this. Bitcoin is a commodity; commodities are valued based on supply and demand. We know for a fact that supply is shrinking, all it will take for Bitcoin’s price to shoot higher is an increased demand.

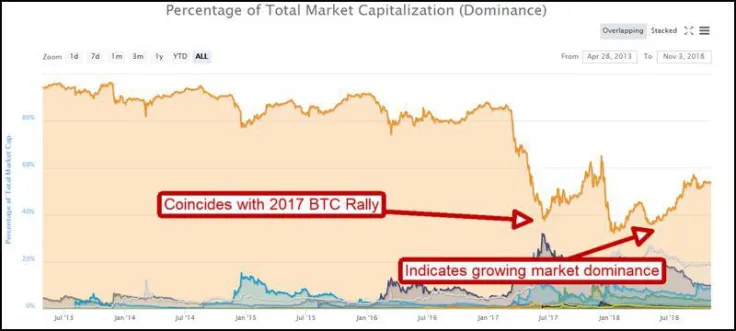

Bitcoin is the dominant cryptocurrency

Despite this year’s bear market in cryptocurrency, Bitcoin remains the leading digital currency by market cap. The total market cap for Bitcoin has been hovering near $110 bln over the past few months and represents more than 50% of the total cryptocurrency market. This figure shows Bitcoin is still the most sought-after digital token commanding the greatest flow of new money.

Over the past year, Bitcoin’s dominance has been in flux as bearish activity and the launch of new tokens induce market volatility. Bitcoin’s dominance fell to a low near 33% in January 2018 and has since recovered. Over the past two months, the token’s dominance has steadily increased to current levels as market participants flock back to the most stable and trusted digital currency on the market.

Description - Chart of Bitcoin price dominance with annotations

This figure is brought into sharp contrast when compared to the #2 and #3 digital currencies by market cap, Ethereum and Ripple. Combined, Ethereum and Ripple command less than 20% of the total market which makes them less attractive to new money seeking to invest in cryptocurrency. When the market comes back, and it will, Bitcoin will be the first choice as it has the greatest respect and trust among digital currency traders.

-

Bitcoin dominance November 2018 is 53%.

-

Ethereum dominance November 2018 is 10%.

-

Ripple dominance November 2018 is 9%.

How does this affect the Bitcoin price prediction 2018? If you look at the Bitcoin price prediction 2017, there is a compelling comparison to be made. In 2017, just before Bitcoin began its wild march to $20,000, the token’s dominance fell below 40% before resurging to more than 60%. Many analysts believe, and I am one of them, this year’s fall to 33% and rebound to 50% are signaling a rebound in Bitcoin price that only needs a catalyst to get started.

Regulation is the catalyst traders are waiting for

The catalyst traders are waiting for is regulation. Regulation and regulatory issues have been hanging over the entire cryptocurrency market for years and are the cause of the 2018 bear market. The war began last fall when China’s financial regulators moved to ban cryptocurrency, cryptocurrency trading, and ICO’s within China. The bear market was set off a month or so later when South Korea, a hotbed of Blockchain technology, made similar moves. Since then, South Korea has softened their stance, embracing Blockchain and digital financial securities, but the issue of regulation is far from being settled.

Description - Bitcoin’s potential to change the world, from CCN.com

The number one issue holding traders back today is the SEC, the CFTC, and US regulation. The SEC and CFTC have allowed the listing of BTC futures, but that is as far as they’ve got regarding the legal listing of Blockchain-based trading solutions in the US. The SEC has created a cryptocurrency czar whose job is to coordinate proper regulation of the market, but still, there is no framework, not even a hint of what may come.

Traders around the world are waiting for a Bitcoin or cryptocurrency ETF to be listed in the US. Many Bitcoin predictions see such a listing as early as this year, although the chances of that are getting slimmer by the day. The SEC has already reviewed and rejected over a dozen requests by money managers to list such an ETF, and there is yet no indication of when, or even if, a Bitcoin ETF will be permitted.

A Bitcoin ETF is on the way, traders need to be ready

A group of Blockchain industry leaders including fund managers, cryptocurrency developers, and hedge fund/private equity investors made a plea to the US Congress for clarity on cryptocurrency regulation. Their stance is that lack of regulation is far more damaging to the US investor than any risks with the technology. The plea resulted in Congress asking the SEC for clarification, and yet still no word.

The biggest hurdle for US regulation of cryptocurrency is a lack of regulated infrastructure; there isn’t any, or not very much, anyway. The good news is that Bakkt may end all that. Bakkt is a joint venture between the ICE (The Intercontinental Exchange) and partners.

“Bakkt is designed to enable consumers and institutions to seamlessly buy, sell, store and spend digital assets. Formed with the purpose of bringing trust, efficiency and commerce to digital assets, Bakkt seeks to develop open technology to connect existing market and merchant infrastructure to the Blockchain.”

The exchange is designed to support the purchase, storage, and trading of digital currencies across ecosystems and includes a digital clearinghouse for trades. The exchange is expected to launch its first products, new BTC/USD futures, in early December 2018 and seen as the stepping stone to a Bitcoin ETF.

The takeaway for traders is this: Bitcoin regulation is holding the market back, and news, for good or bad, is what will drive the cryptocurrency markets over the next twelve months. If the SEC puts the kibosh on BTC and cryptocurrency investing, ETFs, and other retail products, you can rest assured the cryptocurrency market will react negatively. If, on the other hand, a BTC ETF is approved (as expected), you can rest assured Bitcoin prediction and Bitcoin price forecast will turn overwhelmingly bullish.

Description - Bitcoin prices are expected to move higher in 2018 and 2019

My Bitcoin Prediction? It is only a matter of time before the US embraces cryptocurrency regulation and allows a BTC ETF to be listed. If that happens, my Bitcoin price forecast is this: Bitcoin will retest its all-time high near $20,000 and most likely break through to new all-time highs. Bitcoin predictions 2018 are a dime a dozen, everybody has an opinion of when and how high BTC will go. The only thing you need to know is that BTC is going to move higher, if not now, then very, very soon.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin