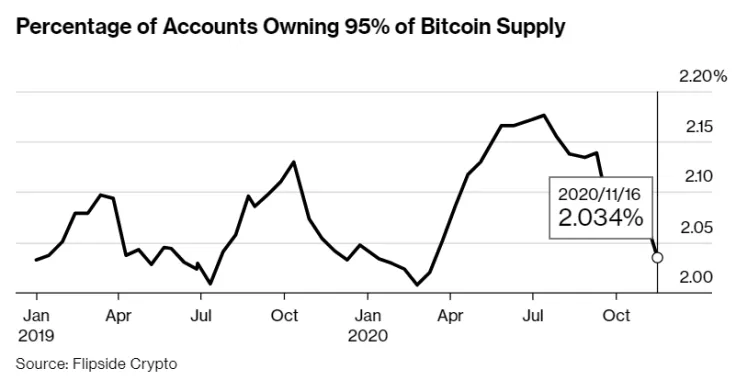

According to a recent Bloomberg report that cites Flipside Crypto, Bitcoin whales have grown even bigger as a result of the most recent rally to $18,000.

The top two percent of Bitcoin addresses now account for a staggering 95 percent of the asset’s total supply.

Big boys pull all the strings

BitInfoCharts data shows that wallets with more than 100 BTC ($1.8 mln as of now) account for 61.5 percent of the total supply. Yet, they represent a minuscule 0.04 percent of the total addresses. There are only 14,005 whales in the world that own that many coins.

Over 16 mln addresses hold less than 0.001 worth of BTC ($17), representing almost 49 percent of all wallets in existence.

The growing concentration of coins in the hands of whales is a troubling trend given that they exert great influence on the market and can manipulate it at a whim. Flipside’s data scientist Eric Stone, however, believes that large liquidations are unlikely:

“The most likely whale story today is that they’ll cautiously liquidate relatively small amounts of BTC over time, rather than risking a supply shock by liquidating larger chunks all at once.”

Advertisement

Exchanges are getting less powerful

Flipside data also shows that cryptocurrency exchanges represent seven percent of the total supply, down 0.7 percent from 2019.

As reported by U.Today, Bitcoin reserves held by exchanges continue to diminish, creating supply crunch.

Yet, the richest Bitcoin address with 141,452 BTC ($2.5 bln) is a cold wallet owned by the Huobi exchange.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin