According to on-chain analytical services, yesterday's trading session in crypto set a number of records. In terms of decentralized exchanges, these milestones seemed impossible months ago.

Yet another high for DEXs: $4.2 billion in 24 hours

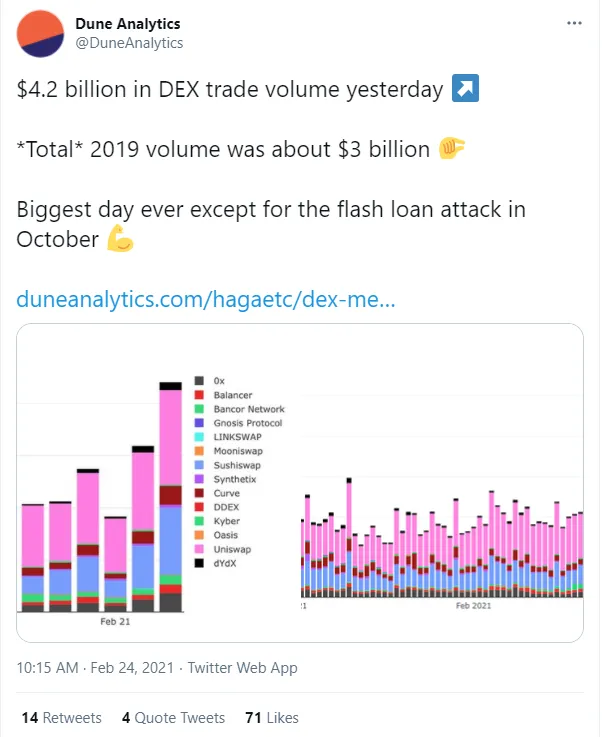

In its latest tweet, Dune Analytics, which addresses the segment of on-chain crypto metrics, noticed that aggregated trading volume on major decentralized trading platforms printed a new high. This excludes the day of the devastating "flash-loan" attack against numerous protocols in October 2020.

The total trading volume for all exchanges surpassed $4,200,000,000 in 24 hours. Uniswap (UNI), SushiSwap (SUSHI), Curve (CRV), 0x (ZRX) and Bancor Protocol (BNT) are the flagship instruments of this craze.

Dune Analytics experts noticed that, in 2019, it took the whole year for the DEX segment to process $3 billion in trading volume. Thus, the interest in decentralized trading surged more than 500x.

Because the vast majority of popular DEXs are working on the Ethereum (ETH) blockchain, this upsurge resulted in a spike in miner commissions. Yesterday, Ethereum (ETH) miners earned almost $50 million in fees in 24 hours.

Record-breaking Bitcoin (BTC) futures trading session

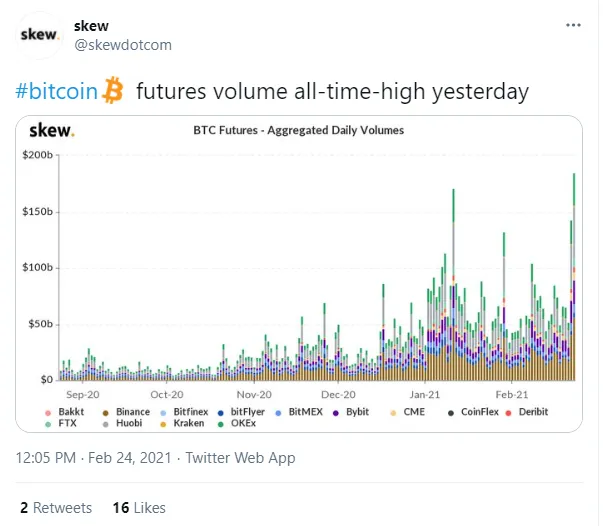

Also, Bitcoin (BTC) futures trading has witnessed a record-breaking day. According to Skew analytical dashboards, its metrics touched a new all-time high at around $175 billion.

Binance Futures and Huobi Futures are responsible for the lions' share of this volume.

As covered by U.Today previously, on Feb. 22-23, 2021, Bitcoin (BTC) bulls went through a series of painful liquidations. More than $1 billion in longs was liquidated on Binance only.

In the same period, the net volume of liquidations for all currencies surpassed $5.2 billion.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin