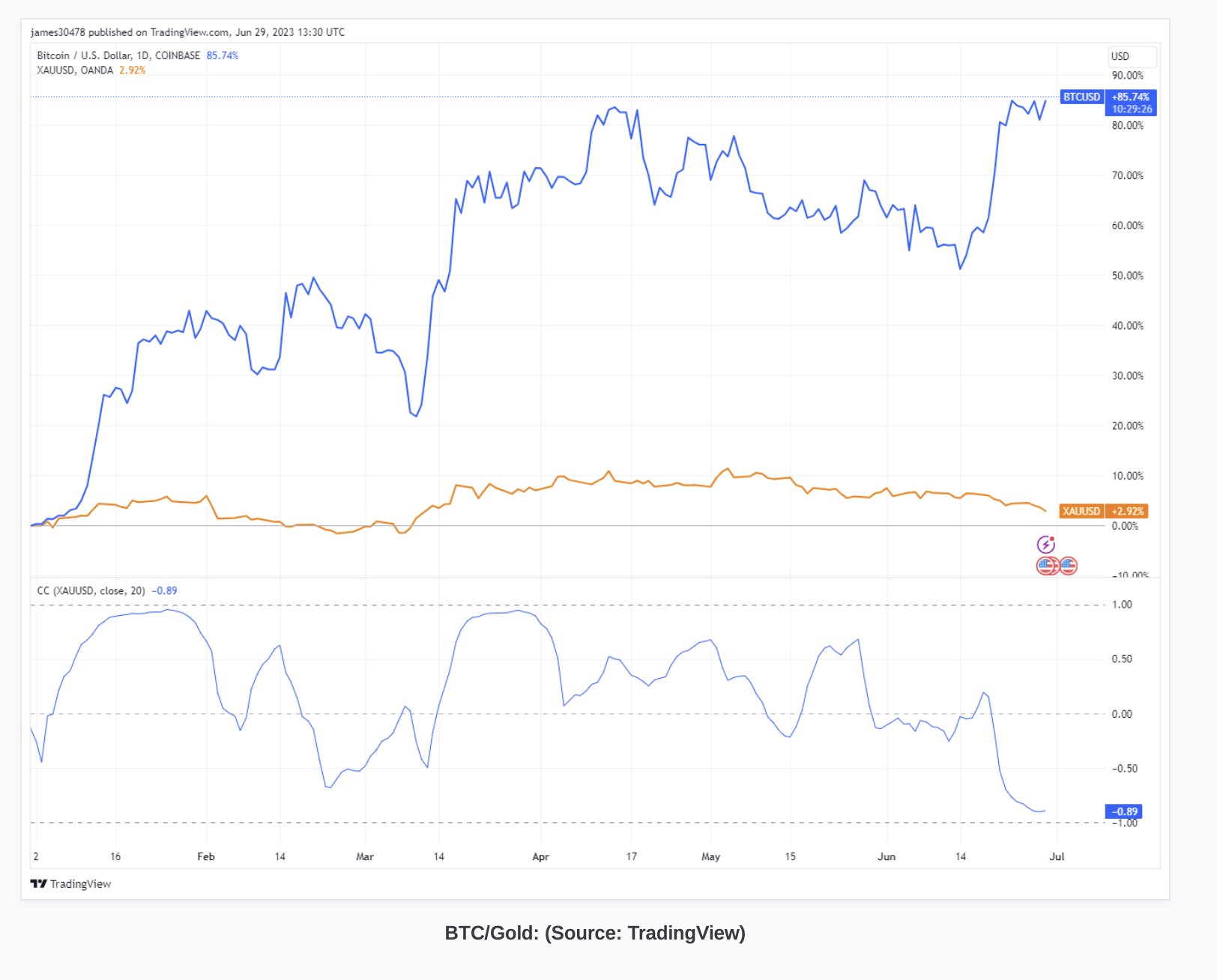

The correlation between Bitcoin and gold has dropped to its lowest point in the past year, reflecting a major shift in their price movements.

The correlation coefficient is currently standing at -0.89, implying an inverse relationship. While gold has seen a modest increase of 2.92% this year, Bitcoin has rocketed by an impressive 85.7%.

The correlation between these two assets is often highlighted due to their shared reputation as a hedge against traditional markets.

The Bitcoin price has seen a substantial uptick due to anticipation surrounding spot Bitcoin ETF filings by major financial institutions, including BlackRock, Fidelity and Invesco.

These ETFs could potentially prove to be a game-changer for Bitcoin, significantly expanding its accessibility to mainstream investors. The much-awaited approval of a spot Bitcoin ETF could potentially spark an inflow of capital that would be similar to what was observed following the launch of the first gold ETFs.

Crypto enthusiasts have long speculated that the launch of the first spot Bitcoin ETF could have implications as significant for the Bitcoin price as the launch of the first gold ETF had for gold.

The advent of the first gold ETF in 2003 helped democratize access to the lustrous metal. It also resulted in an explosion in the gold price, making the yellow metal a mainstream investment.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin