Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Following the hawkish statement of Jerome Powell, head of the US Fed Reserve, during the annual central banking summit that occurred n Wyoming’s Jackson Hole on Friday, August 26, stock markets along with cryptocurrencies began to slump.

Jerome Powell’s speech pushes markets down

The Fed Reserve chairman stated that the US central bank will have to keep to its hawkish stance for a while longer, thus killing traders’ expectations for a pivot to happen any time soon.

The traditional rival of Bitcoin, gold, also went down, according to data presented by Santiment data aggregator – gold, S&P 500, Bitcoin, Ethereum and other digital currencies responded with a sharp fall.

📊 #Bitcoin, #Ethereum, the #SP500, and #gold are all down considerably on a #bearish Friday for traders. $BTC is back down to a 6-week low after #JeromePowell made #hawkish remarks about the state of the US economy, in spite of a positive #CPI report. https://t.co/hTtPT7nWuN?from=article-links https://t.co/ThliKG6SeY?from=article-links pic.twitter.com/mtlkuEBTtB

— Santiment (@santimentfeed) August 26, 2022

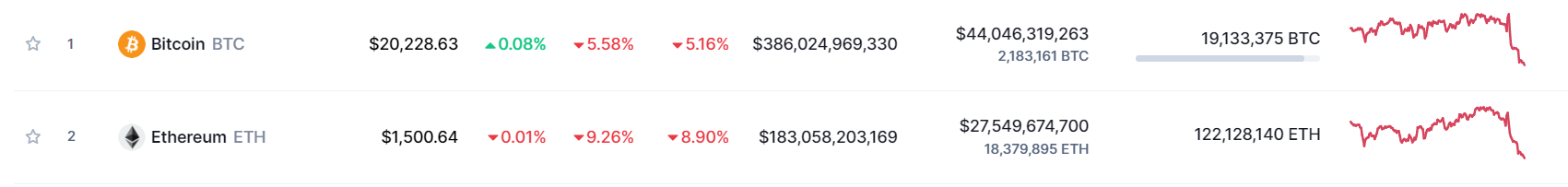

On Friday, the flagship cryptocurrency dropped from slightly above $21,000, hitting the $20,200 zone by now. In the past 24 hours, BTC has declined by over 5 percent.

Ethereum fell from the $1,686 level, trading in the $1,506 zone at press time and losing 9 percent over the past 24 hours.

DOGE, XRP, ADA and other top ten cryptocurrencies reacted with a price decline on Friday but now the crypto market seems to be returning to the green area, at least for the time being.

Ethereum’s recent price action

Ethereum has been demonstrating a decline in price over the past week, sliding down even before the speech of the Fed Reserve Chair.

Many believe that while the upcoming Merge even that will switch the second largest blockchain from PoW to PoS protocol, the implementation of this long-expected upgrade could also act as driver for selling ETH.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov